What's Affecting Markets Today

Asian markets rally

Asia-Pacific markets opened mostly higher on Thursday, following Wall Street’s rally that saw the S&P 500 and Dow Jones Industrial Average reach new records as investors set aside geopolitical concerns.

South Korea’s Kospi rose 0.7%, while the small-cap Kosdaq slipped 0.4%. Japan’s Nikkei 225 gained 0.3%, with the broader Topix up 0.2%, as traders evaluated Japanese producer prices, which rose 2.8% year-over-year in September, exceeding the 2.3% forecast by Reuters.

Japanese retail giant Seven & i Holdings Co. was set to release its quarterly earnings, with market attention on its restructuring plans following reports of a higher buyout offer from Alimentation Couche-Tard Inc. Shares of Seven & i edged up 0.6%.

In China, the CSI 300 advanced 1.7%, while Hong Kong’s Hang Seng index jumped 4% in early trade, rebounding after the Shenzhen Composite Index’s worst session since 1997. Despite initial optimism from Beijing’s stimulus measures in late September, investors remain wary over the lack of additional major economic support.

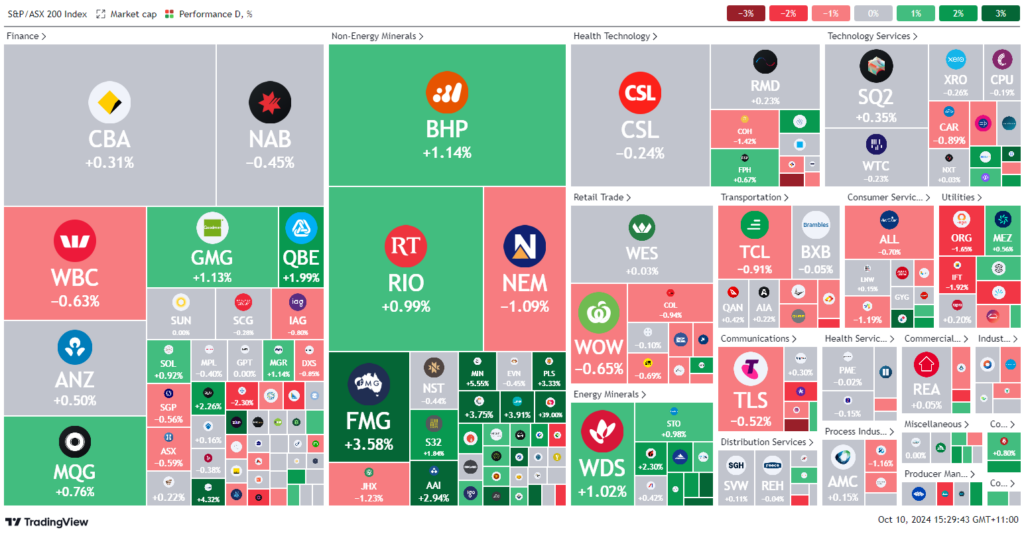

ASX Stocks

ASX 200 - 8,211.8 (+0.3%)

Key Highlights:

Australian shares were set to close at a new record high, following gains on Wall Street, with miners and energy stocks leading the rise amid expectations of further policy easing in the U.S. and China.

The S&P/ASX 200 climbed 0.4% or 28.8 points to 8216.2, approaching its September 30 peak of 8269.8. Iron ore prices rose 1.5% in Singapore, lifting materials stocks, while anticipation of fresh Chinese stimulus supported sentiment.

Arcadium Lithium surged 40% after Rio Tinto’s $9.9 billion takeover offer, boosting other lithium miners, including Lake Resources, Sayona Mining, and Liontown Resources, each up over 7%. BHP rose 0.5% as Norway’s Norges Bank removed it from a climate watchlist, while Fortescue gained 2%.

In energy, Woodside rose 1.2%, Beach Energy advanced 1.8%, and Santos added 0.4%, tracking a rebound in oil prices.

Netwealth surged 5% on record funds growth, while ARB Corporation gained 1.7% on a pending U.S. acquisition. Guzman y Gomez and Synlait Milk also edged higher on positive updates.

Leaders

LTM: Arcadium Lithium Plc (+39.00%)

LTR: Liontown Resources Ltd (+6.96%)

BGL: Bellevue Gold Ltd (+5.93%)

MIN: Mineral Resources Ltd (+5.72%)

HSN: Hansen Technologies Ltd (+4.87%)

Laggards

TUA: Tuas Ltd (-4.47%)

CU6: Clarity Pharmaceuticals Ltd (-4.03%)

DRO: Droneshield Ltd (-4.02%)

VSL: Vulcan Steel Ltd (-3.15%)

SPR: Spartan Resources Ltd (-3.09%)