Overnight – Stocks close at another record despite global chaos

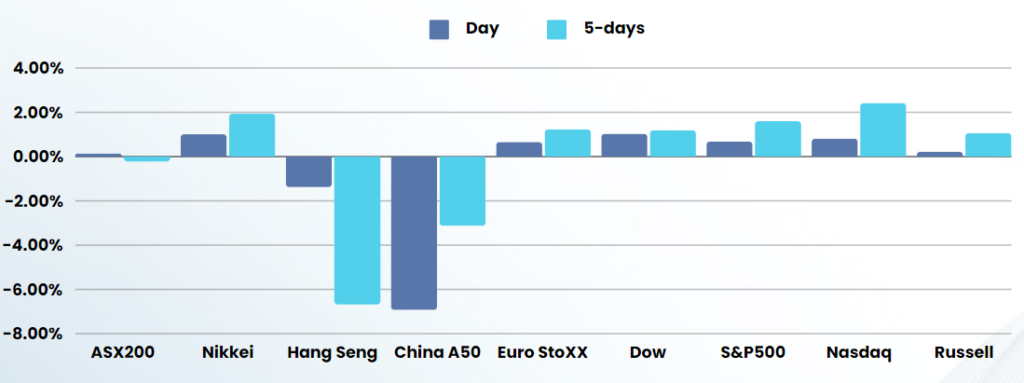

Stocks ground to fresh records as investors continued to digest clues on interest rates from the Federal Reserve, a day ahead of fresh inflation data and Tesla robotaxi event.

The FOMC Meeting minutes showed the majority of the central bankers supported the oversized 50bps rate cut, there were signs that some members preferred to kick off the rate cutting cycle with a more modest cut on worries about the strength of the economy, according to the minutes of the Federal Reserve’s Sept. 17-18 meeting, released Wednesday.

The minutes were somewhat stale as data since the September meeting has pointed to stronger economic growth, dimming investor bets on another round of jumbo rate cuts.

Strong payrolls data released last week sparked doubts over just how much impetus the Fed has to keep cutting rates at a fast pace. Traders were seen pricing in an 81.1% chance for a 25 basis point reduction in November, and an 18.9% chance rates will remain unchanged, according to CME Fedwatch.

The Fed cut rates by 50 bps in September and signalled future cuts will still be dependent on inflation and the labour market.

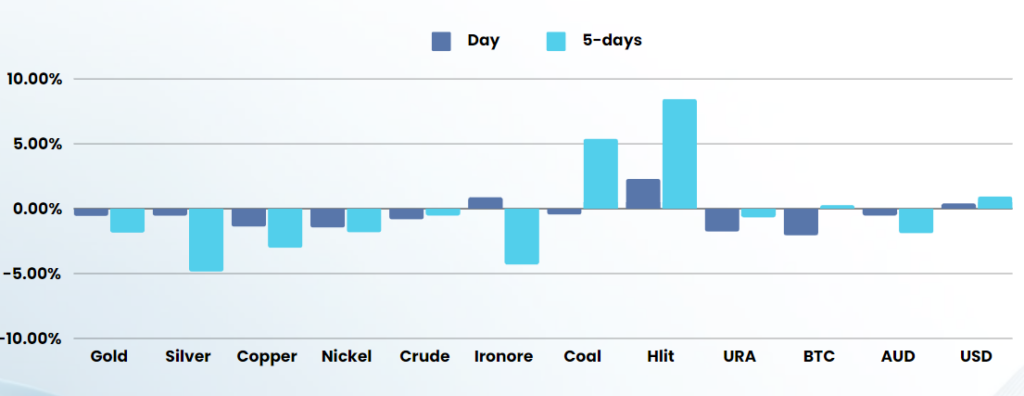

On the economic front, CPI numbers are due Tonight and are unlikely to provide much of a catalyst unless it shows signs of stubborn inflation. There are growing concerns that the last mile of getting inflation to the 2% is likely to more challenging than initially expected in the wake of stronger labour market.

The gulf coast of the US is still reeling from the super storm, hurricane Milton, with insurers likely to see huge claims as it approaches the coast of Florida

US earnings are also on investors minds, with the banks kicking off this quarters earnings season with JP Morgan, Wells Fargo & BNY Melon scheduled for Friday before the open of US markets

The middle east tensions are still bubbling in the background, with Israel expected to deliver “lethal and precise” attacks in the coming days

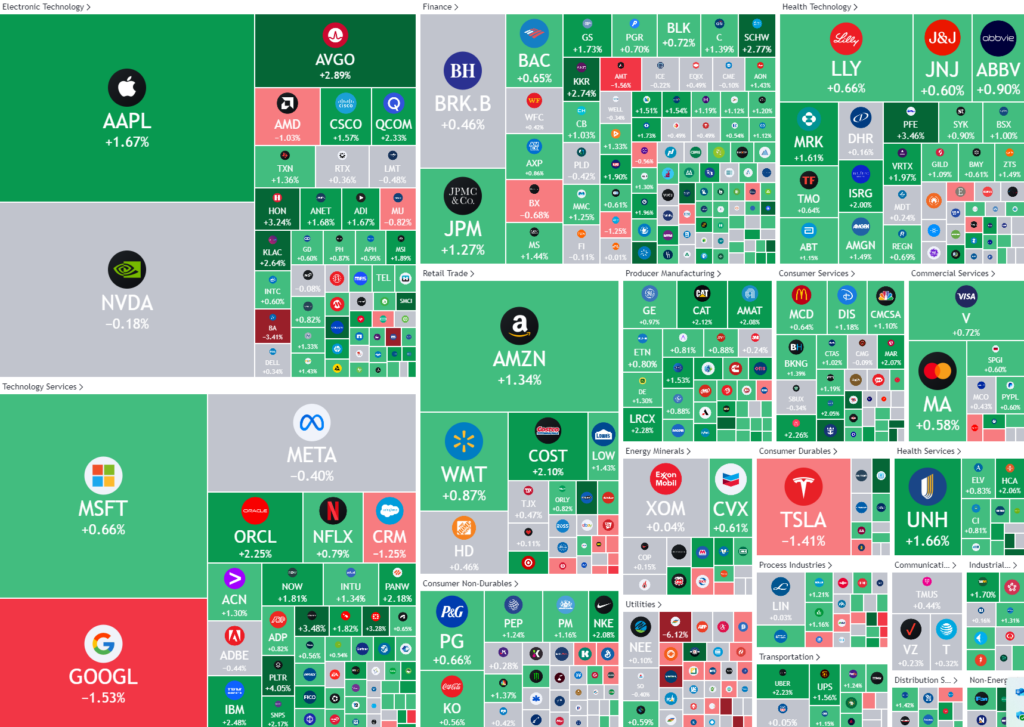

Stock specific

- Alphabet (Google) – fell 2% on news that the US Department of Justice is mulling possible sanctions against Google’s owner, following a landmark antitrust case that found the group guilty of abusing its dominant market position.

- Arcadium Lithium – stock soared 31% after global miner Rio Tinto agreed to acquire its US peer in a $6.7 billion all-cash deal, according to a statement on Wednesday.

- Tesla – The EV maker fell 1% as the electric vehicle maker gears up to kick off its robotaxi event slated for Wednesday.

ASX SPI 8250 (+0.40%)

We don’t expect much movement in comparison to the first half of this week as Chinese markets settle and investors look ahead to a full calendar of geopolitics, earnings, economic data and a major hurricane event in the US

RBA Assist Gov Hunter also speaks after the market closes this afternoon, which could swing rate expectations for the market