As the dust settles on this historic election, investors and policymakers alike will be closely watching how Trump’s proposed policies unfold and their impact on both domestic and global markets. With control of Congress, Trump is positioned to pursue his agenda aggressively, potentially reshaping the economic landscape for years to come. The coming months will be crucial in determining whether Trump can indeed usher in the “golden age” he has promised to the American people.

So where should you invest? And what should you avoid?

Follow the 2016 Playbook

After Trump’s election victory in 2016 included the following key elements:

- Initial market shock and volatility: Trump’s unexpected win initially sent markets into a tailspin, with Dow futures falling as much as 800 points overnight and S&P 500 futures tumbling 5% However, this initial shock was short-lived.

- Quick market rebound: By midday after the election, U.S. stock markets had shrugged off their losses as investors embraced the idea of a Trump presidency. The S&P 500 ended up rising about 1% the day after the election.

- Sector rotation: Several sectors rallied, including:

- Financial stocks, on expectations of deregulation

- Energy stocks, anticipating looser environmental regulations

- Defense stocks, due to promised increases in defense spending

- Biotech stocks also gained

- Small caps and cyclicals outperformed: Small-cap stocks and cyclical sectors like industrials and materials outperformed the broader market

- Bond yields rose: The yield on the 10-year Treasury increased to highs not seen since January, reflecting expectations of higher growth and inflation

- Dollar strengthened: The U.S. dollar index generally strengthened during Trump’s presidency

- Commodities performed well: Both oil and gas futures and related stocks like Chevron saw gains

- Longer-term rally: The S&P 500 increased by around 57% from Election Day 2016 to Election Day 2020

- Underperformance of certain sectors: Clean energy stocks dropped sharply, reflecting uncertainty about Trump’s climate policies

- International market impacts: Some international markets, like Japan’s Nikkei, initially fell sharply (5.4% in this case) but many recovered quickly

It’s important to note that while these trends emerged in 2016, analysts caution against expecting the same playbook to work identically in a potential future Trump presidency. The economic and market conditions are different now, and investors are likely to be more prepared for various outcomes

What the analysts are saying

Analysts from major financial institutions have weighed in on the implications of Trump’s return to the White House.

Citi anticipates transformative effects on trade, security, energy, and fiscal policy, with potential spillovers to Europe and the rest of the world.

UBS sees opportunities in technology, utilities, and financials, despite concerns about the impact of tariffs on hardware and semiconductor companies.

Wolfe Research highlights the importance of House control for fiscal matters, while Berenberg suggests that a Trump presidency could accelerate European defense spending.However, the economic outlook is not without challenges.

ING notes that while Trump’s victory may ensure a lower tax environment that boosts sentiment and spending in the near term, promised tariffs, immigration controls, and higher borrowing costs could become headwinds during his presidential term.

The Federal Reserve is set to begin a two-day policy meeting, with markets expecting a quarter-point interest rate cut, though expectations for future cuts have been tempered in light of Trump’s win.

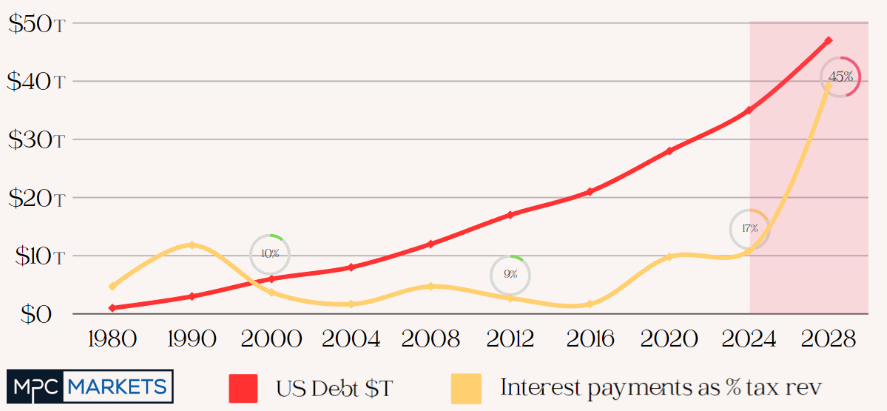

Most importantly, neither candidate has a plan for the spiralling US debt

The US government debt has skyrocketed to a staggering $34 trillion, growing by $1 trillion every 100 days with similar trends observed globally. This unsustainable path has increased reliance on the U.S. dollar, which holds the status of the world’s reserve currency. However, as debt levels continue to climb, there is a noticeable shift towards real assets. Investors, wary of currency devaluation, are increasingly turning to traditional stores of value like gold and silver

The recent BRICS summit attracted 37 countries, which is a poor reflection of the world’s confidence in the US, particularly when the coalition was only formed in 2010 with 5 members. The discussion centred around “de-dollarisation” , threatening the USD place as the worlds reserve currency

Here the safest candidate is the yellow metal that has been accepted as a form of money for thousands of years. Gold had a strong rally in 2024 where it has rallied from $2000 to a record high of $2800 and in our view, is very likely to continue…. Trump or no Trump

Gold has dipped but should continue to rally on US instability and potential trade wars