Overnight – Investors underwhelmed by Google, Microsoft and Meta earning beats

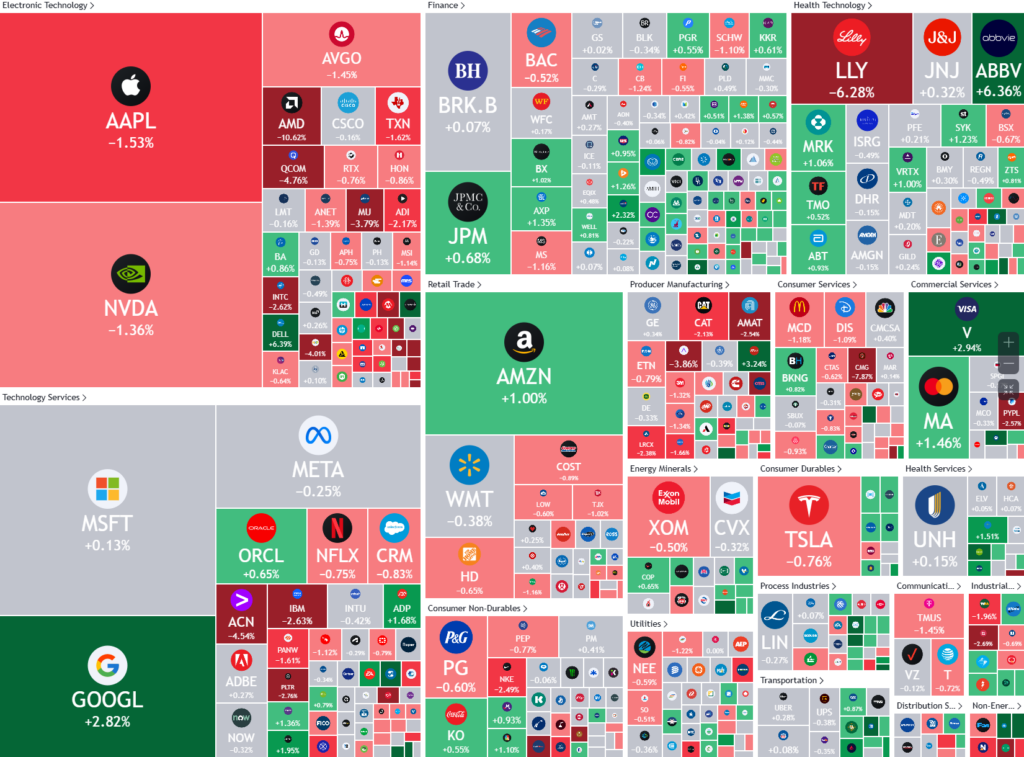

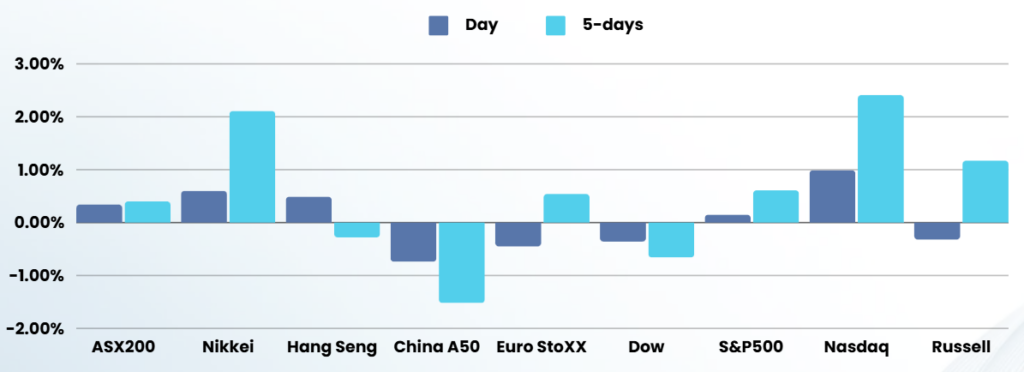

Stocks were mixed overnight as investors digested a jump in Treasury yields and cooling rally in Alphabet (Google), while after the bell, Microsoft and Meta were met with lukewarm enthusiasm, despite beating expectations

Google gave back half of yesterdays, after-market gains, to close 3% higher even after the Google parent reported stronger-than-expected earnings for the September quarter, while stating that its artificial intelligence investments were now bearing fruit. Its cloud business – which is closely linked to AI – grew at its fastest pace in eight quarters, while election-related spending also boosted advertisement sales, especially on YouTube. Strong earnings from Alphabet set a positive tone for upcoming earnings from its tech peers, which are due in the coming days.

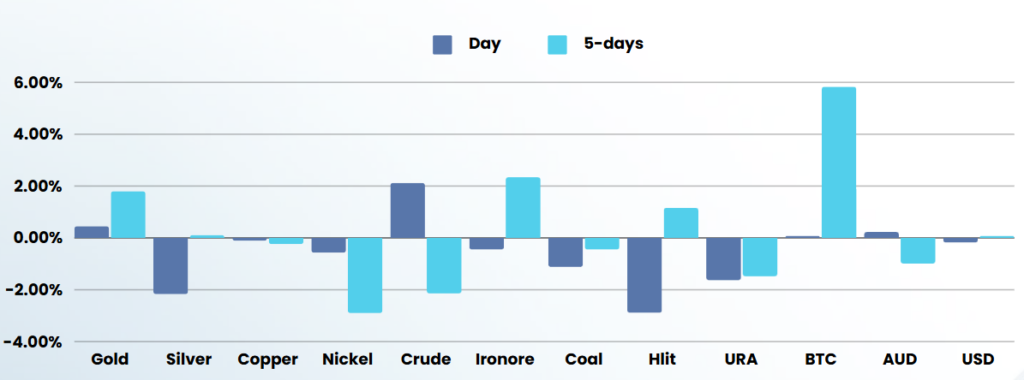

Data released earlier Wednesday showed that the US economy grew at a slower than expected rate in the third quarter, with gross domestic product in the world’s largest economy rising by 2.8% in the July-September period. Economists had predicted the figure would match the second quarter’s pace of 3.0%. Additionally, ADP private sector employment grew by 233,000, an increase from the revised 159,000 last month, a precursor of Friday’s widely-watched nonfarm payrolls data. These readings are likely to factor into the outlook for interest rates, and come before a Fed meeting next week where the central bank is widely expected to cut rates by a smaller 25 basis points.

The readings come just weeks before a Fed meeting, where the central bank is widely expected to cut interest rates by a smaller 25 basis points (MPC does not)

Stock specific

- Humana – stock rose over 3% after the health insurer beat estimates for third-quarter profit, buoyed by strength in its government-backed Medicare Advantage insurance business for older adults.

- Kraft Heinz – stock fell over 3% after the consumer goods company posted a steeper-than-expected fall in quarterly revenue as demand stayed weak for its branded meal kits and snacks.

- Eli Lilly – stock slumped over 6% after the drugmaker missed estimates for third-quarter profit, even as demand for its weight-loss drug soared, hurt by higher manufacturing and acquisition-related costs.

ASX SPI 8194 (-0.02%)

The local market should make a small recovery today after heavy selling yesterday, despite a better-than-expected inflation number that will help the RBA on the path to easing

Woolworths hosts in AGM and fellow supermarket giant Coles will release its quarterly sales figures.

Wesfarmers will also host its AGM.