What's Affecting Markets Today

Short sellers have increased their bets against Star Entertainment, despite recent volatility in the company’s stock. After being halted for nearly a month to stabilize its financial position, Star’s shares dropped by 44% when they resumed trading in late September. However, the stock briefly recovered 13% following a report from the NSW casino regulator, which imposed a $15 million fine on the company for compliance breaches but allowed it to retain its Sydney casino license. Despite this positive news, short positions against the stock have risen to nearly 7% of its float, placing Star Entertainment among the top 20 most-shorted stocks on the ASX.

In a separate case, supermarket chains Coles and Woolworths are defending themselves in court against accusations of misleading shoppers with false promotions. They argue that many price hikes were driven by suppliers during a period of high inflation, and the issue involves the entire industry, including suppliers, retailers, and consumers.

ASX Stocks

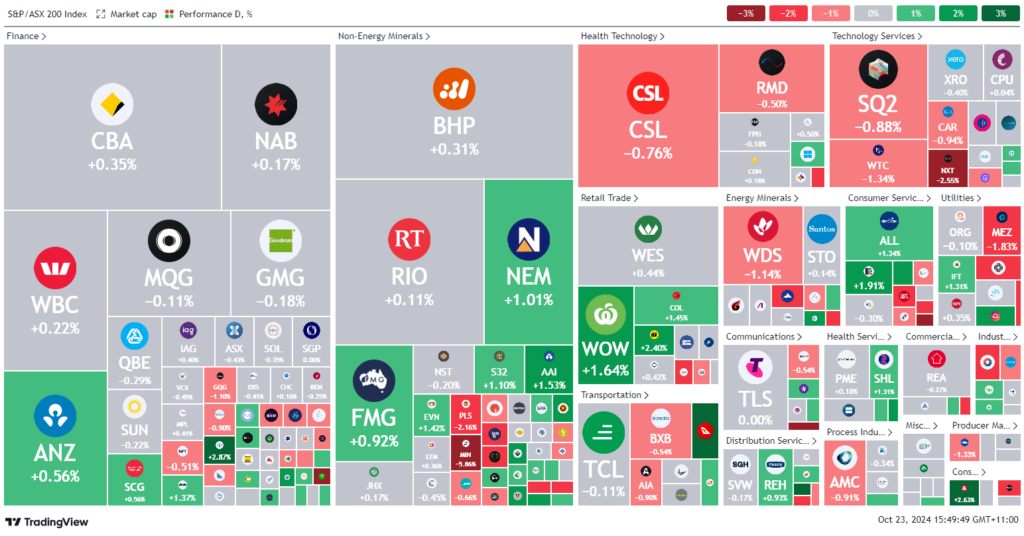

ASX 200 - 8,213.00 (+0.1%)

Key Highlights:

The ASX is set to end flat on Wednesday after fluctuating throughout the day. The S&P/ASX 200 was down 2 points at 8203.1, following Tuesday’s sharp sell-off. Investors are reassessing expectations of rate cuts from the Reserve Bank of Australia and the US Federal Reserve, with ANZ economist Brian Martin noting that a smaller 25-basis-point cut may be likely in November.

Consumer staples, led by Coles and Woolworths, performed well, both rising 1.2% amid an ongoing court case regarding misleading promotions. Gold miners, including Bellevue Gold, Genesis Minerals, and Perseus Mining, rose around 2% as gold prices stabilized near record highs, driven by Middle East tensions and concerns about the US presidential election.

WiseTech fell 1.5%, extending a five-day 15% drop following revelations about its founder’s personal conduct. Mineral Resources dropped 2.7% amid allegations of tax evasion involving CEO Chris Ellison. Meanwhile, Qantas climbed 3.3% after a positive analyst note, and 29Metals sank 16.8% following a report of declining cash reserves. Domain’s CEO announced his resignation, and shares dipped 1.3%.

Leaders

SKT – Sky Network Television Ltd (+9.54%)

ANG – Austin Engineering Ltd (+9.00%)

FND – Findi Ltd (+8.97%)

MAH – Macmahon Holdings Ltd (+7.58%)

3PL – 3P Learning Ltd (+7.11%)

Laggards

PLY – Playside Studios Ltd (-29.37%)

29M – 29METALS Ltd (-20.35%)

AMI – Aurelia Metals Ltd (-9.52%)

INR – Ioneer Ltd (-7.76%)

PEN – Peninsula Energy Ltd (-6.67%)