Last Night's Market Recap

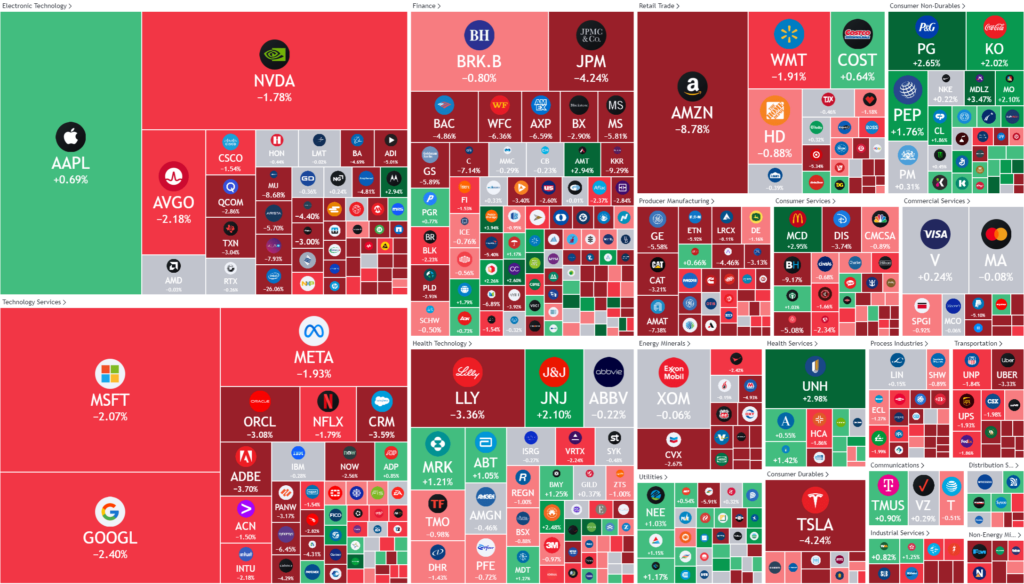

S&P 500 - Heatmap

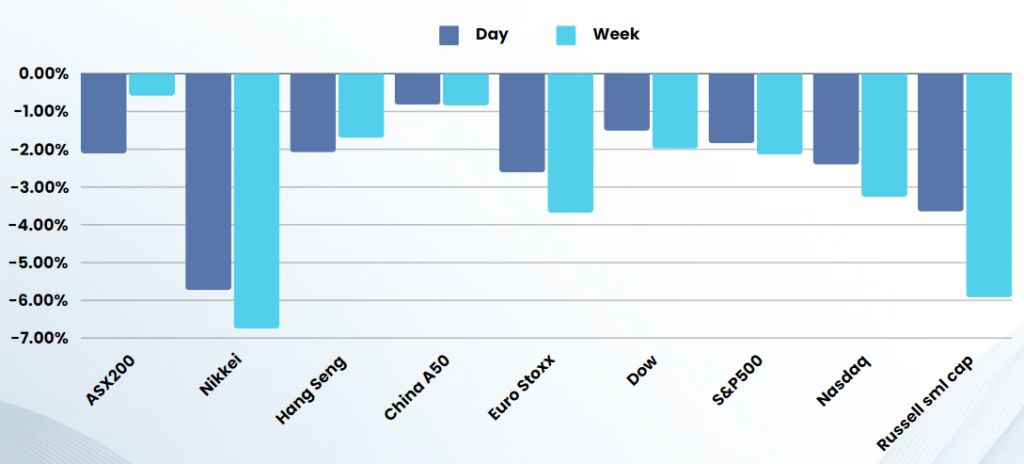

Overnight – Weak jobs number triggers “hard landing” fears

Investors abandoned growth stocks as a much weaker-than-expected jobs report triggered fears the US economy could be heading for recession and sparked a sharp jump in volatility.

The July official jobs report showed that fewer jobs were created last month than expected, with nonfarm payrolls rising 114,000 last month, the lowest since January 2021, and down from a revised 179,000 in June. Economists had seen the July number at 177,000. The unemployment rate also rose to 4.3%, up from 4.1% in June, while month-on-month average hourly wage growth came in at 0.2%, a drop from 0.3% the previous month.

The weaker data prompted many on Wall Street to call on the Fed to slash rates by 50 basis point at the September meeting. US analysts were overwhelmingly concerned, saying “The sharp slowdown in payrolls in July and sharper rise in the unemployment rate makes a September interest rate cut inevitable,” “and will increase speculation that the Fed will kick off its loosening cycle with a 50 bp cut or even an intra-meeting move.”

Fears about the economy ushered a wave of volatility as the CBOE Volatility Index, or so-called fear index, hit 15 month highs, rising to 24.12, the highest level since March 2023.

“The current flare up has put the VIX back over 20 for the first time since the Fall of last year. Its important to note that over the past decade or so VIX has averaged 19 so even a 20 reading is quite low relative to history – it’s the speed and scale of the algo driven selloffs that create the sense of much higher volatility

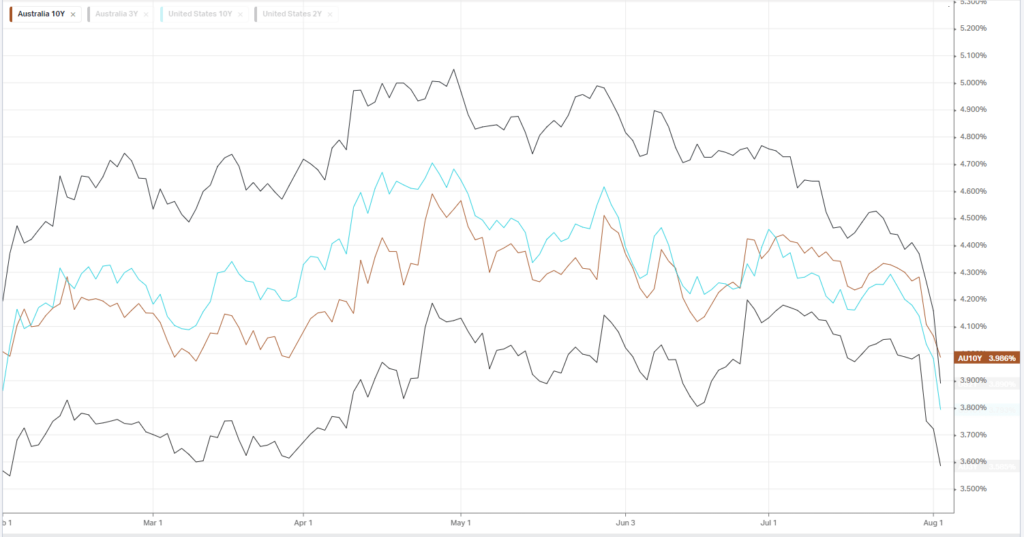

In a further sign of economic worry, the yield on 10-year Treasuries plunged 185 basis points to 3.79% to the lowest levels since December.

Company Earnings

- ExxonMobil (XOM) +0.27% – has reported a robust second-quarter earnings of $9.2 billion, marking one of the most profitable periods in the last decade. The energy giant has seen record production levels in Guyana and the Permian Basin, with the latter achieving 1.2 million barrels per day. Sales of high-return performance products have also reached a new high, climbing by 5% sequentially. Amid these strong operational results, ExxonMobil has returned substantial capital to shareholders, distributing $9.5 billion, including $4.3 billion in dividends.

- Chevron Corporation (CVX) -2.5% – has delivered a strong performance in the second quarter of 2024, marked by an 11% increase in production compared to the previous year and record-setting output in the Permian Basin. The company is poised for further growth with a focus on both traditional and new energy sectors, as well as upcoming projects expected to enhance cash-margin and reduce carbon intensity.

Bonds

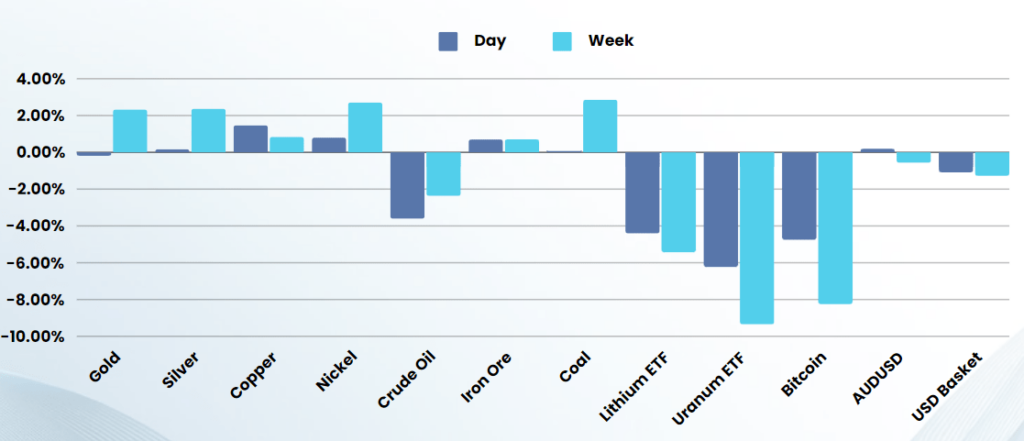

Commodities & FX

The Day Ahead

ASX SPI 7770 (-1.45%)

The ASX is in for a rough start to the week with a horrible lead from global equities. The SPI futures are pointing to a fall of 1.45% however, this is potentially over done as our index is light on the tech names that fell in the US.

The financials and consumer discretionary sectors are the likely victims of sustained selling as both are sitting towards record highs and an economic slowdown weighs heavily on both.

The highly cyclical commodities sector is already pricing in economic collapse, with China struggling, so expect bargain hunters leading into earnings season

Rate hike fears will no longer be an issue, the fear has turned to a slowing economy (which we have been highlighting for months)

This week marks the start of earnings season for the local market, although releases are limited.