What's Affecting Markets Today

The ongoing controversies involving the founders of WiseTech and Mineral Resources (MinRes) highlight the potential risks of founder-led companies. Chris Ellison of MinRes faces allegations of tax evasion, which he has admitted as a lapse in judgment, while Richard White of WiseTech is grappling with allegations from a former partner. Both companies are deeply tied to their founders’ visionary leadership, which has driven substantial growth. Investors have generally favored founder-led companies due to the founders’ large shareholdings, emotional investment, and long-term focus, which have historically delivered higher returns. However, the downside emerges when issues of accountability and governance arise, as boards struggle to confront founders who are integral to the company’s success. If investigations reveal serious misconduct, the boards face a difficult choice: hold the founders accountable and risk destabilizing growth, or allow their influence to continue unchecked. The situations at WiseTech and MinRes underscore the importance of strong, independent governance to balance the power of founders and protect minority investors.

ASX Stocks

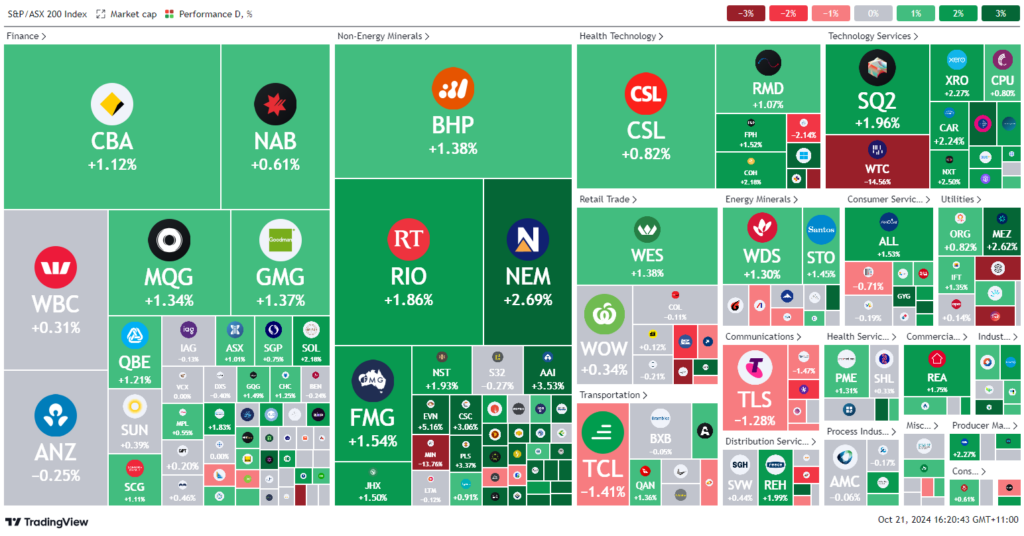

ASX 200 - 8,344.4 (+0.70%)

Key Highlights:

Australia’s sharemarket rose 0.7% on Monday, with the S&P/ASX 200 Index gaining 55.2 points to 8338.7, driven by strength in the materials and healthcare sectors. Mining stocks led the charge, with iron ore prices rebounding and gold prices surpassing $US2700 per ounce. BHP and Rio Tinto both rose by 1.8%, while West African Resources surged 6.6% and De Grey Mining climbed 3.7%. Iron ore futures also saw a 1.3% rise in Singapore.

However, tech giant WiseTech plunged 11% following allegations against founder Richard White by a former partner, leading to a board review. White also continued selling down his stake in the company. Similarly, Mineral Resources dropped 11.4% after an investigation into founder Chris Ellison’s alleged tax evasion came to light, though the board expressed confidence in his leadership.

Elsewhere, furniture retailer Nick Scali fell 6.2%, warning that rising freight rates would impact its gross profit margin, with its net profit forecast for Australia and New Zealand estimated between $30 million and $33 million for the first half.

Leaders

CHN Chalice Mining Ltd $1.99 +17.06%

29M 29METALS Ltd $0.56 +16.67%

AOV Amotiv Ltd $10.99 +10.01%

BC8 Black Cat Syndicate Ltd $0.65 +9.24%

WAF West African Resources Ltd $1.715 +7.52%

Laggards

WTC Wisetech Global Ltd $105.24 -14.08%

MIN Mineral Resources Ltd $39.75 -13.32%

LOV Lovisa Holdings Ltd $30.85 -6.69%

HUM Humm Group Ltd $0.77 -5.52%

WAM WAM Capital Ltd $1.535 -5.25%