Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Investors buy the dip in Tech on rate cut hopes

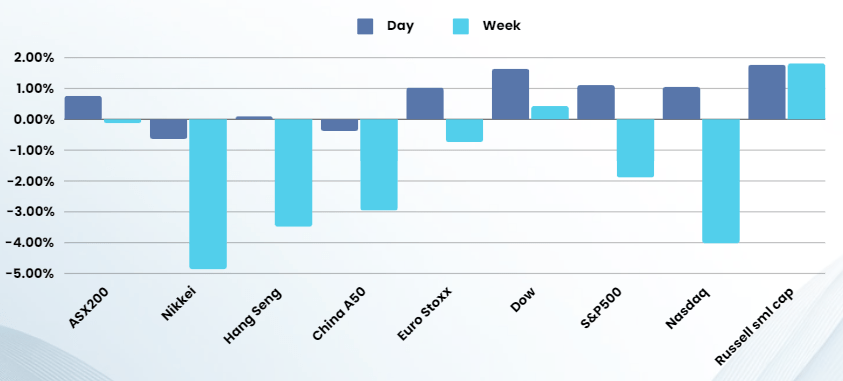

Equities closed the week higher as investors flocked back to tech megacaps that had triggered broad sell-offs earlier in the week, and inflation data boosted optimism that the Federal Reserve will soon commence cutting interest rates.

The Commerce Department said the personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred inflation gauge, edged 0.1% higher last month after being unchanged in May, matching estimates of economists polled by Reuters. In the 12 months through June, the PCE price index climbed 2.5%, also in line with expectations, after rising 2.6% in May. The data likely sets the stage for the Fed to begin cutting rates in September, as the market widely expects.

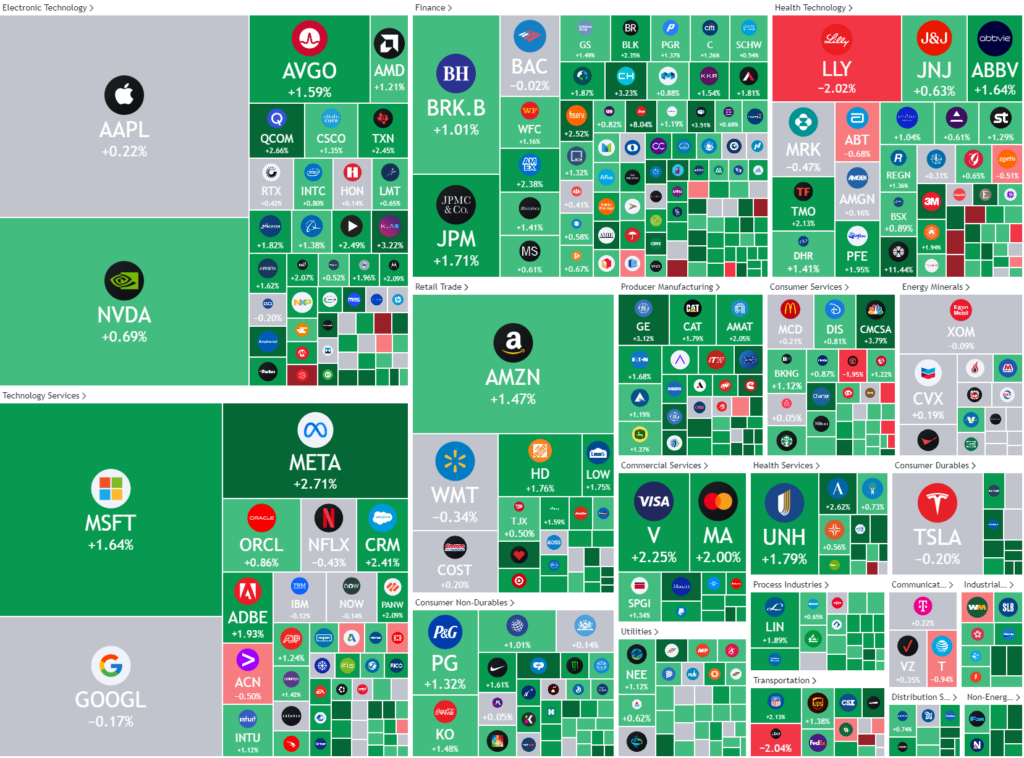

Five members of the so-called Magnificent Seven rose on Friday, led by Meta Platforms which climbed 2.7%. The two exceptions were Tesla and Alphabet whose lackluster earnings had triggered Wednesday’s big market sell-off. They both fell 0.2%, with Alphabet dropping to its lowest close since May 2. With further Magnificent Seven earnings due next week, the immediate outlook for markets may hinge on what type of results these companies deliver. “What we get next week from Apple, Microsoft, Amazon and Meta is really going to set the tone for whether that rotation continues and the direction for the near term.

The rotation involves moving out of a set of high-momentum stocks, whose valuations now appear inflated, to underperforming sectors like mid- and small-cap stocks. This shift seems to have gained momentum in recent weeks, with the small-cap Russell 2000 and S&P Small Cap 600 both advancing to their fourth closing highs of the week. The Russell 2000 scored its third straight weekly gain in two months and its best three-week run since August 2022.

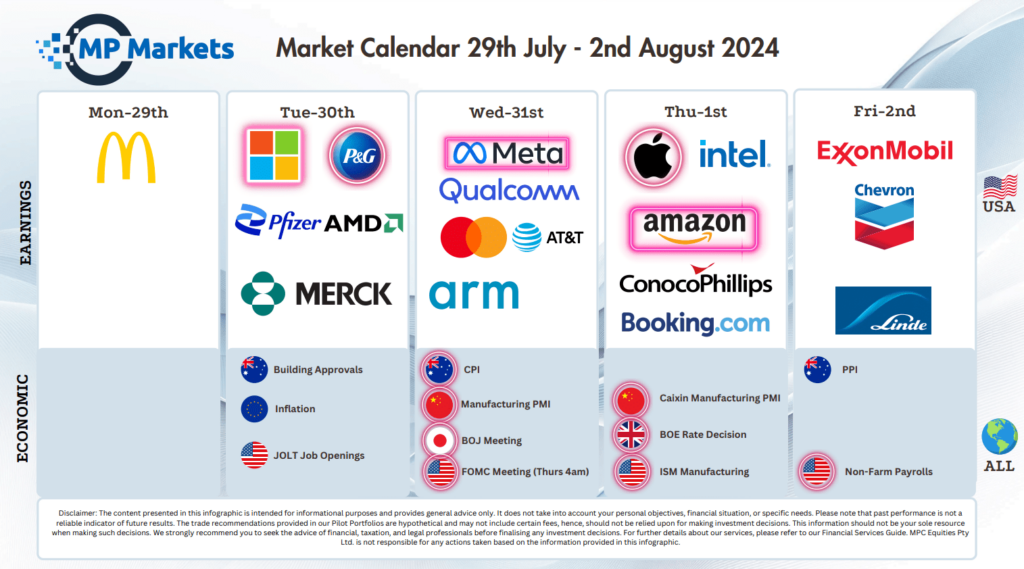

This week Is one of the biggest weeks in recent memory for the market with 3 Central Banks, 3 key pieces of economic data and 4 of the Mag7 reporting earnings. We highly recommend a wait

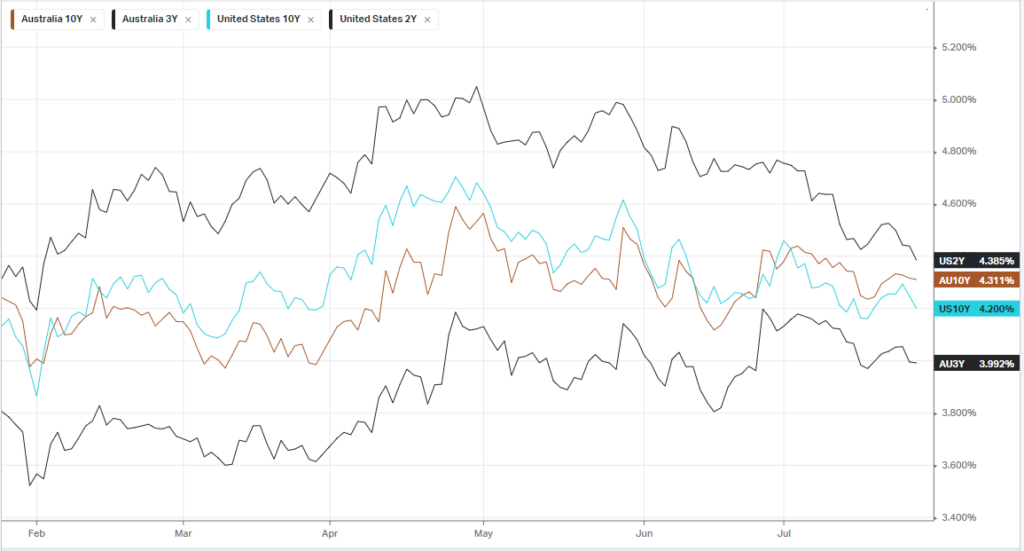

Bonds

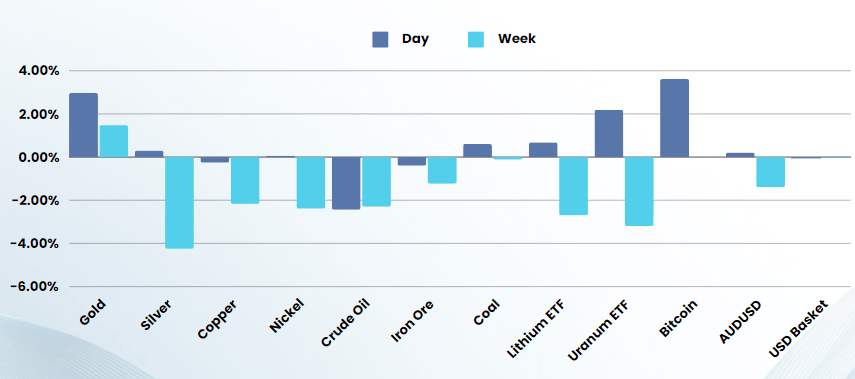

Commodities & FX

The Day Ahead

ASX SPI 7938 (+0.76%)

The ASX is set to start the week positively, in line with Fridays movement.

This week is a very busy week, with Central Banks, AU inflation data, US Employment and 4 of the Mag7 reporting earnings. We highly recommend a wait-and-see stance for the start of the week