What's Affecting Markets Today

Asian markets mostly mixed

Asia-Pacific markets displayed mixed performance on Wednesday, despite key Wall Street benchmarks rising following dovish remarks from U.S. Federal Reserve Chairman Jerome Powell. Powell cautioned against maintaining high interest rates, noting that delaying policy relaxation could significantly dampen economic activity and employment.

In Asia, investors are scrutinizing inflation data from China and Japan. China’s consumer price index rose by 0.2% in June, missing the expected 0.4% increase and down from May’s 0.3%. The producer price index fell 0.8% year-on-year, matching expectations and softer than May’s 1.4% decline. Consequently, Hong Kong’s Hang Seng index rose by 1.01%, while the CSI 300 fell 0.4%.

Reuters reported that Ping An Insurance, China’s largest insurer, is considering issuing $5 billion in convertible bonds.

Japan’s corporate goods price index rose to 2.9% in June, up from May’s revised 2.6%. The Nikkei 225 gained slightly, while the Topix declined by 0.21%. South Korea’s Kospi edged up 0.13%, though Samsung Electronics shares fell 0.22% due to union strike news.

ASX Stocks

ASX 200 - 7,811.6 (-18.1%)

Key Highlights:

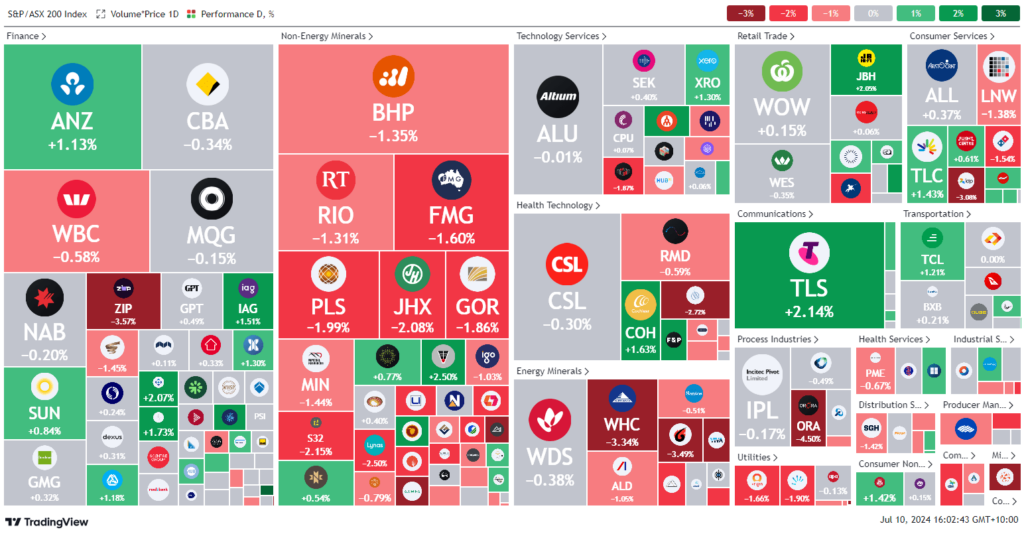

A sell-off in mining stocks pulled the Australian sharemarket down in the afternoon. The S&P/ASX 200 Index fell 0.3%, or 23.6 points, to 7806.1, with seven out of 11 sectors declining.

The materials sector was notably weak, reflecting lower iron ore prices. Singapore iron ore futures for August dropped 2.3% to $US106.9 a tonne. Major players BHP and Fortescue Metals both declined by 1.1%.

The Reserve Bank of New Zealand maintained its official cash rate at 5.5%.

In specific stock movements, Incitec Pivot shares fell 1.2% after halting negotiations with Indonesia’s PT Pupuk Kalimantan Timur for its fertilisers business sale. The company will continue managing its Dyno Nobel explosives and fertilisers businesses separately and proceed with a $900 million stock buyback.

Conversely, Bell Financial surged 4.8% following its announcement of a projected 47% increase in first-half profit before tax to $23.8 million.

Leaders

PWH – PWR Holdings Ltd (+4.53%)

SPR – Spartan Resources Ltd (+3.21%)

RED – RED 5 Ltd (+3.13%)

SGR – The Star Entertainment Group Ltd (+3.06%)

PRU – Perseus Mining Ltd (+2.86%)

Laggards

IFL – Insignia Financial Ltd (-6.80%)

CEN – Contact Energy Ltd (-6.06%)

ORA – Orora Ltd (-4.38%)

A4N – Alpha Hpa Ltd (-4.17%)

BFL – BSP Financial Group Ltd (-3.70%)