Closing Bell

What's Affecting Markets Today

- Japan’s Bond Yield Surge – Japan’s 10-year bond yield reached a nine-year peak of 0.66%. This surge, influenced by rising global interest rates and a robust U.S. economy, might prompt unscheduled bond purchases by the Bank of Japan to manage the ascent. The U.S. Treasury yield, buoyed by a resilient U.S. economy, is at its highest since 2007 at 4.35%.

- US Bank Downgrades – Following Moody’s recent downgrades, S&P Global Ratings has lowered ratings for several US banks such as KeyCorp, Comerica, and Valley National Bancorp due to higher interest rates and industry-wide deposit shifts. The shift towards high-yield accounts by depositors has squeezed liquidity, with the KBW Bank Index for major US banks dropping almost 7%.

- China’s Actions Against Yuan Bears – China is bolstering the yuan by hiking offshore market funding costs and setting a strong daily yuan rate. The People’s Bank of China fixed the yuan at 7.1992 per US dollar, significantly deviating from Bloomberg’s expected 7.3103 rate. In response to a flagging economy, the bank has adopted measures to slow the yuan’s decline, such as dollar sales by state banks.

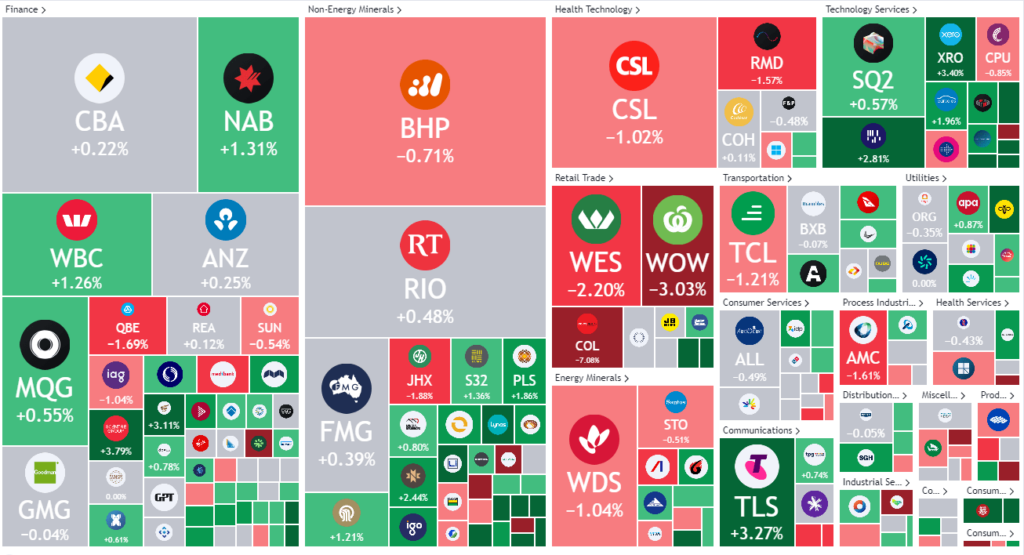

ASX Stocks

ASX 200 -7121.6 +6.1 (0.09%)

What’s happening in reporting season?

A surge in tech stocks has rejuvenated the Australian sharemarket, pushing the S&P/ASX 200 up by 0.1% to 7123.6, despite an earlier dip to 7090. This tech rally, inspired by Wall Street’s momentum ahead of Nvidia’s upcoming earnings result, saw significant jumps in local stocks like Altium and Megaport, which both reported strong earnings. Conversely, the consumer staples sector faced a decline, with Coles’ disappointing earnings leading to a 5.7% fall in its share price.

Key Highlights:

- Newmont’s Acquisition of Newcrest (NCM: ASX) – Newmont announced that the Australian Competition and Consumer Commission (ACCC) has approved its proposed acquisition of Newcrest Mining Limited. This clearance will be forwarded to Australia’s Foreign Investment Review Board for further review.

- Altium Limited’s Upgraded Forecasts (ALU: ASX) – Analysts have upgraded the statutory forecasts for Altium Limited , with a revised revenue prediction of US$315m for 2024, marking a substantial 32% increase from the past year’s sales. Compared to its industry peers, Altium’s projected growth rate is notably higher, suggesting a brighter outlook for the company.

Earnings Releases:

For more detailed summary click the earnings calendar here.

- AKE Allkem (AKE: ASX) – Achieved $US1.2 billion in revenue, planning a merger with Livent.

- BHP Group Limited (BHP: ASX) – Profit down 37% to $US13.4 billion due to reduced sales.

- Woodside Energy Group Limited (WPL: ASX) – 6% first-half profit increase after BHP merger.

- Coles Group Limited (COL: ASX) – 5.2% annual revenue growth, mainly from food price hikes.

- Scentre Group (SCG: ASX) – Significant profit drop due to mall portfolio writedown.

- Viva Energy Group Limited (VEA: ASX) – H1 profit down 50% due to Geelong refinery issues.

- Hub24 Limited (HUB: ASX) – Net profit up 160% to $38.2 million in FY23.

- Megaport Limited (MP1: ASX) – 40% revenue growth with reduced net loss.

- Ingenia Communities Group (INA: ASX) – Underlying profit down 4% YoY.

- Nanosonics Limited (NAN: ASX) – 38% revenue increase, US direct sales shift.

- Monadelphous Group Limited (MND: ASX) – Achieved $1.83 billion in sales revenue.

- Kogan.Com Limited (KGN: ASX) – Gross sales and revenue declined by 28.4% and 31.9%.

- Monash Ivf Group Limited (MVF: ASX) – Positive FY24 outlook, facing genetic tech lawsuit.