What's Affecting Markets Today

Asian markets rally stalls

The rally in Chinese markets lost momentum on Tuesday after the National Development and Reform Commission’s briefing offered few details on further stimulus measures. The CSI 300 index, which surged over 10% at the open following the Golden Week holiday, later trimmed gains to close 5% higher. Meanwhile, Hong Kong’s Hang Seng Index tumbled over 10% before recovering to a 6.4% loss.

Other Asia-Pacific markets also declined, with investors closely monitoring Japan’s August pay and spending data. Household spending fell 1.9% year-on-year, better than the 2.6% decline forecasted by economists, marking the fastest decline since January’s 6.3% drop. Real wages in Japan rose by 2% to an average of 574,334 yen ($3,877.44).

Japan’s Nikkei 225 dipped 0.99%, while the Topix dropped 1.06%. South Korea’s Kospi fell 0.72%, influenced by Samsung Electronics’ weaker-than-expected third-quarter guidance, while the Kosdaq edged down 0.31%.

ASX Stocks

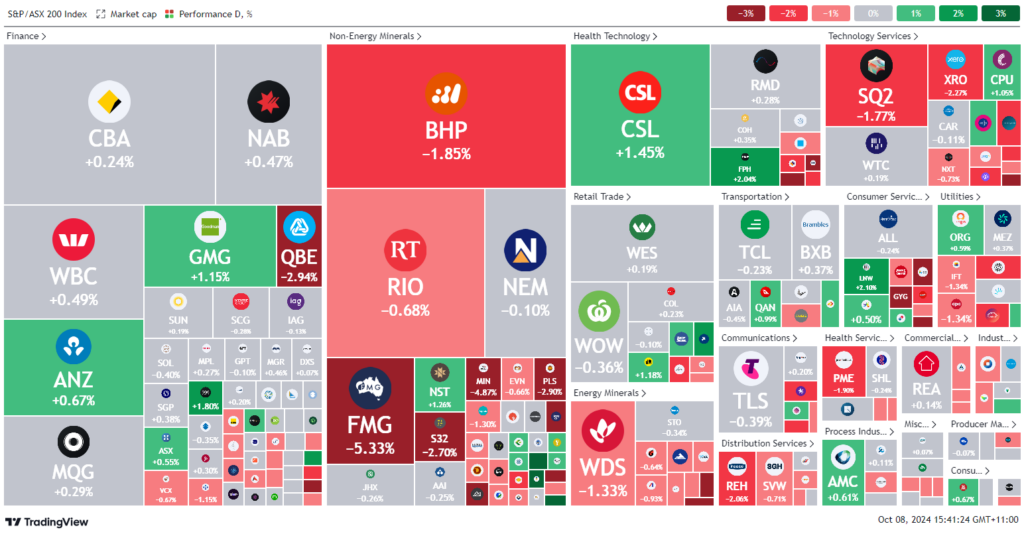

ASX 200 - 8,184.8 (-0.3%)

Key Highlights:

The Australian sharemarket faced a volatile session, weighed down by a sell-off in mining stocks and declining iron ore prices, as investors were left disappointed by the lack of further stimulus from China. The benchmark S&P/ASX 200 index fell 21.1 points, or 0.3%, to 8,184.3 around 1:55 pm AEDT, after a brief rally on hopes that Beijing would announce a public spending package.

China’s sharemarket initially surged as investors returned from a week-long holiday, but gains were quickly pared back following a press conference by the National Development and Reform Commission. Key mining stocks BHP and Rio Tinto dropped over 2% alongside a weaker iron ore price, with futures slipping from above $US114 to below $US110 per tonne. Energy stocks also declined as Brent crude fell toward $US80 a barrel, ending a five-day rally.

In other moves, West African Resources rebounded 6.5% after addressing concerns over its Burkina Faso permits. Meanwhile, Piedmont and Atlantic Lithium gained around 10%, riding momentum from Rio Tinto’s bid for Arcadium. Incitec Pivot fell 1% following news of CFO Paul Victor’s departure in February.

Leaders

WAF West African Resources Ltd (+7.28%)

VAU Vault Minerals Ltd (+4.84%)

BGL Bellevue Gold Ltd (+4.09%)

CCP Credit Corp Group Ltd (+3.03%)

JDO Judo Capital Holdings Ltd (+2.55%)

Laggards

FMG Fortescue Ltd (-6.14%)

MIN Mineral Resources Ltd (-5.83%)

IGO IGO Ltd (-5.08%)

CRN Coronado Global Resources Inc (-4.96%)

VUL Vulcan Energy Resources Ltd (-4.35%)