Overnight – The Tech party rolls on into MAG7 earnings this week

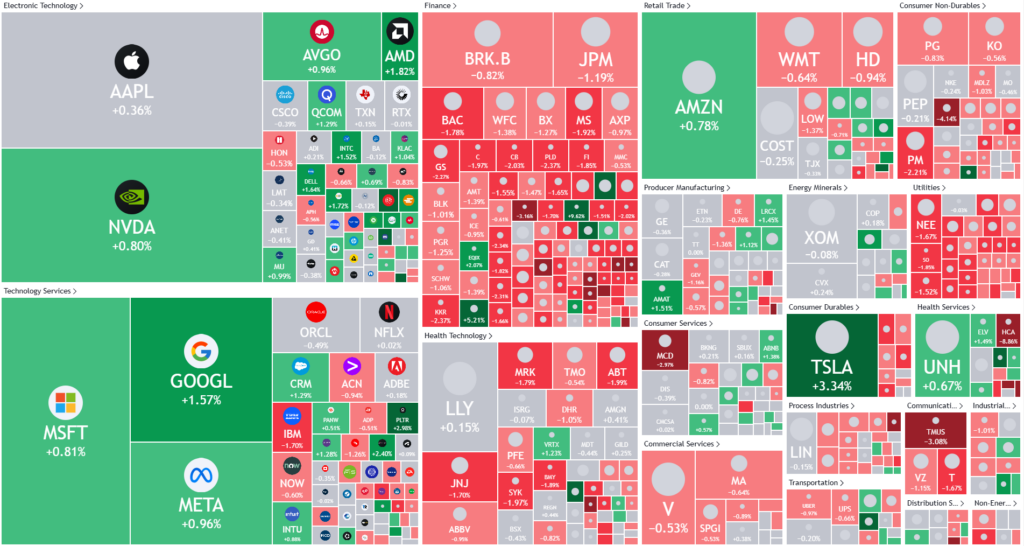

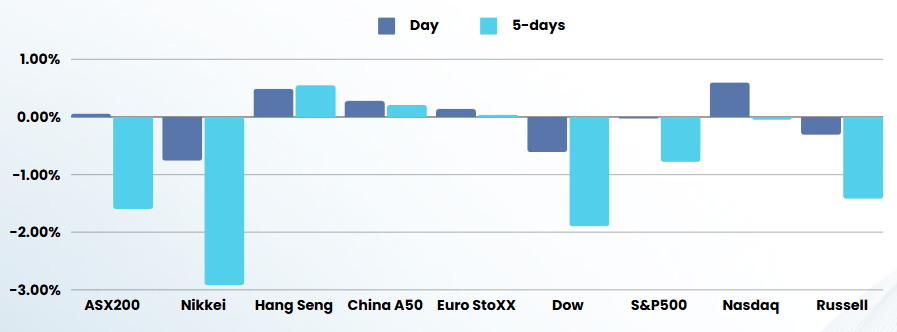

Equities were mixed with the Nasdaq closing higher Friday, after hitting an intraday high as tech stocks continued to make gains as investors piled into high flying tech stocks ahead of a key week of earnings next week.

Tech pushed the broader market, underpinned by a rise in big tech and chip stocks as investors looked to key earnings from the tech sector next week, with five of Wall Street’s so-called “Magnificent Seven” set to report earnings. Apple cut early-day losses despite data showing iPhone sales in China fell in the third quarter, suffering from severe domestic competition. Chip stocks also played a role in the broader market move higher as NVIDIA and Western Digital closed nearly 1% and 6% higher, respectively, with the latter boosted by quarterly earnings that beat estimates.

Alphabet will report on Tuesday, followed by Meta Platforms and Microsoft on Wednesday. Apple and Amazon will then report on Thursday. The five firms represent a large chunk of overall market capitalization in Wall Street, with their earnings likely to act as a bellwether for the broader market. Focus will be squarely on whether artificial intelligence proved to be a major earnings driver, especially amid increased capital expenditures on the fast-growing sector.

Beyond the Magnificent Seven, a barrage of other Wall Street majors are set to report next week, including Advanced Micro Devices, Caterpillar, Visa, Ford, and Uber Technologies.

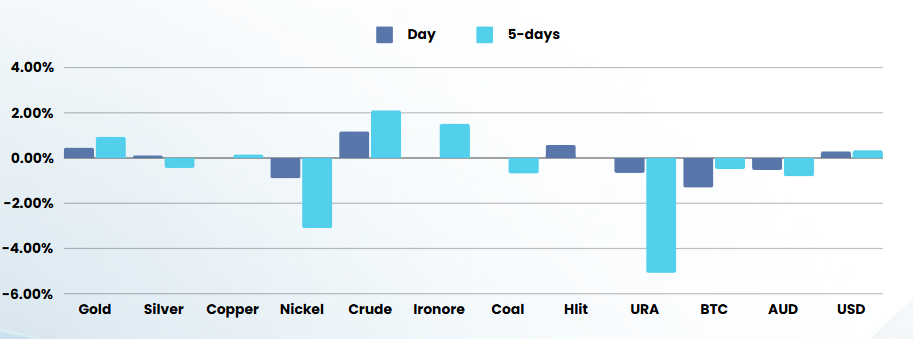

The US Payrolls numbers are looming next Friday, as trader look for a reason for bond yields to retreat. But on Friday night, new orders for key U.S.-manufactured capital goods increased more than expected in September, a positive sign ahead of next week’s publication of the advance estimate of third-quarter GDP next week.

Increased odds of a Donald Trump presidency, over Kamala Harris, also saw markets positioning for inflationary U.S. policies in the coming years.

ASX SPI 8237 (-0.00%)

The local market is unlikely to be overly exciting today with a full calendar of Mega-cap earnings and key economic data stacked later in the week.

US employment (payrolls) Friday will be key and the source of 2 major sell-offs in the last few months, add to that the US election being 8 days away and you would think that investors and traders will be happy to be patient until the smoke clears from major announcements