Last Night's Market Recap

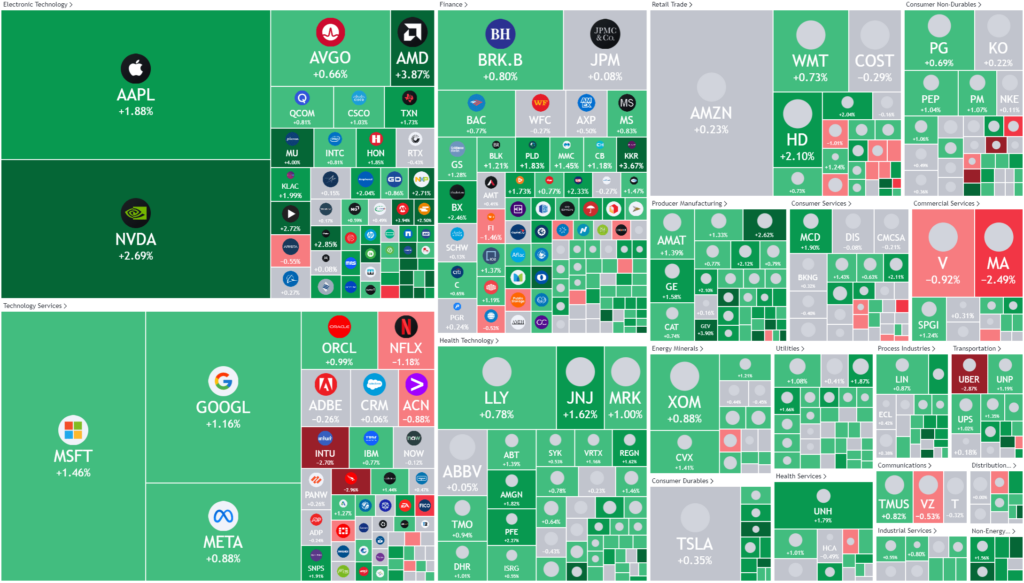

S&P 500 - Heatmap

Overnight – Stocks hit new record as Powell predicts “soft landing“

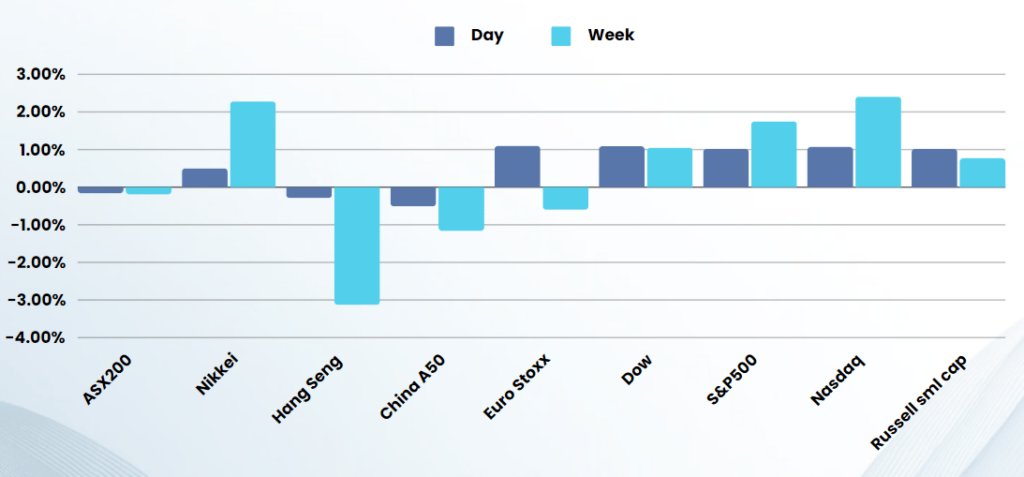

Stocks hit fresh records as the S&P 500 closed above 5,600 for the first time Wednesday, led by tech and ongoing hopes for sooner rate as Fed Chair Jerome Powell delivered his second-day of testimony before Congress, a day ahead of fresh inflation data.

Federal Reserve Chair Jerome Powell said Wednesday he continues to see a soft landing for the U.S. economy even as the central bank’s persists with its restrictive monetary policy measures to bring down inflation. The Fed chief, however, reiterated remarks from a day earlier, saying that “getting inflation down” wasn’t the only risk and central bank needs to “be mindful of where the labour market is.” The Fed Chair’s comments saw traders largely maintain bets on a September rate cut, with CME Fedwatch showing an over 72% chance for a 25 basis point cut during the month.

Tech continue to support the broader market’s record run, aided by a rise in Nvidia and Apple, with the latter rising 1% amid fresh investor optimism over its iPhone sales. Apple is aiming to ship 10% more new iPhone in 2024 compared with last year on expectations that AI-enabled iPhones would help spur demand, Bloomberg reported, citing unnamed sources. Microsoft was up 1% as the software giant is reportedly set to relinquish its observer seat on the OpenAI board amid increasing regulatory scrutiny over generative AI in Europe and the U.S. NVIDIA, meanwhile, added more than 2% pushing the broader chip and tech sector higher.

Keith Dolliver, Microsoft’s Deputy General Counsel, wrote to OpenAI on Tuesday, stating that while the observer seat provided valuable insights into the board’s activities without compromising its independence, it was no longer necessary, given that Microsoft had “witnessed significant progress from the newly formed board.”

Powell’s comments put upcoming consumer price index inflation data, due Thursday, squarely in focus. Economists expect CPI rose 0.1% month-over-month advance and a 3.1% year-on-year gain. Core CPI, which excludes energy and food prices, is expected to have risen 0.2% month over month and 3.4% year on year.

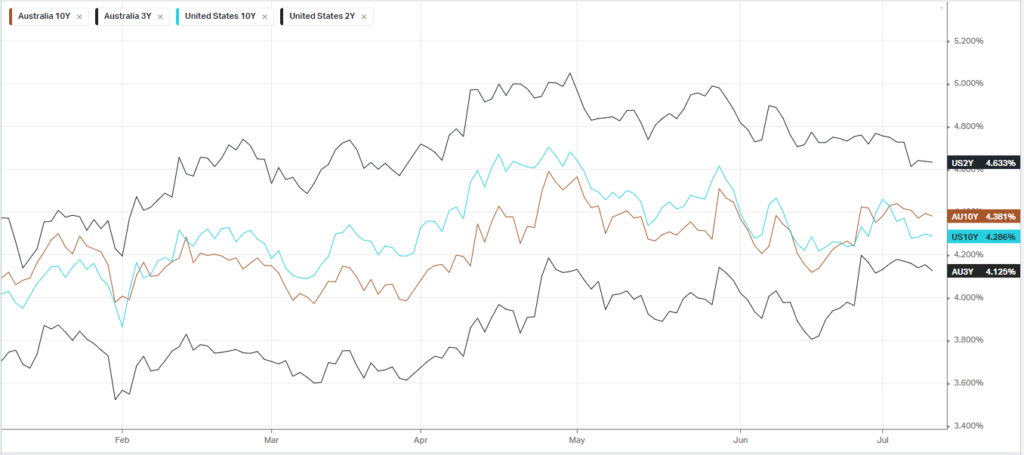

Bonds

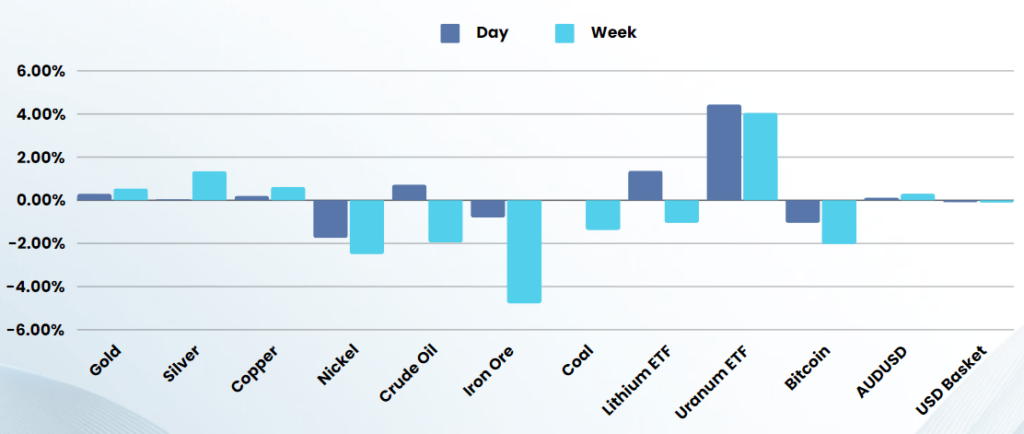

Commodities & FX

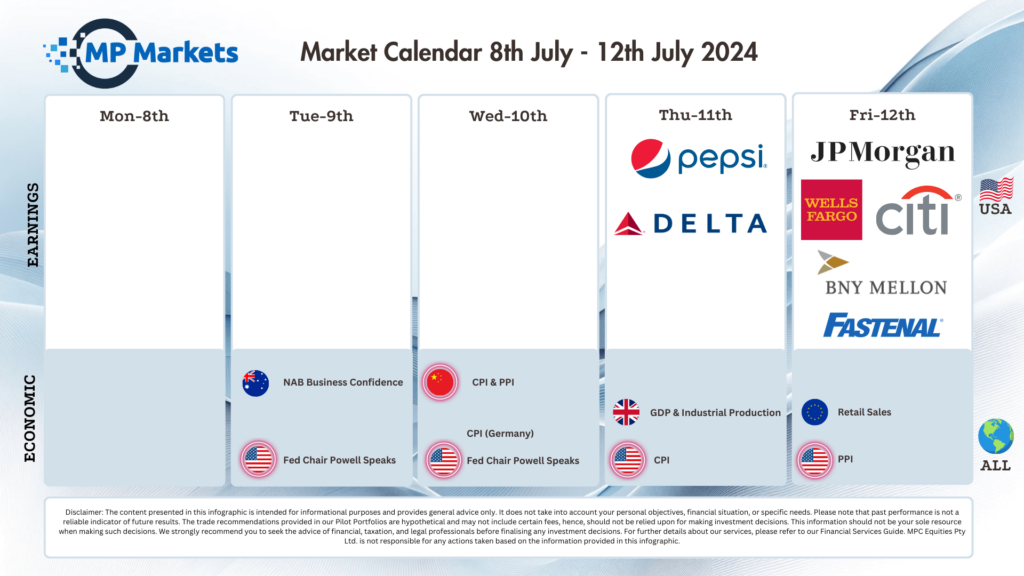

The Day Ahead

ASX SPI 7870 (+0.89%)

With global equities melting up, the ASX is looking undervalued in many sectors that are pricing a hard landing. Mining, real estate and energy are all highly cyclical stocks that have been punished due to predictions that the world will fall hard, however sectors like tech and financials are simply not pricing any of that risk.

If a soft landing is truly achieved, the value in these undervalued sectors and small cap stocks is compelling, while the sectors sitting at record highs, may start to struggle as flows shift

Fund manager and broker comments in the media:

- BHP, RIO – The rout in the ASX’s largest mining companies this year has created a “screaming” buy for some of the sector’s biggest investors (AFR)

- Real estate – Macquarie says “it’s time to buy real estate stocks before rate cuts” (AFR) The broker has warned that the “best” phases for ASX returns is behind us and is urging investors to buy more defensive companies amid signs that returns are starting to falter.