Last Night's Market Recap

S&P 500 - Heatmap

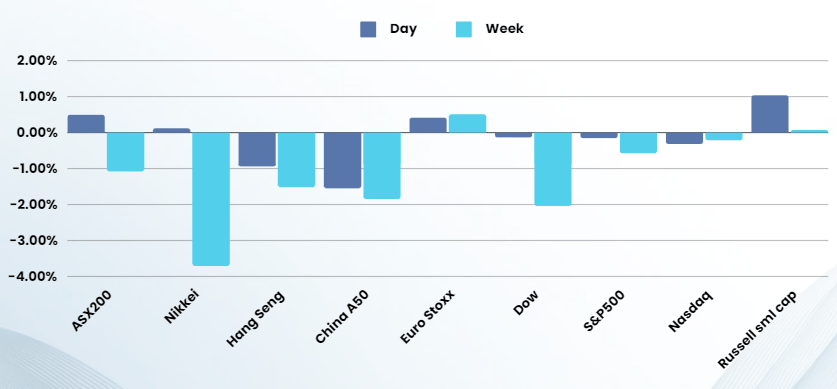

Overnight – Equities end lower as Mag7 earnings get underway

Stocks ended slightly lower overnight amid cautious trading ahead of quarterly earnings from big tech names Tesla and Google.

Aside from corporate earnings, investors will also be keeping their eyes on the U.S. political outlook, with Vice President Kamala Harris looking likely to become the Democratic presidential nominee in the wake of President Joe Biden stating that he will not seek re-election. A recent Reuter/Ipsos poll, showed Harris leading Trump race 44% to 42%. Trump said Tuesday he would be willing to debate Vice President Kamala Harris if she wins the roll call vote at the Democratic National Convention slated for next month.

There was no economic data, however investors will be watching out for advance GDP and PCE later in the week

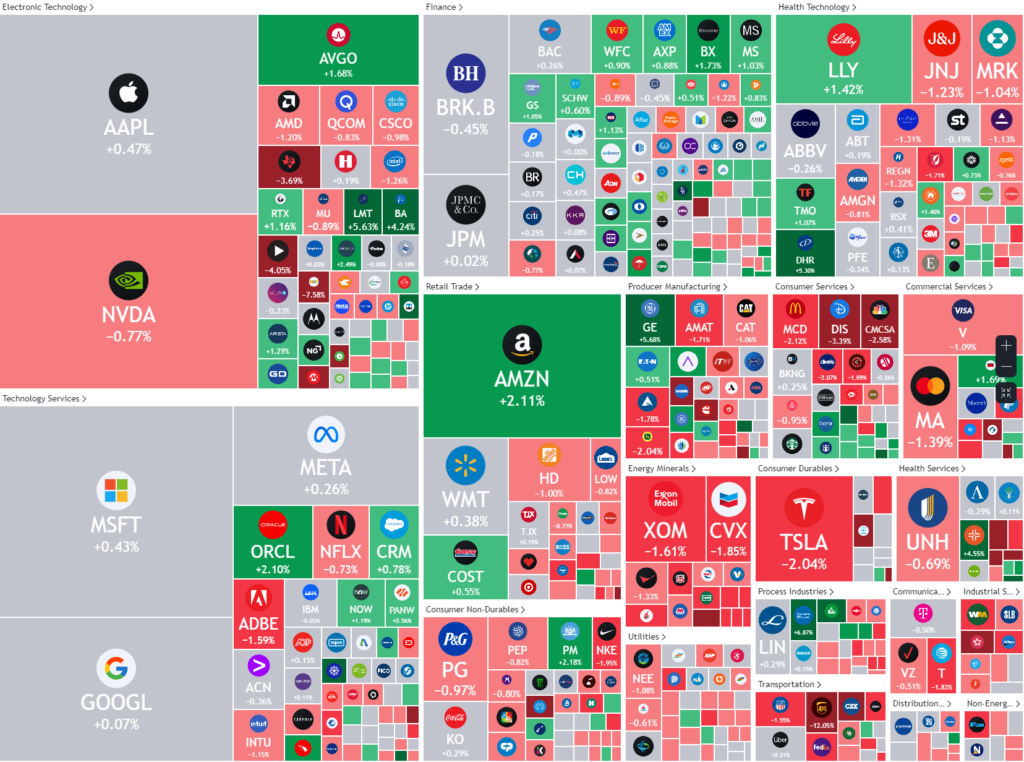

Company Earnings

- Tesla -2% – fell 2% after it reported mixed results for the second quarter, with EPS missing consensus despite a revenue beat. After a sequential decline in production in Q2, the company expects a sequential increase in production in Q3.

- Alphabet -1.6% – rose 2% initially after it reported second quarter results, beating estimates on the top and bottom line. Ad revenue also beat estimates.

- General Motors -6% – closed more than 6% lower after the automaker said it would delay plans or to roll out a new Buick electric vehicle and pushed back plans for open an EV truck factor, with GM chief executive saying the reduced EV investment was to ensure the automaker doesn’t get ahead of demand.

- United Parcel Service -13% – stock slumped more than 13% after the package delivery service reported disappointing second-quarter earnings, amid revenue weakness in the domestic business.

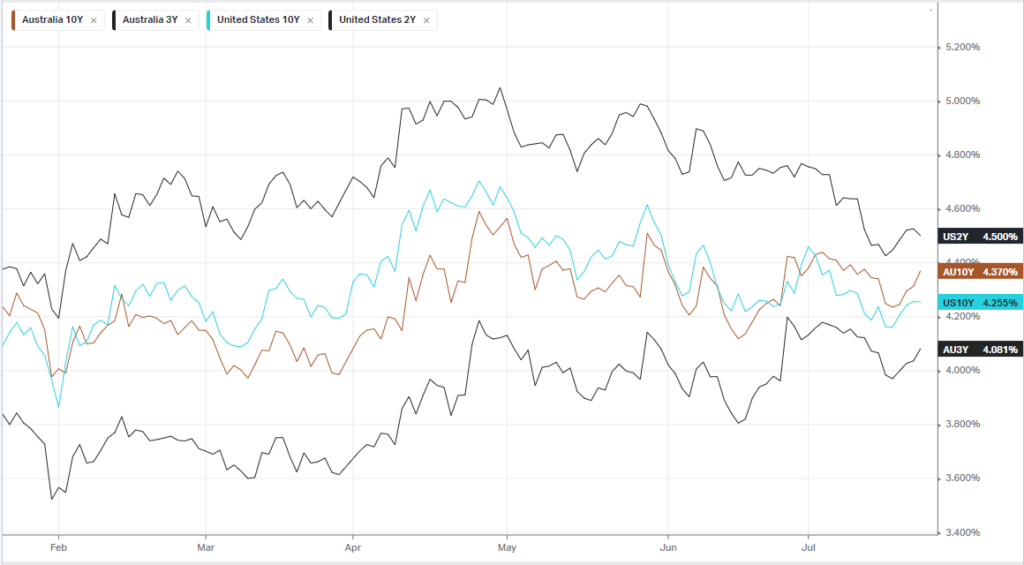

Bonds

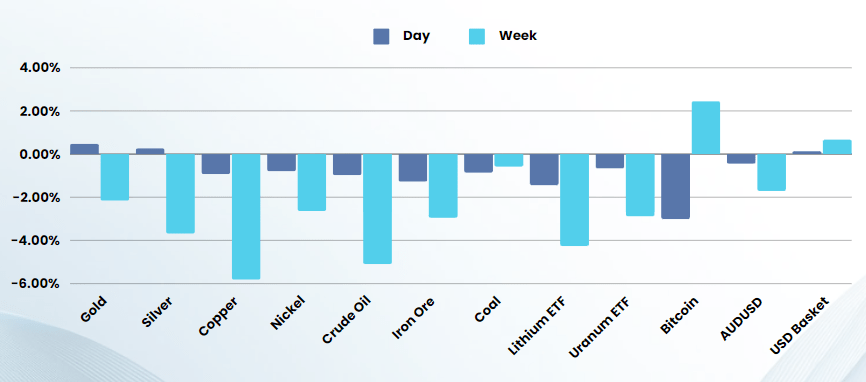

Commodities & FX

The Day Ahead

ASX SPI 7952 (+0.13%)

The ASX is in for another quiet day as the market waits for Mag7 earnings next week and GDP and Inflation data later in the week

Materials are likely to be a drag again as commodities, particularly Iron ore crumbled below $US100 a tonne late Tuesday as a policy meeting in China failed to deliver major stimulus, while supplies stayed strong.

Company specific:

- Pilbara Minerals has recorded a 58 per cent jump to its revenue, according to the lithium exporter’s latest trading update. The ASX-listed miner booked its June quarter revenue at $305 million.