What's Affecting Markets Today

Asia markets mixed

Asia-Pacific markets presented mixed performances on Tuesday following dovish remarks from Federal Reserve Chair Jerome Powell, which had lifted Wall Street overnight. Powell indicated the Fed would not wait for inflation to reach 2% before cutting interest rates, citing the policy’s “long and variable lags.”

These comments, coupled with expectations of favorable fiscal policies following Republican candidate Donald Trump’s failed assassination attempt, propelled the Dow Jones Industrial Average to new highs.

Hong Kong’s Hang Seng index dipped 1.43%, led by consumer stocks, while mainland China’s CSI 300 edged up 0.18%. Ping An shares fell nearly 5% after Chinese insurers proposed issuing $3.5 billion in convertible bonds due in 2029.

India’s Nifty 50 reached an all-time high, rising 0.23%, ahead of next week’s union budget presentation for the financial year 2025.

Japan’s Nikkei 225 gained 0.51%, and the Topix rose 0.78% after a public holiday. TDK Corporation, a major Nikkei component, surged over 4%.

South Korea’s Kospi increased 0.28%, while the Kosdaq declined 1.27%.

ASX Stocks

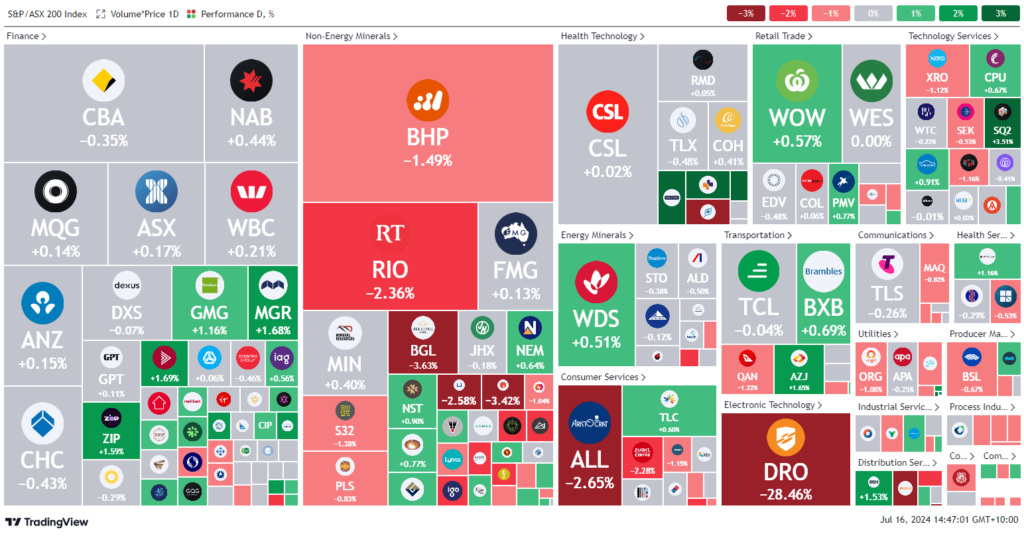

ASX 200 - 8,002.6 (-0.2%)

Key Highlights:

Australian shares are tilting lower, dragged down by iron ore miners, pulling the index from yesterday’s record high above 8000 points. The S&P/ASX 200 fell 11.7 points, or 0.2%, to 8017.4 at midday, despite gains on Wall Street, as traders weighed the possibility of a third US rate cut.

Materials stocks dropped 1.4%, with BHP down 2% to $43.01, influenced by a 1.7% decline in iron ore futures in Singapore to $US107 per tonne. Rio Tinto shares fell 2.2% to $117.26 after receiving approvals for its $US6.2 billion Simandou iron ore project. Rio’s iron ore production and shipments each decreased by 2% in H1 2024.

IGO announced over $250 million in impairments, with shares falling 1.4% to $5.91. Electric Optic Systems surged 4.9% to $1.70 on a 92% revenue increase from Middle Eastern orders. Droneshield shares plummeted 30% before entering a trading halt.

Leaders

PNV: Polynovo Ltd (+5.68%)

LIC: Lifestyle Communities Ltd (+4.13%)

IRE: Iress Ltd (+3.80%)

OBM: Ora Banda Mining Ltd (+3.49%)

SQ2: Block Inc (+3.44%)

Laggards

DRO: Droneshield Ltd (-28.46%)

ADT: Adriatic Metals Plc (-10.86%)

ERA: Energy Resources of Australia Ltd (-5.26%)

WA1: WA1 Resources Ltd (-5.12%)

SLC: Superloop Ltd (-4.22%))