Overnight – Stocks grind higher as investors consider broader options

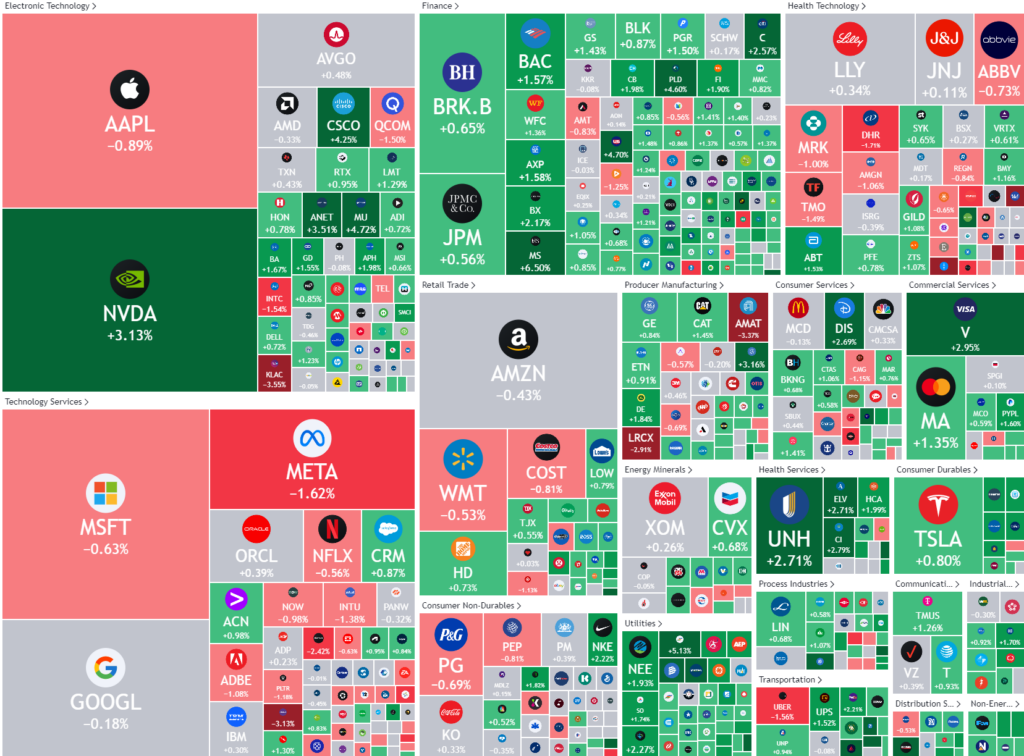

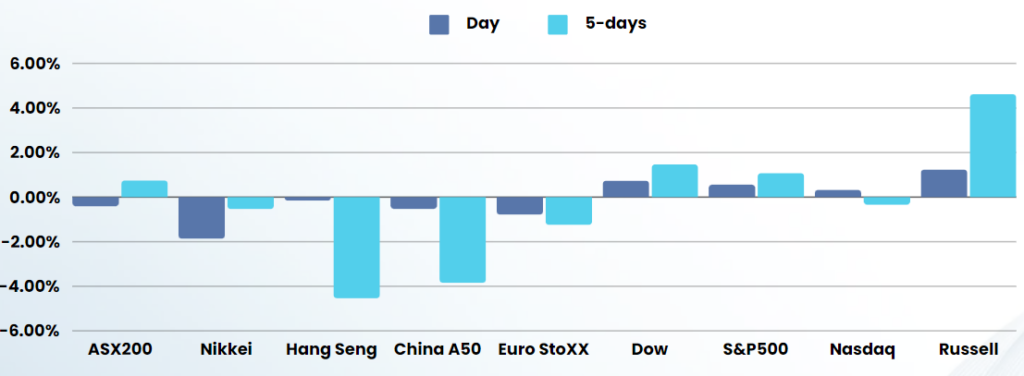

US stocks moved higher overnight following a wobble the previous day as chip stocks steadied and investors continued to rotate out of the Mag7 into the broader market.

The switch has been pronounced in the last week as Wall Street continued to roll out quarterly earnings with strong bank & cyclical earnings results have encouraged investors back to the broader market.

Tech stocks were in the red Wednesday as a rebound in chip stocks following an ASML led rout was offset by weakness in Microsoft and Apple. ASML fell more than 5% adding to its losses from a day earlier when the chip equipment maker cut its 2025 sales forecast, triggering concerns about softer AI demand. Chipmakers were also rattled by a report suggesting the U.S. government was considering limiting sales of AI-related chips to certain countries – a scenario that heralds weaker sales.

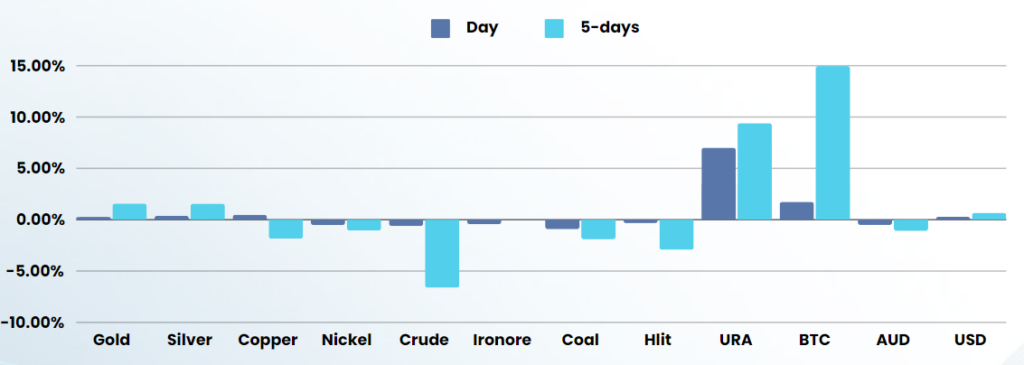

Uranium helped the utilities top the sector gains, with Dominion Energy’s increase among the catalysts after it was one of the power companies with which Amazon.com announced agreements for developing nuclear technology to power data centers.

Meanwhile, investors remained focused on the European Central Bank’s rate decision on Thursday.

Stock specific

- Morgan Stanley – stock rose more than 6% after the lender’s profit surpassed estimates on a bumper third quarter for investment banking that had also buoyed rivals.

- Abbott Laboratories – rose more than 1% after the company slightly lifted its annual profit forecast, after beating Wall Street estimates for quarterly earnings on strong sales of its medical devices including its glucose-monitoring products.

- United Airlines stock rose 12% after the carrier reporting third-quarter earnings ahead of expectations and announcing a new $1.5 billion share repurchase program.

ASX SPI 8386 (+0.72%)

We expect the local market to outperform the US lead as the broad based rally in the US is usually a more significant influence rather than the Mega-tech rally that has driven US Indices higher in the last year.

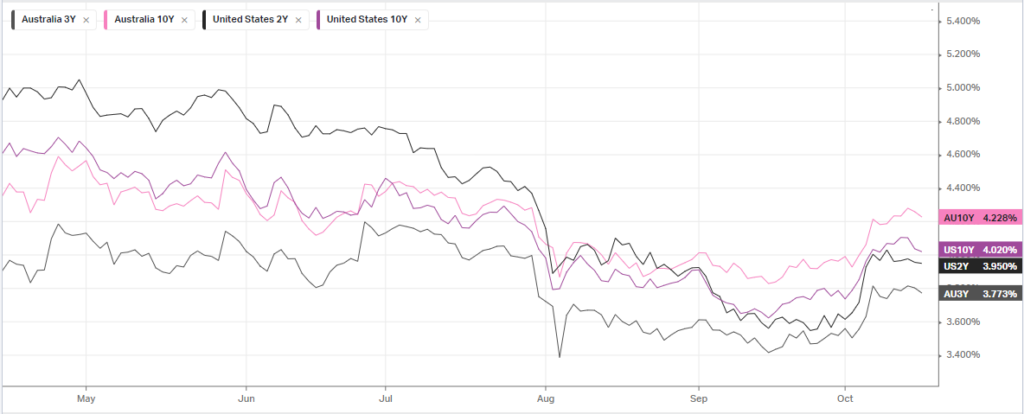

Traders will be watching the AU employment data at 1130 AEDST with the RBA still on the fence on when an interest rate cut might come.

Uranium stocks will have a very strong day and lead the energy sector higher on the news that Amazon has followed Microsoft’s lead in using nuclear for data centers

While we continue to see record highs, we are still of the view that investors should be looking to take some profits and returning back to some cash