Overnight – Stocks slip as Chipmakers weigh

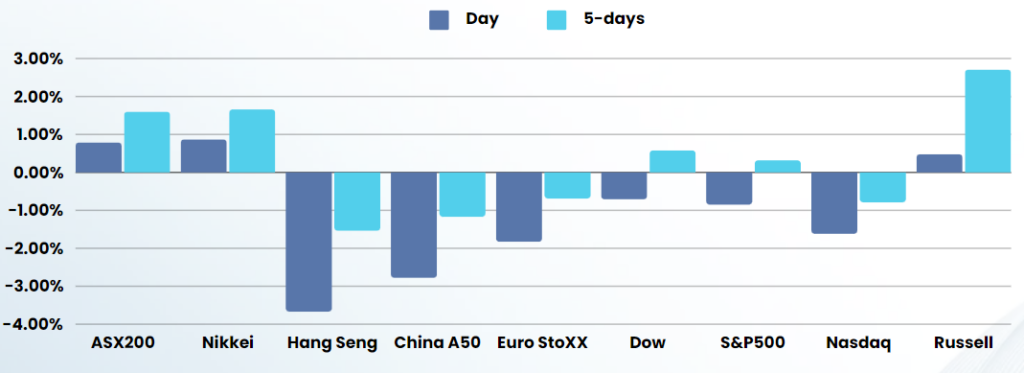

US stocks followed world stocks lower on Tuesday as weak sales forecast from chipmaker ASML weighed on tech shares, while crude extended its slide due to easing supply worries and weakening demand.

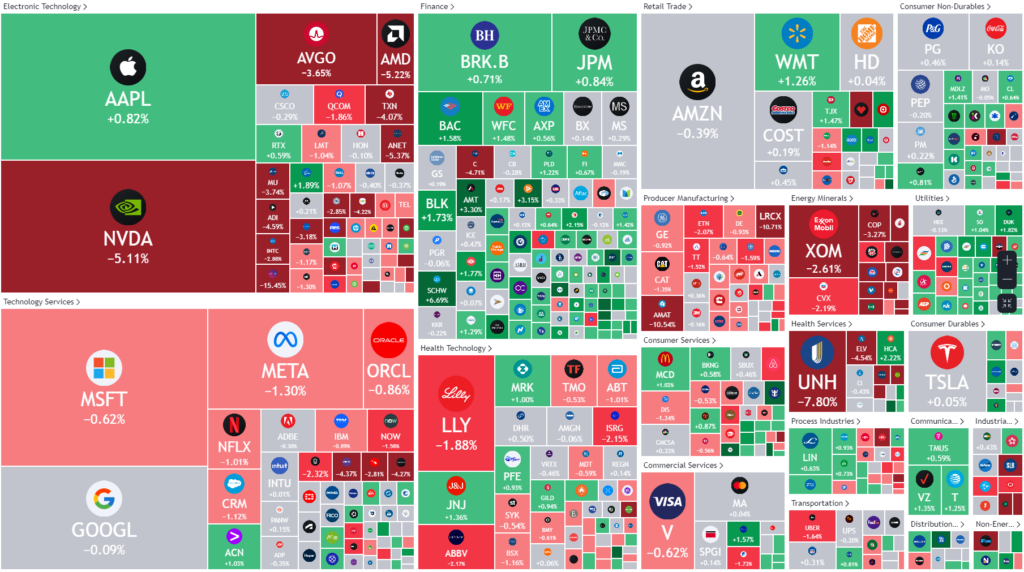

On a somewhat subdued day for trading, given bond markets were shut due to the federal holiday, U.S. equities maintained the upward momentum from Friday, when major banks kicked off the third-quarter corporate earnings season on a positive note. Financial firms Goldman Sachs, Citigroup and Bank of America all posted better-than-expected profit, while healthcare companies UnitedHealth and Johnson & Johnson results underwhelmed investors. But Netherlands-based chip equipment maker ASML posted third quarter results that surprised markets with weak bookings and lower-than-expected sales forecasts, dour news that proved contagious to the U.S. chip sector.

Meanwhile, investors remained focused on the European Central Bank’s rate decision on Thursday.

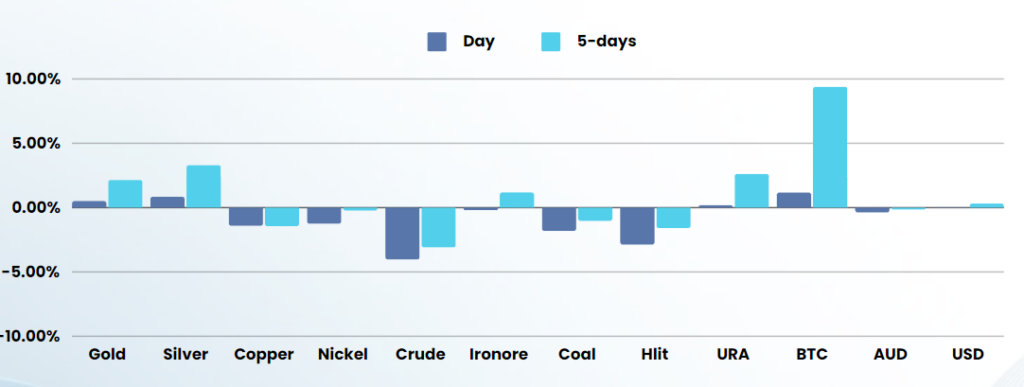

Oil prices slid to a near two-week low, extending Monday’s losses amid easing supply pressures arising from the conflict in the Middle East, amid reports Israel’s Prime Minister Benjamin Netanyahu told U.S. President Joe Biden’s administration that Israel would avoid striking Iranian oil targets. Additionally, OPEC and the International Energy Agency both lowered their global demand forecasts, mostly due to weakness in China.

Benchmark U.S. Treasury yields edged lower, pausing after touching a 2-1/2 month high in the wake of soft manufacturing data from the New York Federal Reserve. The yield on benchmark U.S. 10-year notes fell 3.7 basis points to 4.036%, from 4.073% late on Friday. The 30-year bond yield fell 5.9 basis points to 4.3228% from 4.382% late on Friday. The 2-year note yield, which typically moves in step with interest rate expectations, rose 1.3 basis points to 3.954%, from 3.941% late on Friday.

The dollar was nominally lower against a basket of world currencies amid wagers that the Federal Reserve will proceed with modest rate cuts in the near term.

ASX SPI 8314 (-0.45%)

We are likely to take a breather after a record close yesterday. Gold stocks should do well, while

We would look to be trimming some holdings and returning back to some cash as the market looks over-extended