Overnight – Tech props up US stocks despite Chinese stimulus misfire

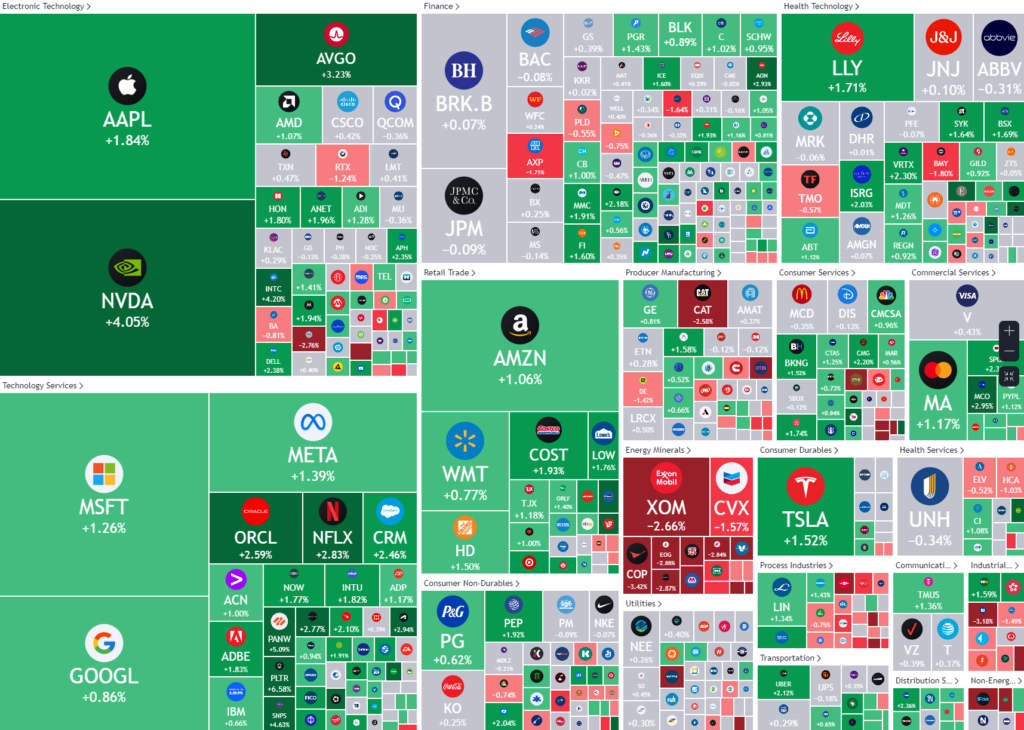

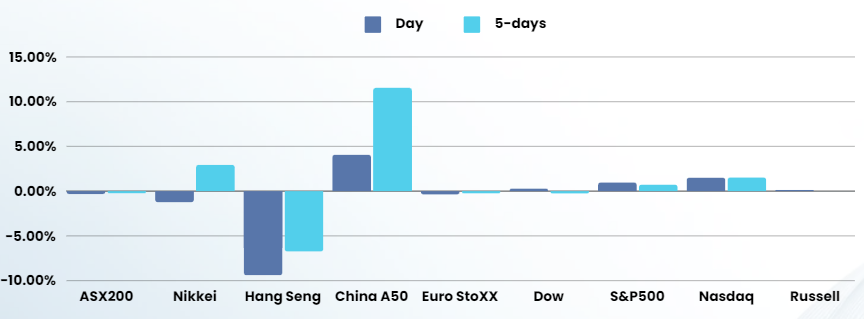

The US market was led higher by tech, particularly Nvidia, despite a rout in Chinese stocks, with Chinese tech index having their worst day in history

NVIDIA led the broader tech sector higher on optimism about the chip demand outlook after Foxconn chairman Young Liu’s said demand for Foxconn servers, which are powered by Nvidia’s upcoming Blackwell chip, is “much better than we thought.” Alphabet was marginally higher, a day after its Google unit was ordered by a US judge to reconfigure its Android operating system to allow rivals to make their own app marketplaces and payment options, marking a setback for the tech giant’s defense against antitrust claims.

There is little in the way of economic data due Tuesday to influence interest rate expectations, although the minutes of the September meeting are due on Wednesday and the September consumer price index on Thursday, with investors watching for any signs of inflation remaining sticky. Fed speakers continue to chime in on the rate outlook. Boston Federal Reserve President Susan Collins said further rate cuts will likely be needed as inflation continues to fall. While Atlanta Fed President Raphael Bostic said the strength in labor market points to ongoing economic strength.

Traders are currently pricing in an 80.9% chance the Fed will cut rates by 25 basis points in November, and a 19.1% chance the central bank will not cut rates at all, CME Fedwatch showed. Traders were also seen pricing in a higher terminal rate for the Fed’s current easing cycle.

The central bank slashed rates by 50 bps in September and announced the start of an easing cycle. But it still flagged a data-dependent approach to future rate cuts.

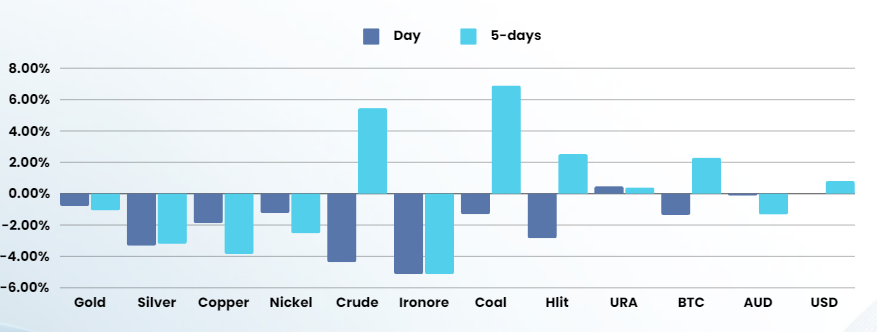

The lukewarm “commitment to economic targets” rather than the announcement of the buzz-phrase “Bazooka stimulus” tediously repeated by financial pundits saw commodities and the Chinese market crater, with Oil, Copper and Iron ore giving back much of last weeks gains

Hurricane Milton is looking like it will devastate the Gulf of Mexico in what is being described as the strongest Hurricane in 100 years

Company specific

- DocuSign is set to join the S&P500 MidCap 400 index on Friday, replacing MDU Resources, sending its shares more than 6% higher.

- PepsiCo stock rose 1.9% after the soft drinks giant reported third-quarter earnings beat expectations but its revenue fell short of estimates as the company faced subdued category performance in North America and international business disruptions.

ASX SPI 8236 (+0.18%)

Today will be a rough day for the materials sector after the severe reversal of the “Stimulus Bazooka” financial markets pundits repeated so much in the last week, the market believed it.

The lack of a stimulus announcement and the prevailing sell off, is more the market (yet again) mispricing in a hyperbolic fashion.