Overnight – Banks kick off earnings with better-than-expected results

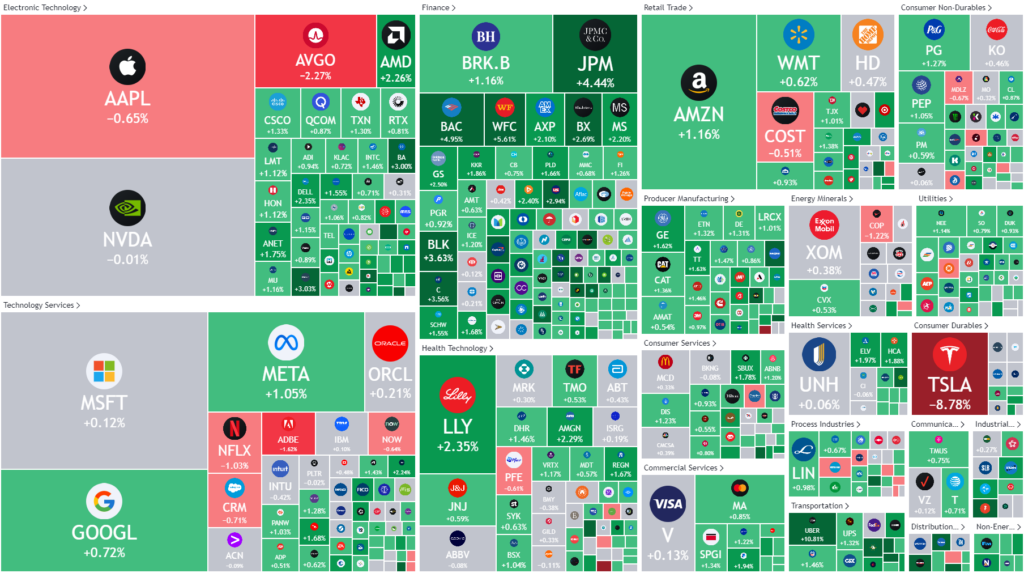

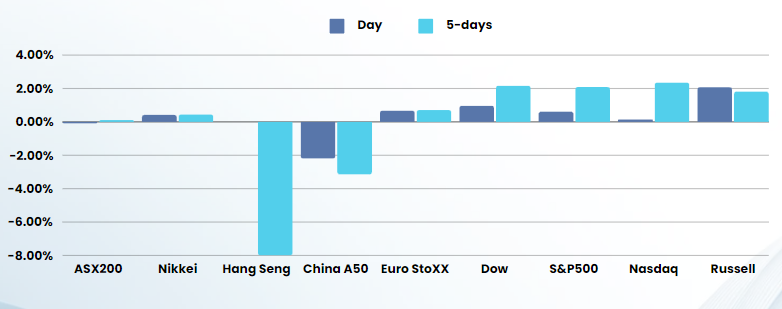

The S&P 500 and the Dow scored record closing highs on Friday, with the big boosts from financial stocks after banks reported strong quarterly results while the latest inflation data fuelled expectations for a U.S. Federal Reserve rate cut in November.

Major financial companies kicked off earnings season with JPMorgan Chase finishing the session up 4.4% after the lender reported higher-than-expected third-quarter profit and raised its annual interest income forecast. Shares in Wells Fargo rallied 5.6% after its profit also beat analysts’ expectations. BlackRock stock gained 3.6% after the asset manager reported that its assets under management had hit a record high for the third straight quarter. Other stocks in the industry rose broadly, making the S&P 500 Financials index the biggest index points boost for the benchmark.

Earlier in the day, data from the U.S. Department of Labor showed the Producer Price Index (PPI) for final demand was unchanged on a monthly basis in September, compared to the 0.1% rise expected by economists polled by Reuters.

Friday’s PPI data follows Thursday’s Consumer Price Index (CPI) reading, which was slightly higher than forecast, although weekly jobless claims rose more than expected. Meanwhile, a preliminary reading of the University of Michigan’s October consumer sentiment index stood at 68.9, compared with analysts’ estimate of 70.8.

During the session the consumer discretionary index was under pressure from an 8.8% slump in shares of Tesla after the EV maker unveiled its long awaited robotaxi, but did not provide details on how fast it could ramp up production or deal with potential regulatory hurdles.

Stock specific

- JPMorgan Chase shares rose nearly 5% on Friday after profit beat expectations in the third quarter, fueled by gains in investment banking and rising interest payments. JPMorgan’s investment-banking fees surged 31%, doubling guidance of 15% last month. Equities propelled trading revenue up 8%, exceeding an earlier 2% forecast.

- Wells Fargo’s profit beat analysts expectations in the third quarter as it set aside less money than expected to cover potential loan losses and predicted its interest income would stabilize, sending shares up 6% on Friday. In the near term, Wells Fargo forecast its net interest income (NII) — or the difference between what it earns on loans and pays out for deposits — would drop by 9% in 2024. That was more pessimistic than analyst expectations of an 8.4% decline, after the Federal Reserve cut borrowing costs last month.

ASX SPI 8296 (+0.55%)

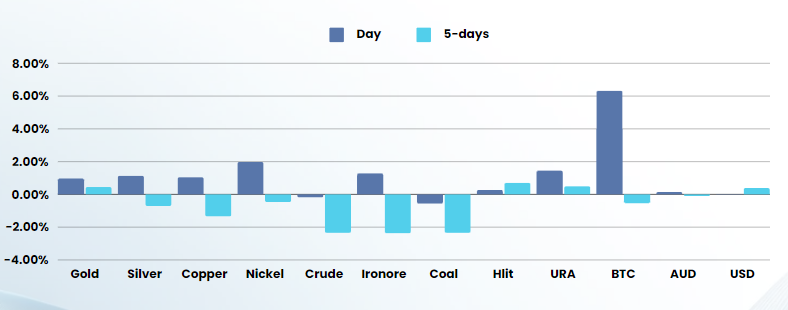

The ASX should have a positive start, with a positive lead from US banks on Friday. The materials sector may disappoint as investors who were hoping to hear Chinese authorities spell out exactly how much the government will throw at the crisis, the amount of stimulus was reassuring but the briefing was disappointing, due to a lack of detail

China’s highly anticipated announcement of financial stimulus plans on Saturday was big on intent but low on the measurable details that investors need to ratify their recent return to the world’s second-biggest stock market. Saturday’s news conference by Finance Minister Lan Foan reiterated Beijing’s broad plans to revive the ailing economy, with promises made on significant increases to government debt and support for consumers and the property sector.