Closing Bell

What's Affecting Markets Today

RBA’s Rate Decision

The Reserve Bank of Australia (RBA) has maintained the cash rate at 4.1% for the fourth consecutive month. Despite inflation surpassing its peak, it remains high and is expected to persist. The RBA emphasized its commitment to returning inflation to its target and hinted that further monetary policy tightening might be necessary. The market reacted with bond yields easing, anticipating a firmer RBA stance on inflation. This decision marks the first under new governor Michele Bullock. Key factors influencing the decision include recent oil price surges and significant shifts in global bond yields.

Yen’s Position

The US dollar’s rally is pushing the yen towards the 150-level, a significant threshold for potential Japanese intervention. This level is crucial as it prompted interventions in late 2022 and early 2023. Japanese authorities have expressed a “strong sense of urgency” regarding the yen’s position, with more comments expected from the finance ministry.

Bond Market Movements

Following the RBA’s decision, the Australian dollar decreased slightly, and bond yields softened. Traders anticipate a stronger RBA commitment to address inflation. Interest rate swaps have adjusted their expectations, now predicting a 62% chance of a rate increase to 4.35% this year.

ASX Stocks

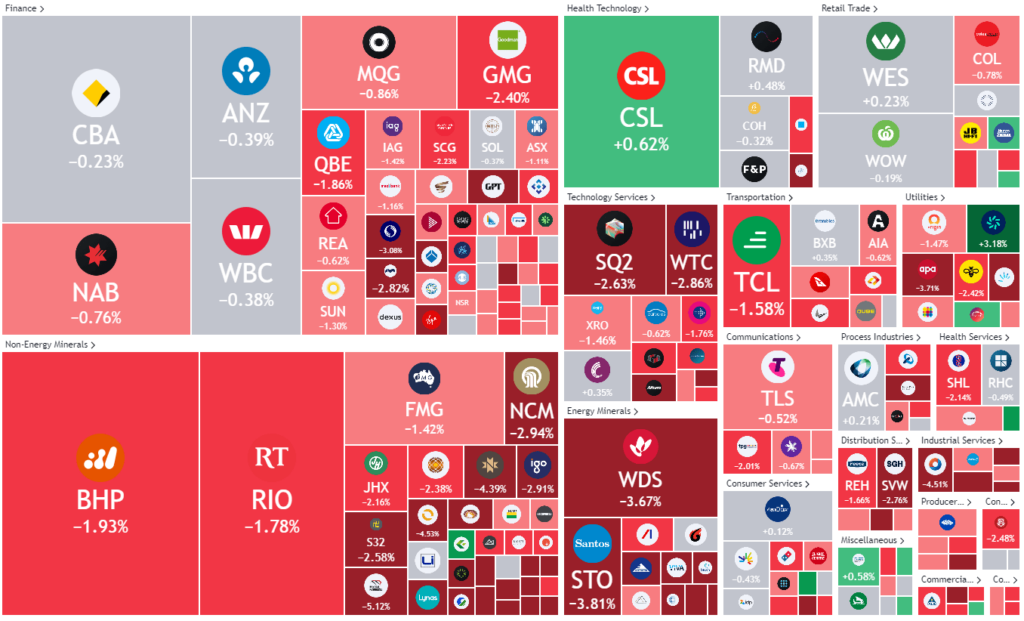

ASX 200 - 6938.9 -94.3 (-1.34%)

Key Highlights:

The Australian sharemarket remained near a six-month low post the RBA’s rate decision. The S&P/ASX 200 index dropped by 1.1%, with energy and mining sectors experiencing over 2% declines. Hawkish comments from the US Federal Reserve influenced bond yields, with the 10-year US Treasury rate reaching its highest since 2007. Tribeca portfolio manager Jun Bei Liu highlighted concerns over the rise in the 10-year bond yield, suggesting prolonged high interest rates could negatively impact the equity market. Stocks like BHP Group, Rio Tinto, and Fortescue experienced declines, mirroring the dip in iron ore prices. Other notable movements included Woodside Energy’s 3.5% drop and Computershare’s 0.9% rise following its announcement of selling its US mortgage services business.

Leader

LFG-Liberty Financial Group (+11.43%)

MEZ-Meridian Energy Ltd (+2.97%)

MAD-Mader Group Ltd (+2.85%)

NEU-Neuren Pharmaceuticals Ltd (+2.68%)

TAH-Tabcorp Holdings Ltd (+2.14%)

Laggards

SYA-Sayona Mining Ltd (-9.52%)

WGX-Westgold Resources Ltd (-8.14%)

WAF-West African Resources Ltd (-6.77%)

SLX-SILEX Systems Ltd (-6.42%)

PDN-Paladin Energy Ltd (-5.46%)