Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Tech continues to fade as sun sets on Mag7

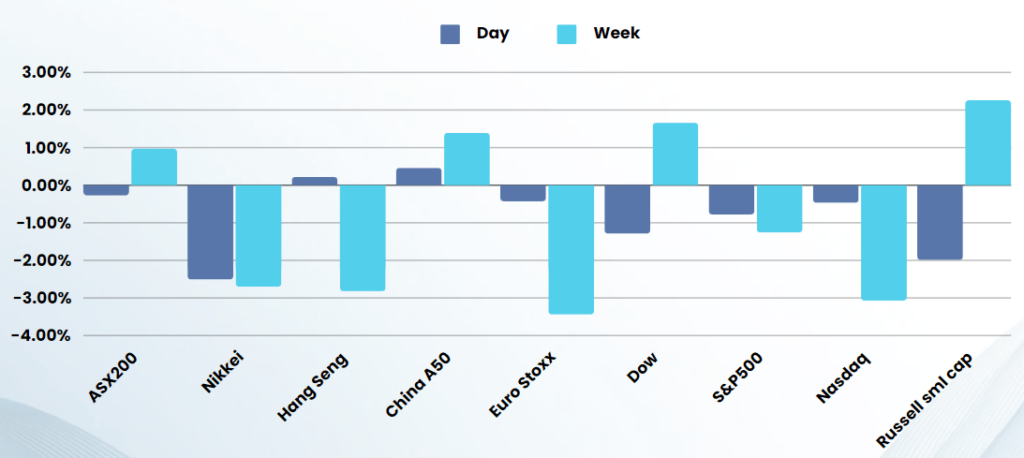

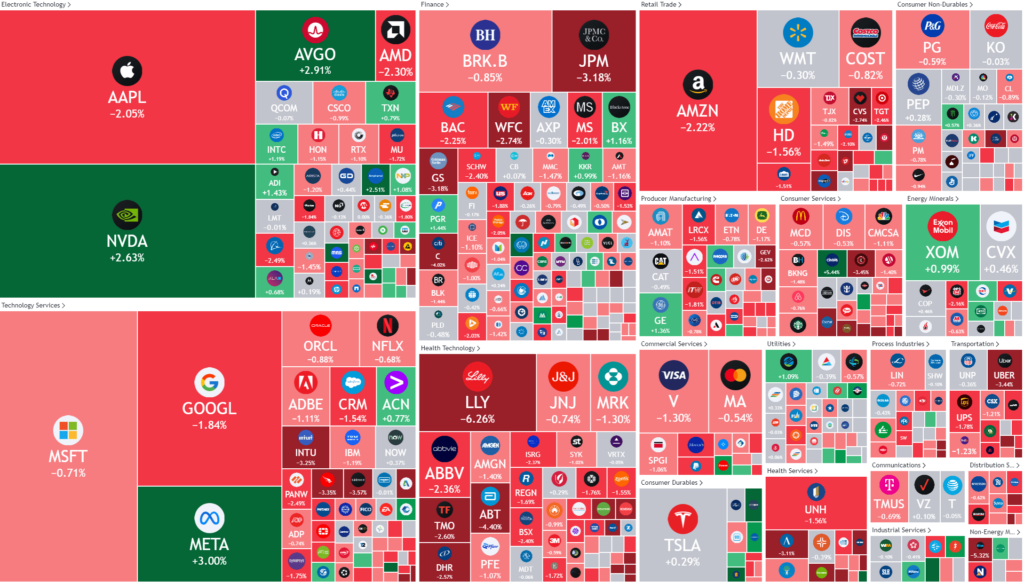

Equities ended lower overnight, pressured by wild swings as the early-day rebound in tech faded amid an ongoing rotation out of high-flying megacap tech stocks ahead of earnings from Netflix

Megacap tech stocks including Apple, Google, Amazon and Microsoft added to recent losses pressuring the broader market amid an ongoing rotation out of megacap tech just ahead of earnings from Netflix.

NVIDIA, however, bucked the trend rising 2% as investors appeared to buy the recent dip in the chipmaker despite ongoing jitters about deeper US chip ban.

The number of Americans filing new applications for unemployment benefits rose more than expected last week, climbing 20,000 to a seasonally adjusted 243,000 for the week ended July 13, the Labor Department said on Thursday, above the 229,000 claims expected. Claims were revised lower in the prior week, but the unemployment rate rose to a 2-1/2-year high of 4.1% in June. This suggests the labour market is cooling as the Federal Reserve’s interest rate increases in 2022 and 2023 slow demand.

Investors are pricing in a more than 91% chance of a 25-basis point interest rate cut from the Fed by its September meeting, according to CME’s FedWatch.

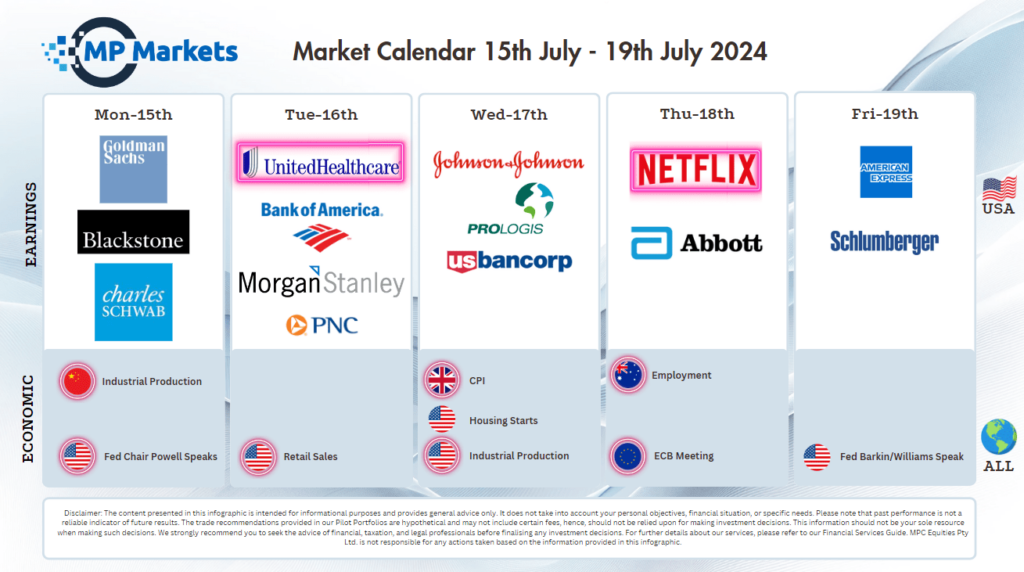

Company Earnings

- Netflix -1% – fell 1% in afterhours Thursday after the streaming giant reported Q3 revenue guidance that fell short of estimates and overshadowed better-than-expected Q2 results. Third-quarter revenue guidance that fell short of Wall Street estimates results even as the streaming giant reported better-than-expected Q2 results amid blowout subscriber adds, driven by a strong content slate and an ongoing crackdown on password sharing.

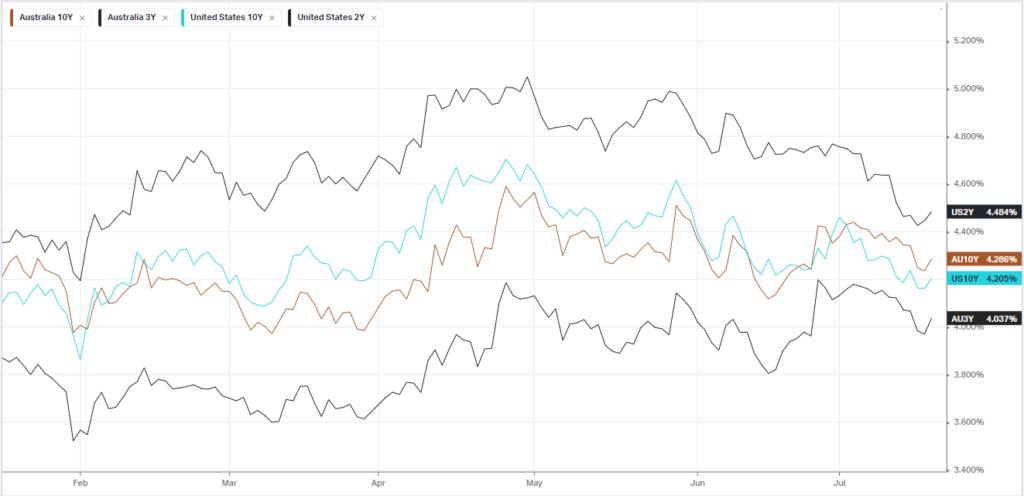

Bonds

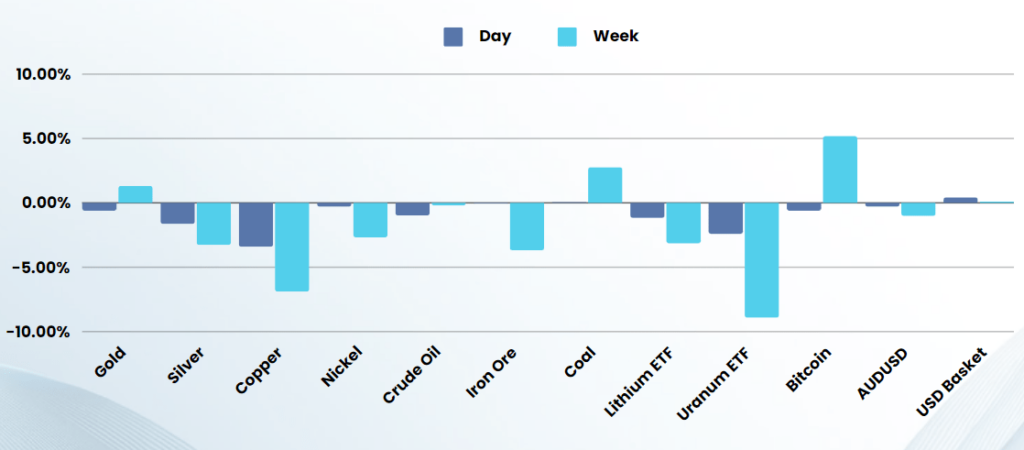

Commodities & FX

The Day Ahead

ASX SPI 7930 (-1.01%)

The ASX is in for a rough end to the week after making new records above the milestone 8,000 level. The continued fade of the US Tech stocks has Investors are asking “are we on the brink of another Nasdaq crash?” and the answer is starting to concern the market. To be fair, there has been no shortage of things to worry about. Suffice to say that a simple reversal in price momentum in an asset class that has risen sharply for a number of years (sucking in huge quantities of loose money) is often sufficient in itself to cause prices to crash as investors rush to the exits

Domestically areas of concern are definitely the overpriced bank stocks and the current softness in commodities prices

Company specific:

- Beach Energy and Whitehaven Coal are set to issue quarterly operational updates.

- Michael Hill – Jewellery store operator Michael Hill has blamed poor economic conditions for a challenging year that saw its group EBIT finish between $14 million and $16 million.