Overnight – Treasury yields spike, putting stocks on the back foot

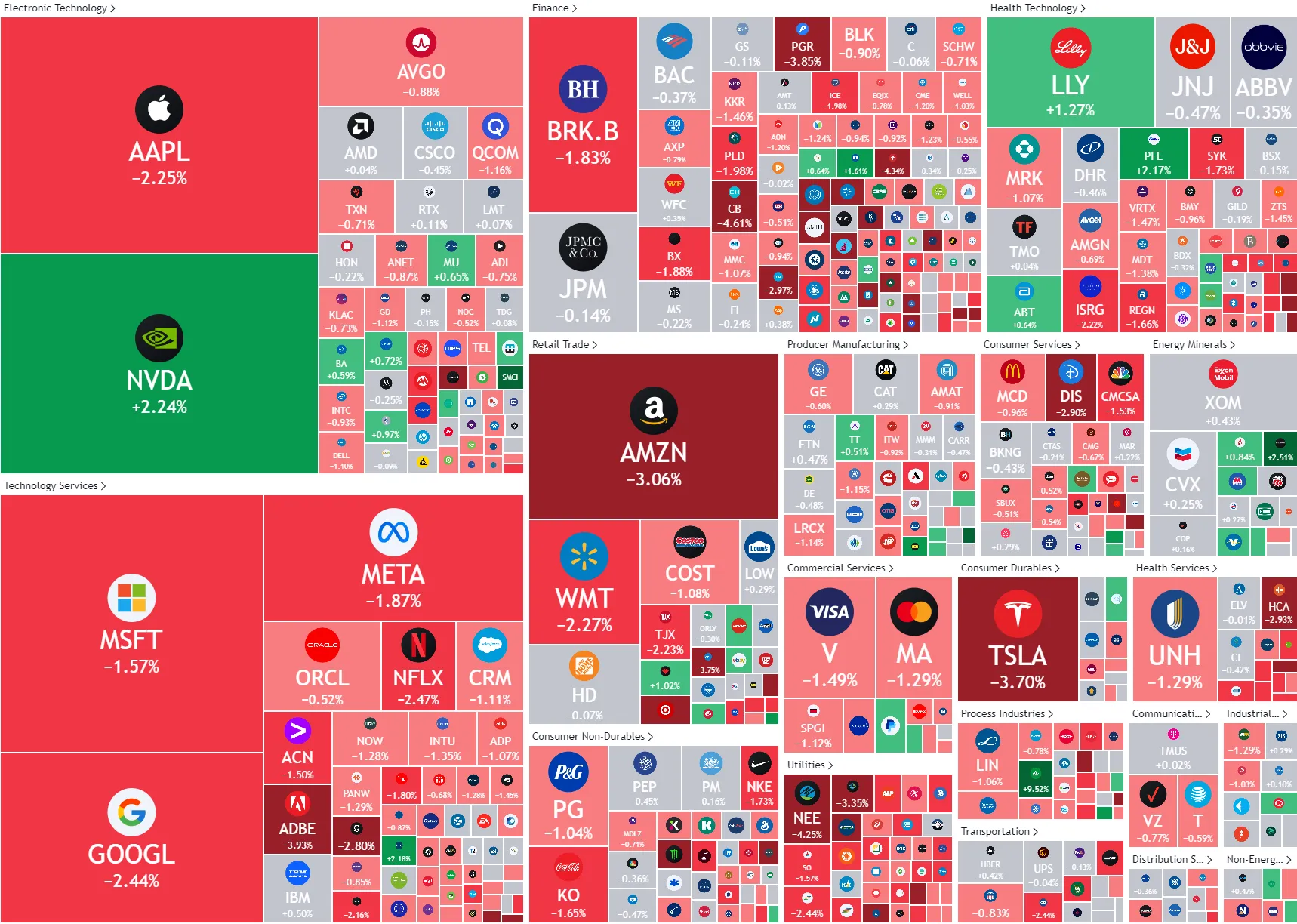

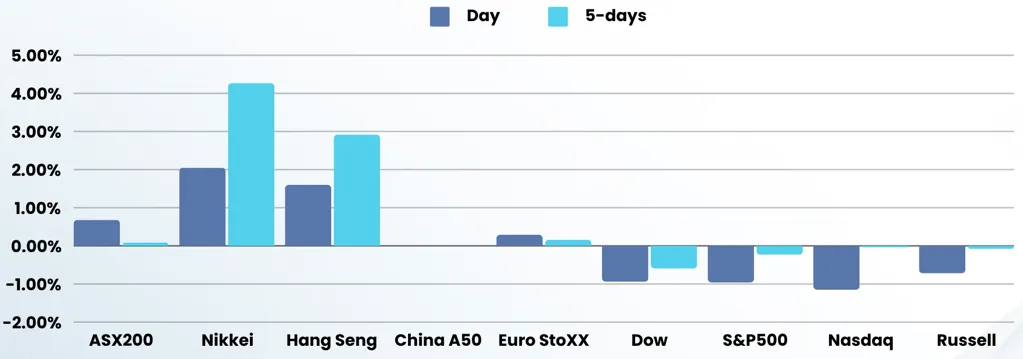

A jump in long term Treasury yields overnight put stocks on the back foot after a much stronger-than-expected September jobs report dimmed hopes for another jumbo-sized rate cut at the Fed’s November meeting.

The rebound in job growth puts the FOMC on a path of 25bp cuts for now, if at all, after the market got carried away with overly optimistic interest rate views. These wild bond movements could be avoided if traders and Investors actually listened to the Fed. The recent market noise is coming from the “tug-of-war” between the 2 vastly conflicting market views, a perfect soft landing or a deep recession, with the reality (as always) somewhere in the middle

A slew of Federal Reserve officials are set to speak in the coming days, offering monetary policy clues following the strong September jobs report. Minneapolis Fed President Neel Kashkari suggested Monday that the Fed welcomed the strong September jobs report, underscored the strength economy, which the central bank hopes will continue as its focus is now on the labour market. “It looks like it is still a strong labour market…it’s really good news as we want to keep a strong labour market,” Neel Kashkari said, referencing the blowout September jobs report.

The minutes of the Fed’s September meeting due Wednesday are likely to provide further clues on rate cuts. The Fed had cut rates by 50 bps during the meeting and marked the start of an easing cycle. Consumer price index inflation data for September is also due later this week, and is likely to factor into expectations for the path of U.S. interest rates. The third-quarter earnings season is set to start this week, with major banks JPMorgan Chase, Wells Fargo and Bank of New York Mellon set to report quarterly earnings on Friday. Markets will be watching to gauge whether corporate earnings persevered against pressure from high interest rates and sticky inflation.

Bullish investors are hoping results will justify increasingly rich valuations in the stock market. The S&P 500 is up 20% for the year so far and is trading near record highs despite recent volatility spurred by rising geopolitical tensions in the Middle East.

Company-specific

- Alphabet (Google) fell more than 2% after a U.S. judge delivered a final ruling on a antitrust lawsuit brought by Epic Games that forces the tech giant to offer alternatives to its Google Play store for downloading apps on Android phones. Google has vowed to appeal the decision.

- Pfizer stock rose 2.2% after Bloomberg reported that activist investor Starboard Value has taken a stake of about $1 billion in the drugs giant, seeking to spur a turnaround of the struggling company.

- Amazon.com fell more than 3% after Wells Fargo downgraded the e-commerce giant to equal weight from overweight as worries about rising competition from Walmart

ASX SPI 8251 (-0.33%)

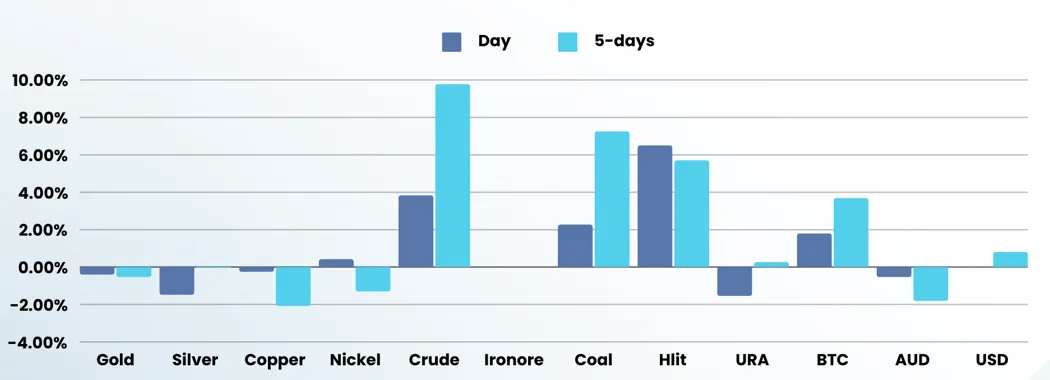

Today will be all about squaring up holdings as the local market heads into a 3-day weekend with the risk of the middle east tensions, payrolls numbers and China coming back online Monday… all with the ASX closed on Monday

Expect a steady stream of selling in risk assets for most of the day.