In the world of mining investments, understanding the various mining methods is crucial for assessing the viability, safety, and profitability of projects. This knowledge is not just technical; it’s fundamental to making informed investment decisions in the mining sector.

Surface vs. Underground Mining

Mining methods broadly fall into two categories: surface mining and underground mining. Each has its own set of advantages and challenges:

Surface Mining

- More cost-effective for suitable deposits

- Generally safer for miners

- Higher production rates

- Simpler logistics and ventilation requirements

- Larger environmental footprint

Underground Mining

- Less environmental impact

- Access to deeper deposits

- Reduced surface land use

- More selective in ore extraction

- Higher costs and safety risks

Key Surface Mining Methods

- Open-pit Mining: The most common method for hard-rock commodities like gold, copper, and iron ore

- Dredging: Used for extracting minerals from water bodies

- Hydraulic Mining: Employs high-pressure water to dislodge sediment or ore

- In-situ Leaching: Involves injecting a solution to dissolve minerals for extraction

Important Underground Mining Methods

- Sublevel Open Stopping (SLOS): Effective for steeply dipping orebodies

- Cut and Fill Stoping: Used for irregular or steeply dipping orebodies

- Block Caving: Cost-effective for large-scale, low-grade mineral deposits

- Room & Pillar: Suitable for flat-lying orebodies with moderate to high stability

Technological Advancements in Mining

The mining industry is embracing technological innovations to address challenges such as declining ore grades. These advancements include:

- Automated and remote-controlled machinery

- Drone technology for surveys and inspections

- Advanced drilling and blasting techniques

- Real-time data analysis

- Environmentally-friendly processing methods

The Role of AI in Mining

Artificial Intelligence is set to revolutionize mining methods by:

- Analyzing vast datasets to guide mining method selection

- Optimizing resource extraction

- Improving safety measures

- Reducing environmental impacts

ESG Considerations in Mining Methods

The choice of mining method now extends beyond economic and technical feasibility to include Environmental, Social, and Governance (ESG) considerations. Investors must consider factors such as:

- Water management

- Biodiversity preservation

- Land stewardship

- Worker health and safety

- Long-term environmental impact

Conclusion

As the demand for critical minerals and metals continues to rise, driven by the energy transition and global economic growth, understanding mining methods becomes increasingly important for investors. Successful investments in this sector require a deep understanding of the technical aspects of mining, including the selection of appropriate mining methods. Expert assessment by a multi-disciplinary technical team is crucial for evaluating and optimizing investment opportunities across all phases of mining

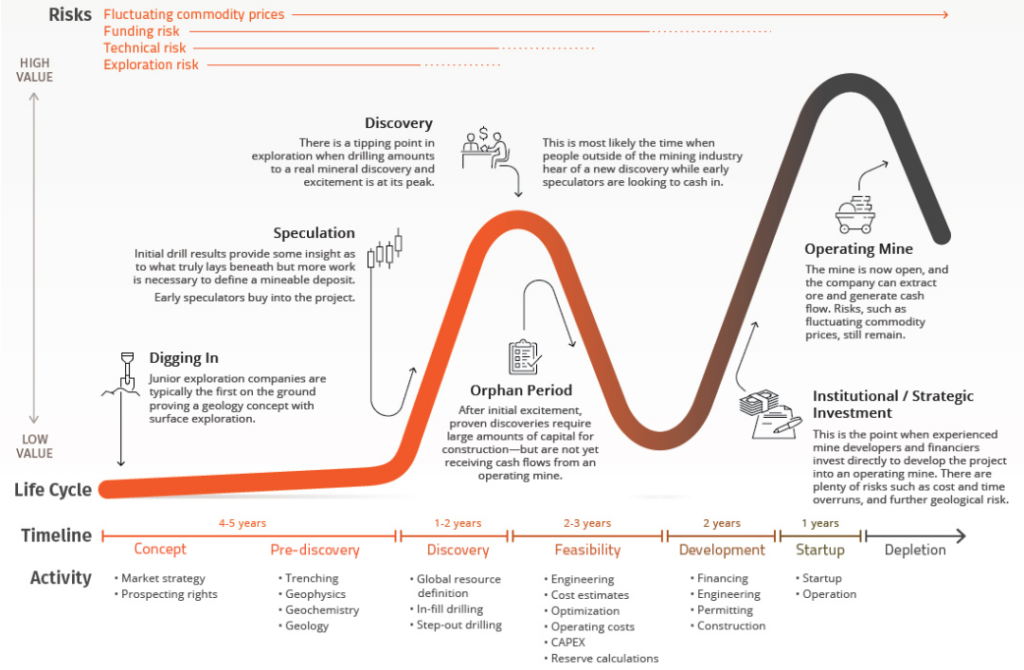

The Lassonde Curve

The Lassonde Curve is a valuable tool for investors in the mining sector, particularly those interested in junior exploration companies. Named after Pierre Lassonde, a prominent figure in the mining industry, this curve illustrates the typical life cycle of a mining project and its corresponding value creation

The curve depicts the relationship between time, risk, and value throughout a mining project’s development. It consists of several key stages:

- Concept/Pre-Discovery: This initial phase carries the highest risk and lowest value. Geologists develop theories about potential mineral deposits based on preliminary data

- Discovery: As exploration progresses and promising results emerge, speculative interest grows, potentially leading to a spike in perceived value

- Feasibility Studies: Following discovery, the project enters a period of detailed analysis. This stage often sees a dip in perceived value as excitement wanes and the complex realities of mine development set in

- Development and Construction: As the project moves towards production, perceived value typically begins to rise again

- Production: The final stage represents the realization of the project’s potential, with value generally reaching its peak

For investors, the Lassonde Curve offers several insights:

- It helps in timing investments by identifying potential entry and exit points

- It illustrates the cyclical nature of mining investments, preparing investors for periods of both growth and stagnation

- It highlights the importance of key milestones, such as resource estimates and feasibility studies, in driving value

- It demonstrates the high-risk, high-reward nature of early-stage mining investments

Understanding the Lassonde Curve can help investors set realistic expectations, manage risk, and identify opportunities throughout a mining project’s lifecycle. However, it’s important to note that while the curve provides a general framework, individual projects may deviate from this pattern due to various factors such as market conditions, commodity prices, and project-specific challenge

Other common mining terms

- Exploration: The initial stage of searching for mineral deposits through geological surveys, sampling, and preliminary drilling

- Discovery: The point at which a significant mineral deposit is found, often leading to a surge in investor interest and share price

- Resource Estimation: The process of quantifying the size and grade of a mineral deposit, typically occurring after discovery

- Preliminary Economic Assessment (PEA): An early-stage study that provides an initial economic evaluation of a mineral project

- Feasibility Study: A comprehensive technical and economic study of a project’s viability, including detailed assessments of all aspects of the proposed mine

- Development: The stage where a company prepares for mine construction, including securing funding and building an operational team

- Production: The phase where the mine is operational and generating revenue from mineral extraction

- Depletion: The gradual exhaustion of the mineral resource as mining progresses

- Orphan Period: A time during the feasibility stage when investor interest may wane due to lack of exciting news flow

- Drill Core: A cylindrical sample of rock obtained through drilling, used to analyze mineral content and assess a deposit’s potential