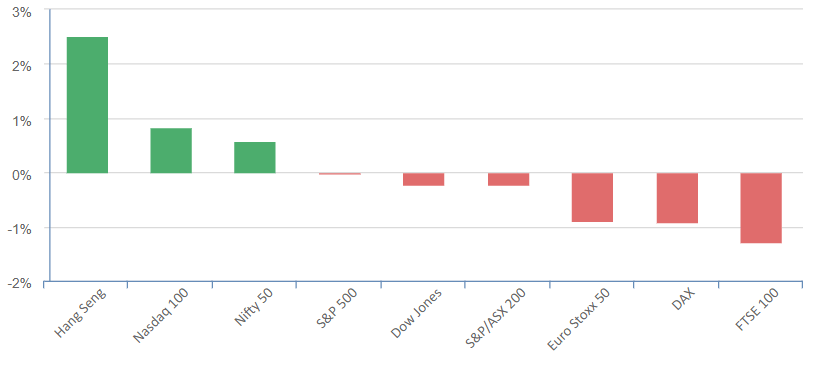

Overnight – Rising rate hike expectations cap equities gains

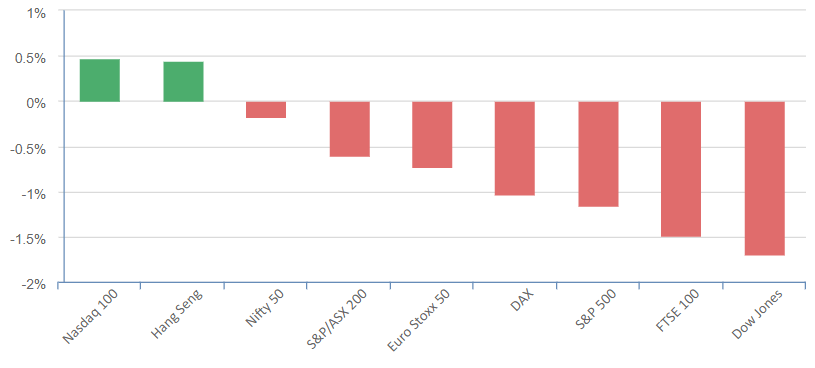

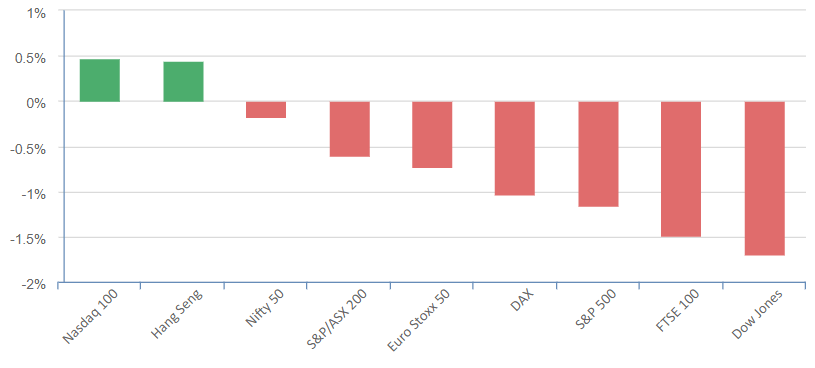

Equites gave back initial gains from the US govt averting a shutdown until Treasury yields were pushed higher by growing expectations for another Federal Reserve interest rate hike. The US2Y yield rose 5.2 points to 5.098%, while the US10Y rose 9.3 basis points to 4.669%. Congress passed a short-term funding measure to keep the government funded through Nov. 17, avoiding a shutdown that many had expected to dent near-term economic growth. About 30% of traders expect the fed to lift rates next month, up from about 18% last week.

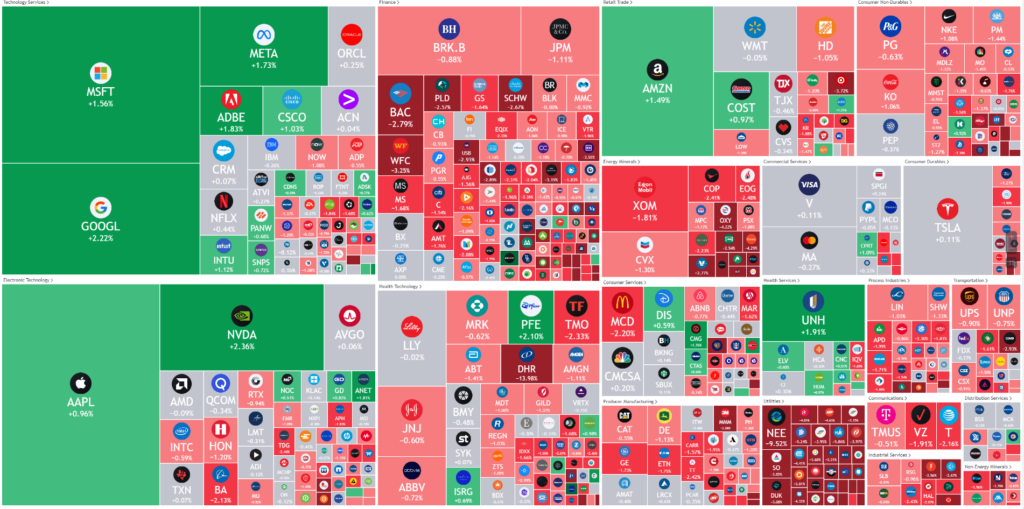

Big tech cut some gains, pressured by rising Treasury yields, the enemy of growth stocks, though remained supported by a rise in Google and Meta. NVIDIA, up 2%, also helped support the broader tech sector after Goldman Sachs added the chipmaker to its “conviction buy list,” which typically includes the stock that the bank believes is likely to outperform.

Energy fell more than 2%, paced by decline in EQT, Marathon Oil and APA, as oil prices were dragged lower by concerns about rising supply and higher dollar. Still, oil prices remained above $90 a barrel, with some forecasting a boost in demand from China’s annual ‘Golden Week’ holiday.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 6963 (-1.42%)*

Tthe ASX will have a rough day as higher yields pushed the USD higher, triggering a sell-off in commodities like gold, silver and oil. The focus will be on the RBA rate decision at 1430 which will give investors nerves considering the recent rise in bond yields.

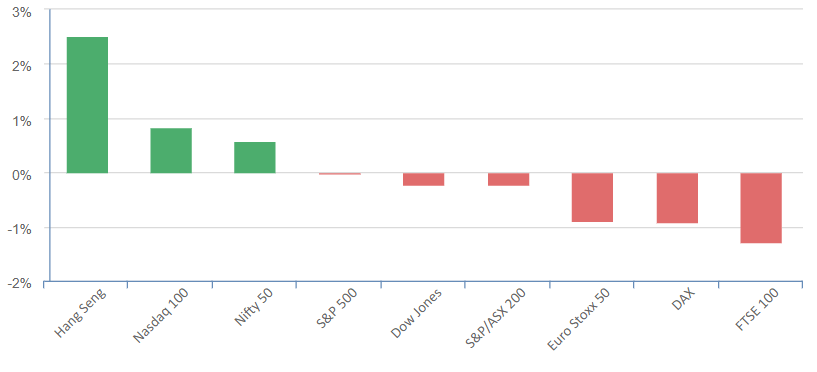

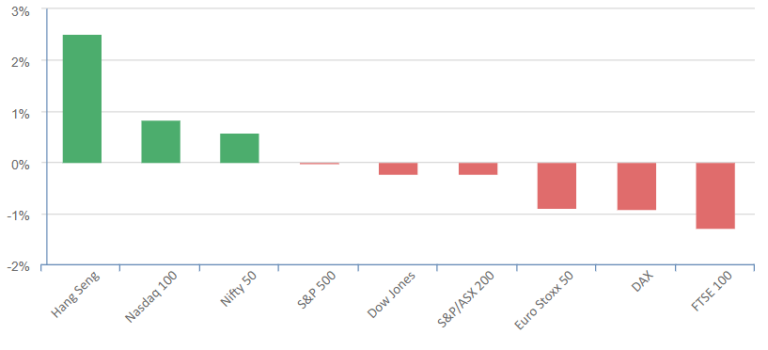

Chinese markets are closed this week for the Mid-Autumn Festival and China’s National Day.

*ASX24 SPI price as at 7am AEDST