Last Night's Market Recap

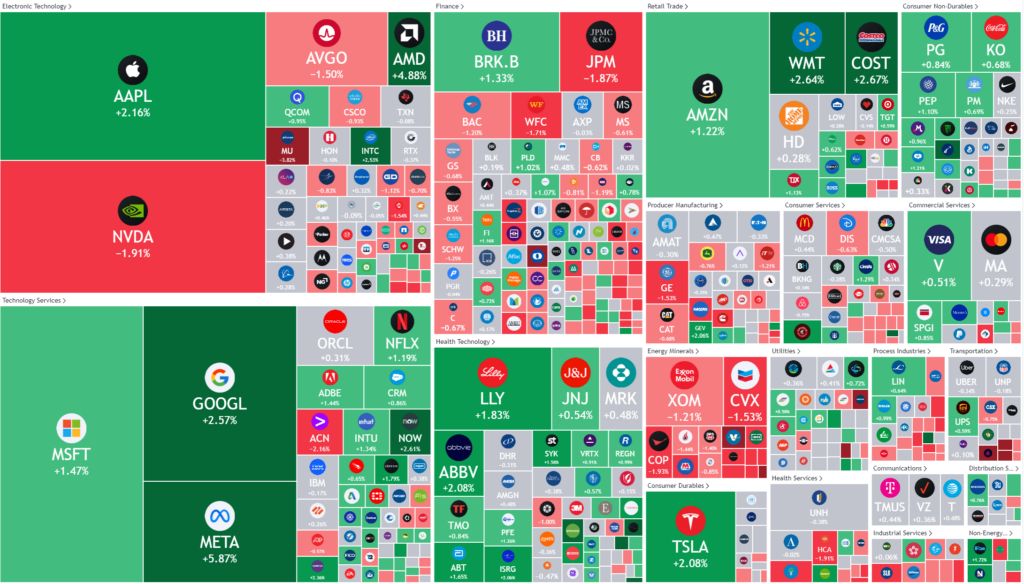

S&P 500 - Heatmap

Overnight – Previous months job numbers mysteriously disappear

Equities closed at record highs Friday on bets that Federal Reserve rate cuts may soon be on the horizon after 100,000 jobs “disappeared” from April and Mays jobs numbers.

While the 206,000 headline jobs number was slightly above expectations, the mysterious disappearance of over 100,000 jobs from the previous months, has us at MPC suspicious of the election year numbers and it seems the market agreed.

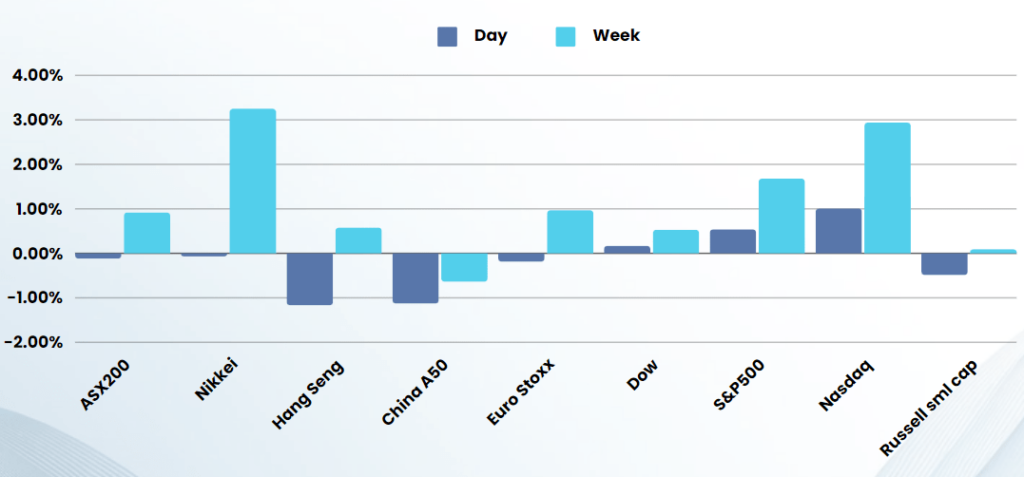

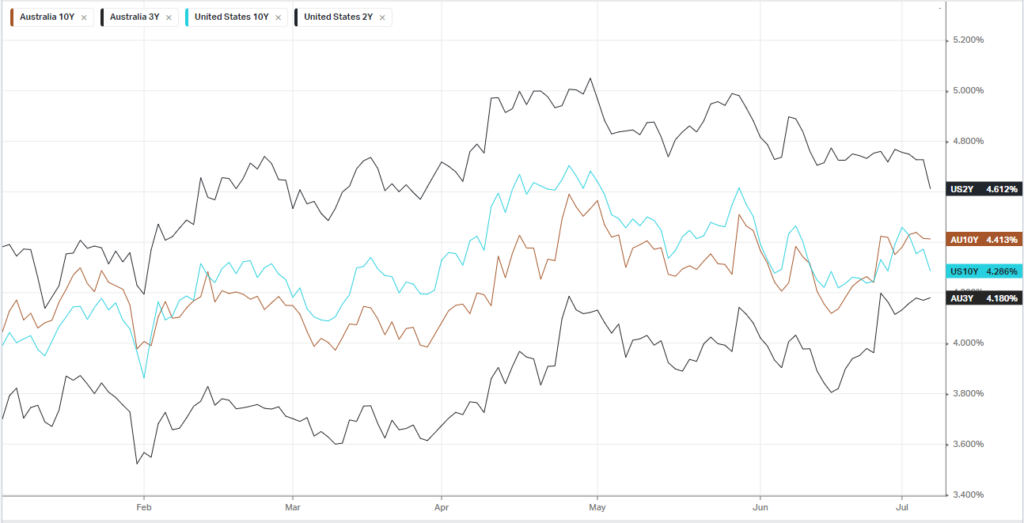

Treasury yields came under pressure after the monthly jobs report for June showed the economy added 206,000 jobs last month, down from 218,000 in May, but the solid headline payrolls number was accompanied by sizeable downward revisions, as jobs gains for the May and April were revised lower. Adding to signs of cooling labor market the the unemployment rate rose to 4.1%, from 4.0% in May, average hourly wage growth slowed, strengthening the case for a September rate cut.

Meta led the rise in big tech as the social media company soared more than 4% to hit record highs earlier in the day, with Alphabet, Microsoft, and Apple also higher. NVIDIA didn’t partake in the rally, down 2%, after New Street Research downgraded the stock to hold from buy, citing concerns about valuations, the first downgrade we have seen in this rally. Tesla stock added 2% on reports that several state-owned firms in China’s financial hub of Shanghai have recently purchased the EV manufacturer’s best-selling Model Y as service cars after Tesla cars reportedly were added to the list Chinese local government purchase list.

Company specific

- Macy’s +9% – stock rose over 9% after the Wall Street Journal reported that Arkhouse Management and Brigade Capital Management have raised their bid to buy the department store chain for about $6.9 billion.

Chinese EV stocks -5% – including Li Auto , Nio Inc Class and Xpeng were sharplly lower after the European Union proposed increased tariffs on electric vehicles imported from China commended on Friday.

Bonds

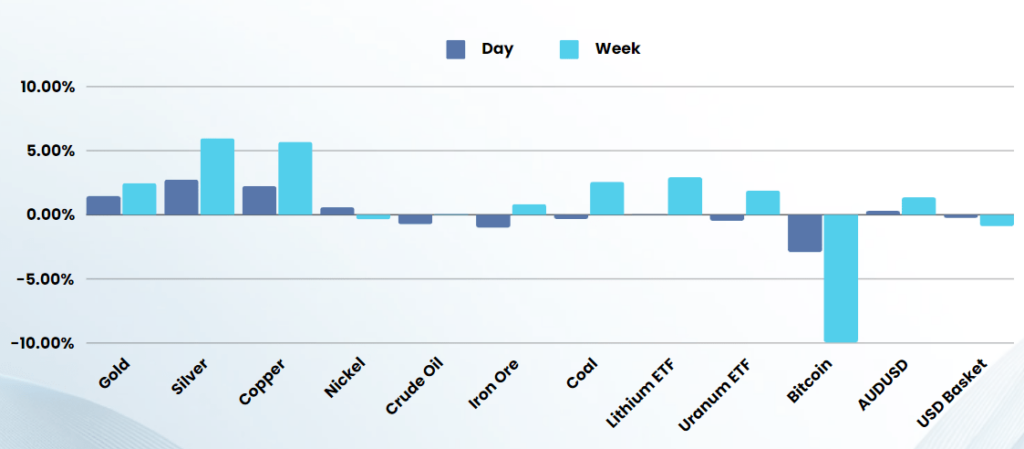

Commodities & FX

The Day Ahead

ASX SPI 7797 (-0.01%)

We are looking at a positive start to the week, particularly in the materials sector as gold, silver and copper rallied over 2%. There is a possibility we may see some selling in the banks with US bank earnings coming up and the new financial year freeing up investors to sell after a stellar year for banks last FY.

This week has a busy schedule with Chair Powell testifying twice and US inflation data at the end of the week.