Release Summary

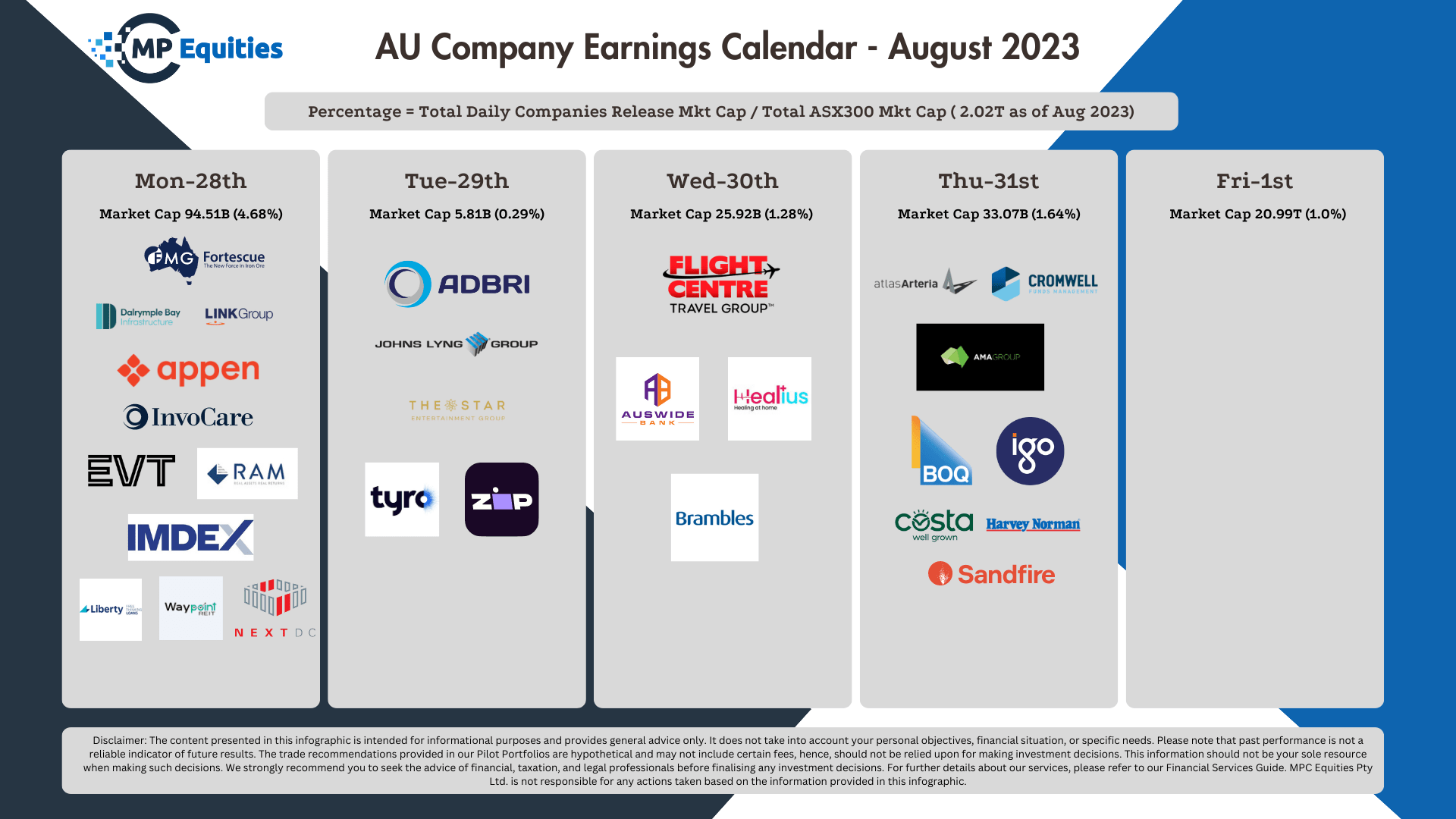

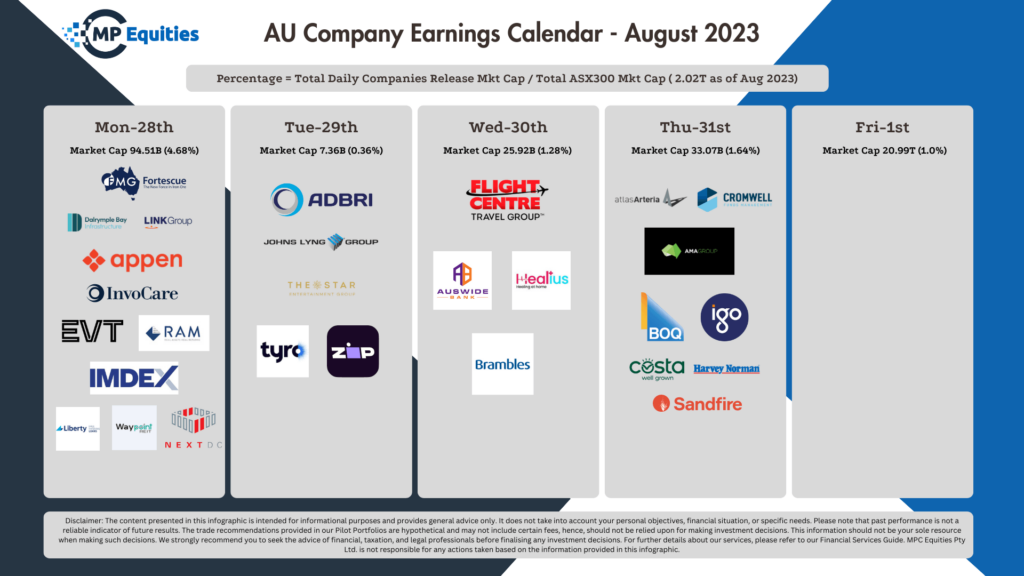

Fortescue Metals Group Limited (FMG: ASX) – Fortescue Metals has appointed Dino Otranto as its new chief executive. The company declared a fully franked final dividend of $1 a share. For the financial year 2023, the iron ore giant reported a 3% decrease in revenue, amounting to $US16.9 billion ($26.3 billion). Its EBITDA dropped by 6% to $US10 billion, and the net profit after tax fell by 23% to $US4.8 billion. Fiona Hicks decided to leave the company after serving for just under six months.

Nextdc Limited (NXT: ASX) – NextDC, a data centre player, saw its revenue increase by $71.1 million, marking a 25% growth, reaching $362.4 million. The company’s EBITDA also rose by 20% to $182.6 million. However, for the full year ending June 30, NextDC posted an after-tax loss of $25.64 million, primarily due to a 270% surge in energy costs in 2023 compared to 2022. Despite these challenges, the company’s stock has risen by over 50% this year, reaching $13.62.

Evt Limited (EVT: ASX) – Hospitality leader EVT Limited reported a 25.4% increase in its revenue for the financial year 2023, reaching $1.2 billion. The company’s earnings before interest and tax and amortisation were reported at $187 million, marking a 35.2% growth. Furthermore, the net profit after tax soared by 99.8% to $106.5 million. EVT also declared a fully franked final dividend of 20¢ a share.

Invocare Limited (IVC: ASX) – Artificial intelligence data services company Appen experienced a 24% drop in its revenue for the first half, settling at $139.5 million. The company reported a significant net loss of $43.3 million for the six months ending June 30. As of June 30, 2023, Appen held a cash balance of $55.2 million. The company has decided not to pay a dividend this year.

Waypoint Reit Limited (WPR: ASX) – Waypoint REIT reported its financial performance to be in line with guidance, with distributable earnings amounting to $55.6 million or 8.28 cents per security. The company’s statutory net profit was $29.1 million. As of June 30, 2023, the investment property portfolio comprised 402 properties valued at $2,920.4 million.

Neuren Pharmaceuticals Limited (NEU: ASX) – Neuren Pharmaceuticals highlighted a total income of A$64.4 million for the half-year ending 30 June 2023, which included A$62.9 million revenue from DAYBUE. The company’s profit after tax was A$47.8 million, and the cash generated by operations was A$44.9 million.

Liberty Financial Group Limited (LFG: ASX) – Liberty Financial Group reported a 17% decline in its after-tax profits for the financial year 2023, amounting to $181.1 million. The company’s final dividend was reduced to a fully franked 24¢ a share. Despite the challenges, the company’s operating income saw a 41.8% increase, reaching $1.25 billion.

Imdex Limited (IMD: ASX) – Mining services company Imdex reported a 22% decline in its net profit for the financial year 2023, settling at $35 million. However, the company’s revenue saw a 20% increase, amounting to $411.4 million. Imdex also declared a final fully franked dividend of 2.1¢ a share.

Link Administration Holdings Limited (LNK: ASX) – Link Group, a superannuation administration and share registry company, has decided to pay a final dividend of 4¢ a share despite reporting a significant bottom-line loss of $418 million for the 12 months ending June 30. The company’s revenues increased by 4.5% to $1.23 billion.

Appen Limited (APX: ASX) – Appen, an artificial intelligence data services company, reported a 24% decline in its revenue for the first half, amounting to $139.5 million. The company faced a net loss of $43.3 million for the six months ending June 30. As of June 30, 2023, Appen’s cash balance was $55.2 million. The company has decided not to pay a dividend this year.

Mineral Resource (MIN: ASX) – Reports after market

- Mineral Resources (ticker: MIN:ASX) – Mineral Resources is exploring potential partnerships in the lithium sector and has initiated discussions with various car manufacturers. The company’s share price witnessed a surge of 6.5%, reaching $68.60. Despite achieving record earnings from its lithium division, the company’s annual profits took a hit due to a $552 million write-down on its iron ore operations. The net profit for the year stood at $244 million, marking a decrease of $107 million from the previous year. Revenue saw a significant increase of 40%, amounting to nearly $4.78 billion, with the underlying EBITDA rising by 71% to reach $1.8 billion. The company announced a fully franked final dividend of 70¢ per share.

- Adbri Limited (ticker: ABC:ASX) – Adbri reported a modest increase in its net profit by 3%, totaling $49.7 million for the first half of the year ending June 30. This growth was supported by a 14% rise in revenues, which reached $926 million, attributed to the price hikes on its product range. Despite the profit lift, the company has decided against disbursing an interim dividend, aiming to conserve capital for the upcoming upgrade of the Kwinana plant situated in Western Australia.

- Star Entertainment Group Limited (ticker: SGR:ASX) – Star Entertainment disclosed a staggering full-year loss of $2.4 billion. This loss was primarily due to the company writing off more than $2 billion in value from its casinos located in Sydney, Gold Coast, and Brisbane. However, on a brighter note, the company’s revenue climbed by 22%, aggregating to $1.9 billion for the entire financial year.

- Johns Lyng Group Limited (ticker: JLG:ASX) – Johns Lyng is optimistic about FY24, projecting a robust revenue growth of 18.5%. For the financial year 2023, the company reported a 43.2% surge in revenue, reaching $1.28 billion. The EBITDA for the same period rose by 42.9%, amounting to $119.4 million. Shareholders can expect a final dividend of 4.5¢, which is scheduled for payment on September 18.

- Tyro Payments Limited (ticker: TYR:ASX) – Tyro announced a record EBITDA of $42.3 million for the year concluding on June 30. The company expanded its retailer base using its machines by 14% and reported $150 million in loan originations. The shares of the company experienced a boost, increasing by 13% to settle at $1.27.

- Zip Co Limited (ticker: ZIP:ASX) – Zip Co unveiled its record transaction volumes and revenue figures for the year ending in June. The company processed transactions worth $8.9 billion on its platform, marking a 7% growth. The group’s revenue set a new record at $693.2 million, which is 16.1% higher than the previous year. The cash gross profit for the company stood at $250.6 million, reflecting a 20% growth.

- Brambles Limited (BXB: ASX) – Brambles has lifted its final dividend to US14¢ per share, up from US12¢ a year ago. The company reported a 19% increase in net profit after tax for the year ending June 30, reaching $US703.3 million. Sales revenue rose by 14% to $US6.08 billion, even with a 2% decrease in volumes. The company’s CEO, Graham Chipchase, highlighted strong annual results amidst challenges. Brambles also announced the appointment of Joaquin Gil as its new chief financial officer.

- Flight Centre Travel Group Limited (FLT: ASX) – Flight Centre reported a significant year-on-year turnaround in underlying earnings, amounting to $301.6 million. The company will pay an 18¢ per share fully franked dividend, marking the first since the pandemic began. The travel group has seen profit and sales in the first two months of FY 2024 surpass the previous year’s figures.

- Healius Limited (HLS: ASX) – Healius reported a substantial loss of $368 million for the year, primarily attributed to impairments in its pathology business. The company’s revenue saw a decline, linked to a decrease in COVID-19 related testing. Healius is currently under a takeover offer from rival ACL. The company’s loss for the year ending June contrasts with the previous year’s $308 million profit. Healius did not declare a dividend and has initiated reforms to improve its business operations.

IGO Limited (IGO:ASX) – In FY23, IGO Limited reported a revenue of $1,023.9M and a post-tax profit of $549.1M. This financial performance includes results from assets acquired from Western Areas Limited. The company highlighted a substantial net profit of $1,603.6M from its lithium joint venture with Tianqi Lithium Energy Australia Pty Ltd. However, the Nova Operation saw an 18% revenue decrease from the previous year, influenced by an 18-day operational halt due to a fire incident. The Forrestania Operation contributed $275.5M in revenue, and an impairment charge of $968.5M was recorded on certain assets. The net tangible asset backing per ordinary share rose to $5.01.

Atlas Arteria (ALX:ASX) – Atlas Arteria reported a 17% increase in interim net profit, reaching $136.5 million. This growth was attributed to rising income from its toll roads in various countries. However, the Chicago Skyway experienced a 2.4% traffic decline due to roadworks, though its toll revenues saw an 8.6% increase. The company’s income benefited from currency strengths and inflation, as some toll fares are linked to consumer price indices. Atlas Arteria plans to distribute dividends of 20¢ per share for both the first and second halves of the year.

Harvey Norman Holdings Limited (HVN:ASX) – Harvey Norman, Australia’s leading home and white goods retailer, reported a significant decline in profits and dividends for fiscal 2023. The company’s pre-tax profit stood at $776 million, a 32% decrease. Total revenues across all segments reached $4.28 billion, marking a 5.1% decline. The company’s net profit dropped to $546.8 million from the previous year’s $811.5 million. Despite these challenges, Harvey Norman’s property portfolio surpassed the $4 billion milestone. The company declared a final dividend of 12¢ per share.

Sandfire Resources Limited (SFR:ASX) – Sandfire Resources’ new chief, Brendan Harris, highlighted the successful performance of the new Motheo mine in Botswana. The company underwent significant transformations, acquiring new mines and retiring the Degrussa mine. This led to a 15% decrease in revenue for the year. Sandfire reported a loss of $US53.6 million, a stark contrast to the previous year’s profit of $US109 million. The company did not declare a dividend, choosing to prioritize expansion and balance sheet strengthening.

Cromwell Property Group (CMW:ASX) – Cromwell Property Group reported a net loss of $443.8 million, primarily due to a decline in property valuations. The operating profit decreased by 21% to $158.6 million. Despite the challenges faced in 2023, the company disposed of $505 million worth of non-core assets. The company anticipates fiscal 2024 to be challenging, with a focus on reducing gearing.

AMA Group Limited (AMA:ASX) – AMA Group is seeking a cash injection of up to $60 million. The company’s shares have plummeted nearly 40% this year, and concerns have been raised about its ongoing viability. The company recently downgraded its earnings guidance.

Update coming next week.

Previous Weeks

No posts found!