Last Night’s Market Recap

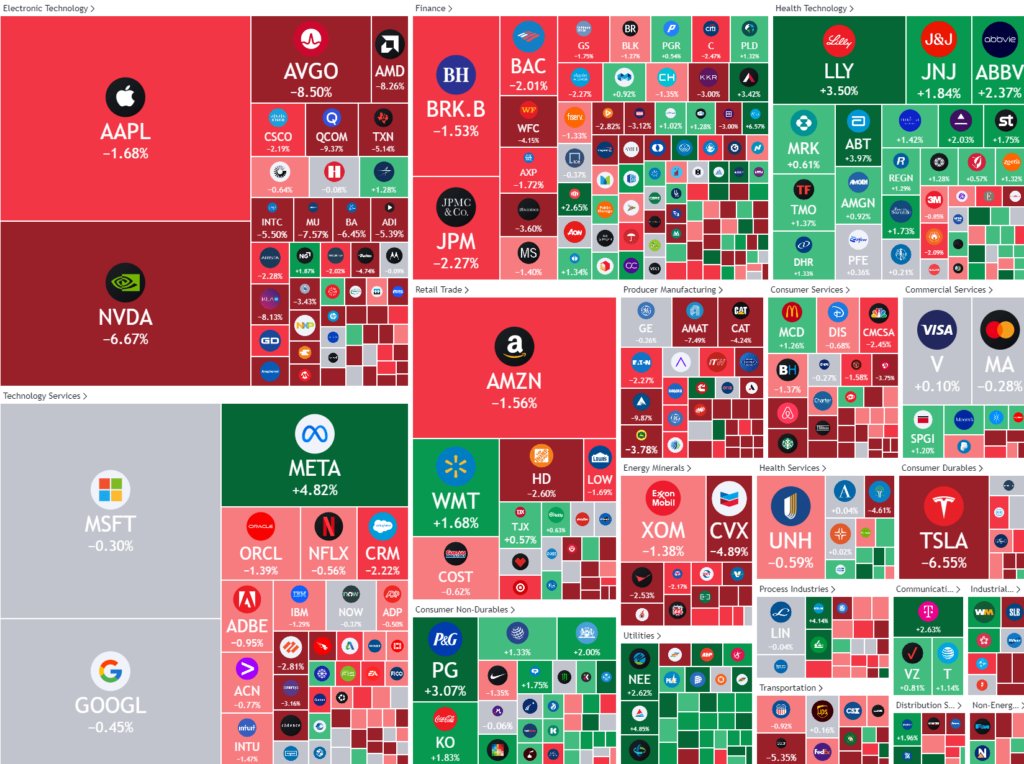

S&P 500 – Heatmap

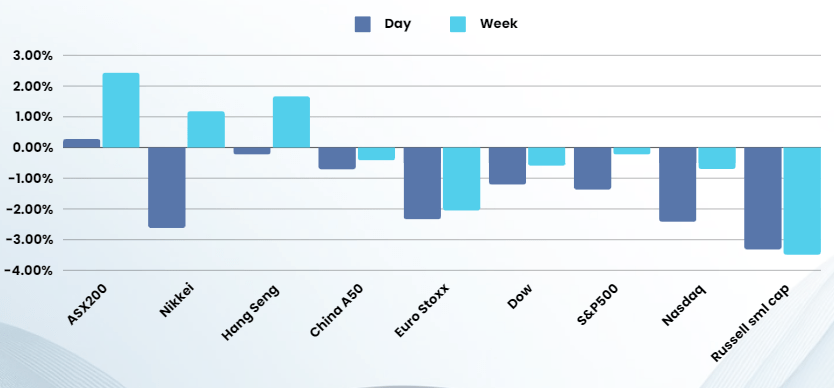

Overnight – Weak economic data rattles equities

Weaker economic data rattled investors overnight as jobless claims rose and US manufacturing data notched its 16th straight contraction, the longest streak in a quarter of a century

Initial jobless claims increased to 249,000 for the week ended in Jul. 27, higher than expected, while the ISM manufacturing index for July came in at 46.8, below the 48.2 forecast. The 16-month streak of sub-50 readings that extended from November 2022 through March 2024 was the longest streak of contraction since August 2000-January 2002 (18 months), notably exceeding the decline surrounding the Great Financial Crisis.

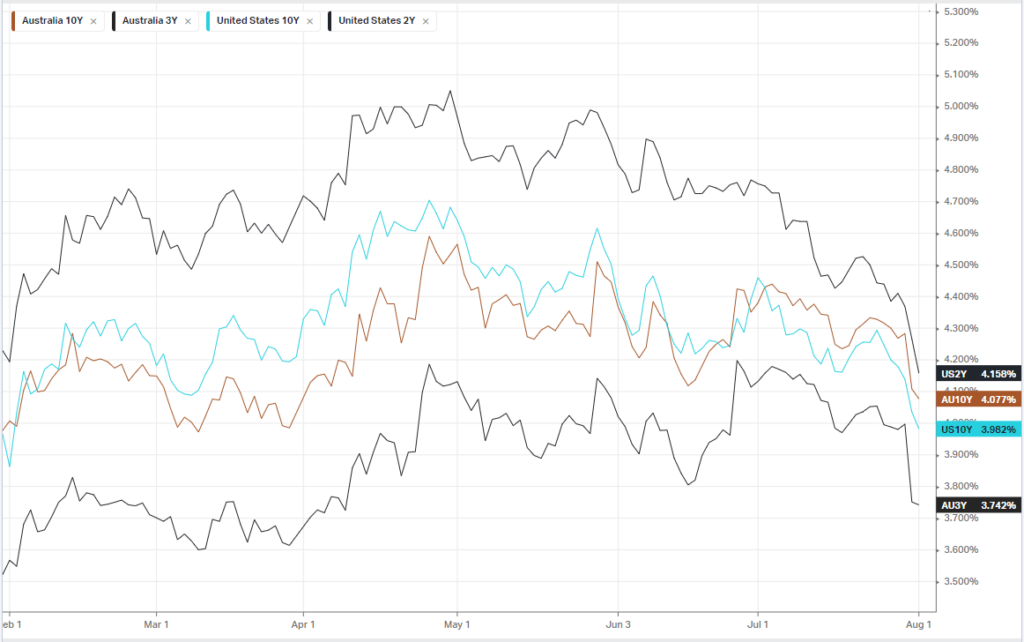

The duo of reports added to concerns about an economic downturn even as the Federal Reserve is expected to lower interest rates next month. The 10-year Treasury yield fell below 4% for the first since February as jitters about a hard landing resurface.

Technology stocks followed the broader market, lower, even as Meta Platforms jumped nearly 5% following stronger-than-expected second-quarter earnings and upbeat guidance. The results showed that its investments into AI to improve the efficacy of its target ads are starting to bear fruit, the first of the Mag7 to monetize AI. AI will be leveraged to accelerate progress across many objectives with significant compute requirements, and therefore CapEx is expected to grow ‘significantly’ in FY25.

After the bell, Apple survived its new iPhone delay with a rise in services revenue, however Amazon fell 6% and Intel collapsed 20% on poor guidance

Company Earnings

- Apple -1.07% (+0.64% post earnings) – after it reported another strong quarter, beating consensus estimates on the top and bottom line. Services revenue reached a new all-time high.

- Amazon -6% – after publishing disappointing quarterly sales and sales guidance. Net sales are expected to grow between 8% and 11% compared with third quarter 2023.

- Intel -20% – after it suspended its dividend and announced a cost reduction plan, while issuing disappointing guidance. Its comprehensive reduction in spending includes a more than 15% headcount reduction.

- Moderna -21% – after the drugmaker cut its full-year revenue guidance, citing low EU sales and a competitive vaccine environment in the US

- Qualcomm -9% – after flagging a revenue hit after the U.S. revoked one of its export licenses for sanctioned Chinese telecom firm Huawei. The chipmaker also reported quarterly results that topped Wall Street estimates.

- Arm Holdings -16% – after chip designer’s softer guidance offset better-than-expected quarterly results.

Bonds

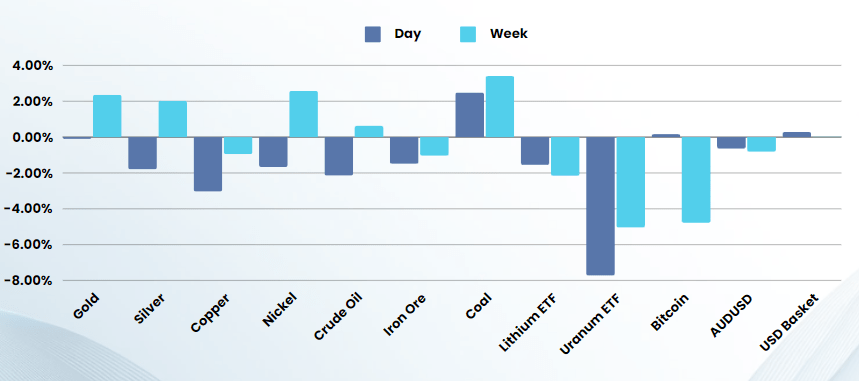

Commodities & FX

The Day Ahead

ASX SPI 7925 (-1.78%)

There will be one word to describe the local market on the open “ugly” with futures pointing to a 1.8% fall. Once the initial panic is out of the way, the market is likely to stabilize and head back into the middle of the range as most of the downside in the US market was in chip stocks or the MAG7

Company specific:

- Resmed – Sleep apnoea devices manufacturer ResMed’s revenue rose 9 per cent to $US1.2 billion ($1.85 billion) in the last quarter of fiscal 2024, taking quarterly dividends to US53¢ per share, up 10 per cent. In the 12 months to June, revenue jumped 11 per cent to $US4.7 billion, driven by high demand in the US, Canada and Latin America. Non-GAAP diluted earnings per share rose to $US2.08, from $US1.6 a year ago, thanks to strong sales and higher gross margins.