What's Affecting Markets Today

Asian markets mostly higher

Asia-Pacific markets mostly rose on Friday, diverging from Wall Street’s decline after a sticky U.S. inflation report. Investors in the region focused on the Bank of Korea’s rate decision, which saw a 25 basis point cut to 3.25%—its first since 2020, signaling the end of a multi-year tightening cycle. This follows easing inflation in South Korea, which fell to 1.6% in September, below the central bank’s 2% target.

Mainland China’s CSI 300 index slipped 0.8%, as momentum from recent stimulus waned, while Hong Kong markets were closed for a public holiday. China’s Ministry of Finance is set to unveil a new fiscal stimulus package on Saturday, aiming to revitalize the economy.

Oil prices pulled back after a surge of over 3% on Thursday, driven by increased fuel demand ahead of Hurricane Milton and concerns about Middle East tensions. Brent crude fell 0.35% to $79.11 per barrel, while WTI dropped 0.34% to $75.60. Japan’s Nikkei 225 rose 0.7%, and the Topix added 0.4%

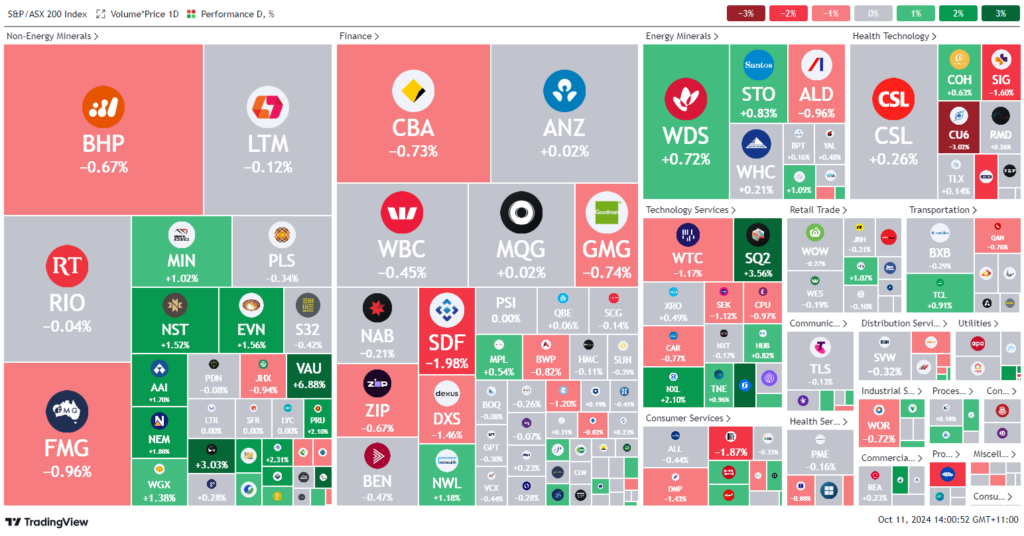

ASX Stocks

ASX 200 - 8,210.5 (-0.2%)

Key Highlights:

Australian shares dipped at midday, mirroring a weaker U.S. session as September inflation exceeded forecasts, and weekly jobless claims hit a 12-month high. The S&P/ASX 200 Index fell 0.2% or 14.4 points to 8208.6, with losses in seven out of 11 sectors.

Real estate stocks, sensitive to interest rate shifts, dropped 0.7%, leading the decline. In contrast, gold miners saw gains as investors turned to safe-haven assets. Regis Resources, Capricorn Metals, and Genesis Minerals rose over 3%, following a 1% uptick in gold prices to $US2633 an ounce.

Key stock movements included WiseTech, whose founder Richard White sold $60 million in shares, leading to a 1.4% drop in the stock. SiteMinder gained 5.3% to $6.74 after an upgrade to a buy rating by Jarden analysts.

Meanwhile, two tech firms sought fresh capital: Dubber launched a $25 million equity raise to boost sales, while Appen announced a $50 million capital raising and a $5 million share purchase plan for AI investments.

Leaders

CTT Cettire Ltd (+14.01%)

PYC PYC Therapeutics Ltd (+11.11%)

ASB Austal Ltd (+10.40%)

VAU Vault Minerals Ltd (+7.81%)

ADT Adriatic Metals Plc (+6.65%)

Laggards

CU6 Clarity Pharmaceuticals Ltd (-3.37%)

IMD IMDEX Ltd (-2.61%)

NEU Neuren Pharmaceuticals Ltd (-2.28%)

GNE Genesis Energy Ltd (-2.07%)

NAN Nanosonics Ltd (-1.95%)