Overnight – Stocks continue meteoric rise as Fed cuts rates by 25bps

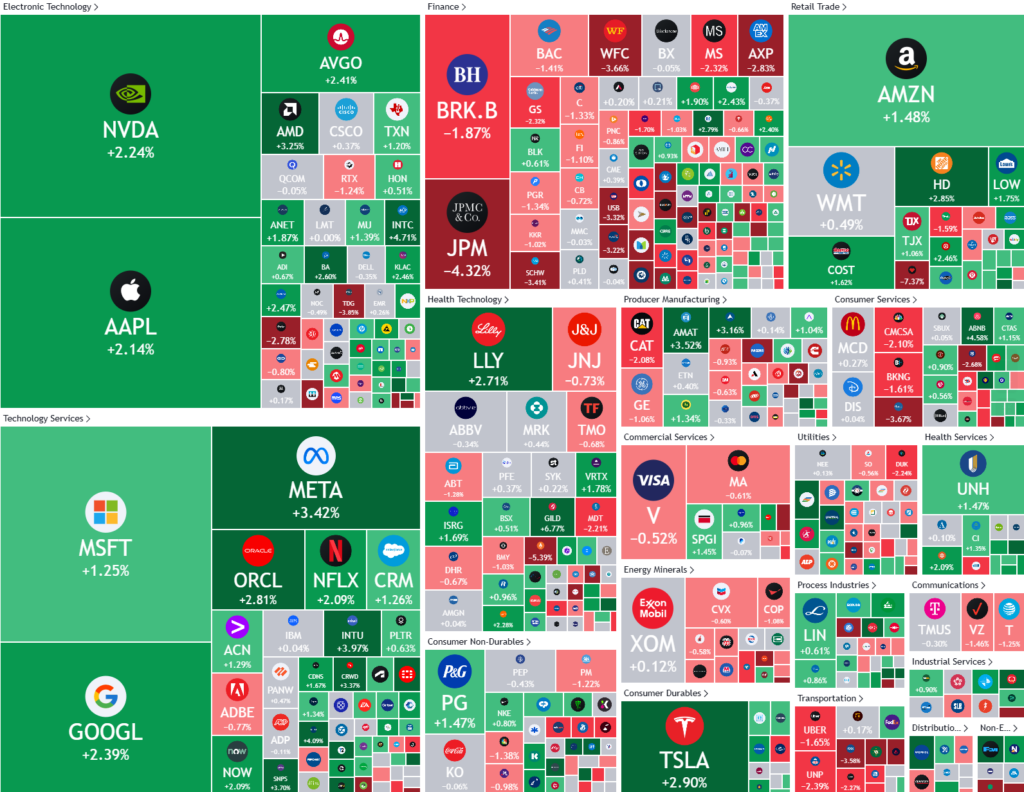

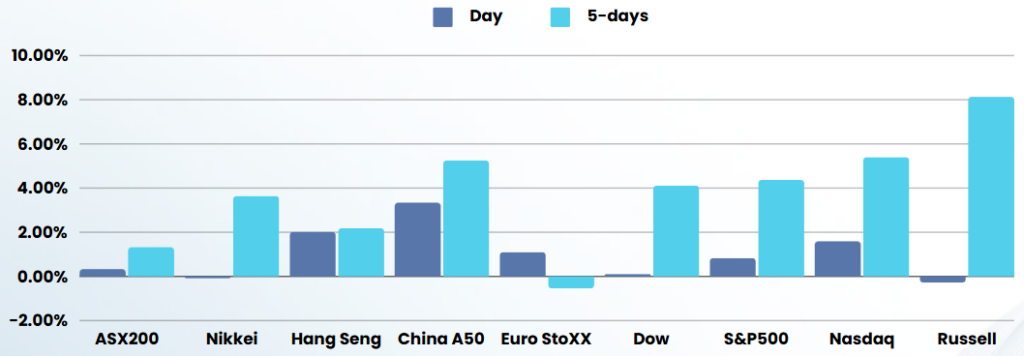

Stocks continued to climb to fresh records, a day after notching its biggest-one day gain in two years as the Federal Reserve delivered a widely expected rate cut.

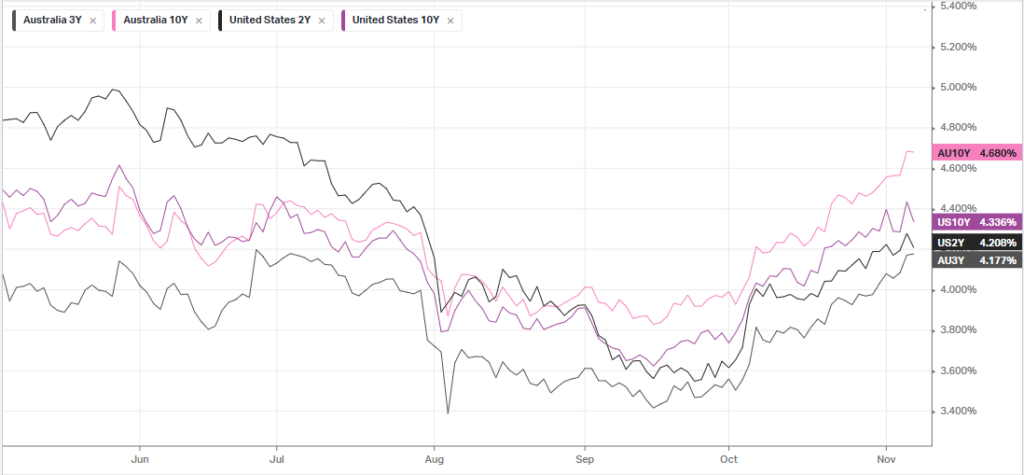

As many had expected, the Fed cut rates by 25 basis points on Thursday, taking its benchmark rate to a range of 4.5% to 4.75%. The move marked a downshift from the 50 basis point rate cut that kicked off the cutting cycle in September, as incoming economic had mostly surprise to the update.

“Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated,” the Fed said in its monetary policy statement on Thursday.

“Elections have consequences and we could see a marginal improvement in growth relative to their forecasts, but also a marginal increase in inflation relative to their forecasts. That would call for a more gradual pace of rate reductions.”

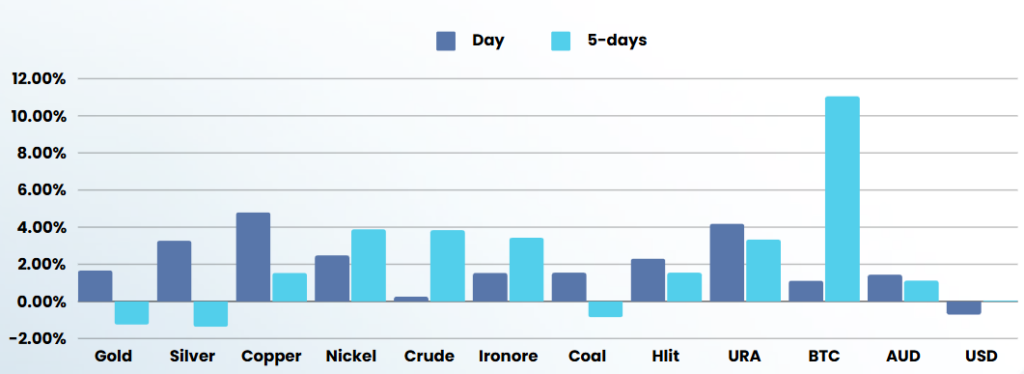

Many of the “Trump trades” unwound after an extreme reaction yesterday as commodities and the USD reversed on many media agencies switching their focus to the US debt

Stock specific

- Moderna – gave up early-day gains to trade 2% lower even as the drugmaker reported a surprise net income in the third quarter and announced changes at its leadership team. The beat on the bottom line was driven by higher-than-expected COVID-19 vaccine sales, but Moderna said it expects lower sales in 2024 compared with last year.

- Qualcomm – gave up the bulk the of gains even after its fiscal Q4 results topped analysts estimates and the chipmaker announced a $15B stock buyback program. The chipmaker’s “story continues to transform from a “wireless communications supplier to one focused on leveraging its compute expertise for edge applications where power/performance is key

- Warner Bros Discovery – stock rose over 10% after the mass media giant reported a surprise third-quarter profit, but missed revenue estimates as its studio business took a hit from fewer blockbuster releases.

- Lyft – stock soared about 23% after the ride-hailing company posted sales above expectations, upbeat guidance, and unveiled a new partnership for self-driving cars. Lyft’s guidance and strong quarter “show that management’s strategy of improving the customer experience, the cadence of product innovation and pricing is starting to bear fruit, driving active riders & rider frequency growth

ASX SPI 8340 (+1.21%)

The Aussie market will finally enjoy some of the sky-high optimism today as commodities reversed, 2 central banks cut rates and the US continues its stratospheric bull-run.

The banks may be a drag as ANZ has reported a drop in net profit in the 2024 financial year. Net profit after tax for the 12 months until the end of September was $6.54 billion, down 8 per cent on the prior year. CEO Shayne Elliot said competition in the banking sector remained “intense”.

Earnings are scheduled for Arcadium Lithium, Block, News Corp, NexGen Energy and REA Group.