What's Affecting Markets Today

Asian markets stronger

Asia-Pacific markets mostly rose on Wednesday following positive comments from U.S. Federal Reserve Chair Jerome Powell on inflation progress. Investors also analyzed a range of regional data.

The au Jibun Bank reported Japan’s composite PMI dropped to 49.7 in June from 52.6 in May, indicating a decline in private sector activity for the first time in seven months. This decrease was driven by a slight reduction in services activity, the first since August 2022, which outweighed a marginal rise in manufacturing output.

Meanwhile, China’s Caixin services PMI showed the sector expanded for the 18th consecutive month, though at the slowest pace since October 2023, with a June PMI of 51.2, down from 54.0.

Japan’s Nikkei 225 rose 1.2%, and the Topix gained 0.4%. South Korea’s Kospi increased by 0.34%, while the Kosdaq added 0.52%. Hong Kong’s Hang Seng Index climbed 1.12%, while the CSI 300 fell 0.18%. Alibaba shares rose 1.7% following a $5.8 billion share repurchase announcement.

ASX Stocks

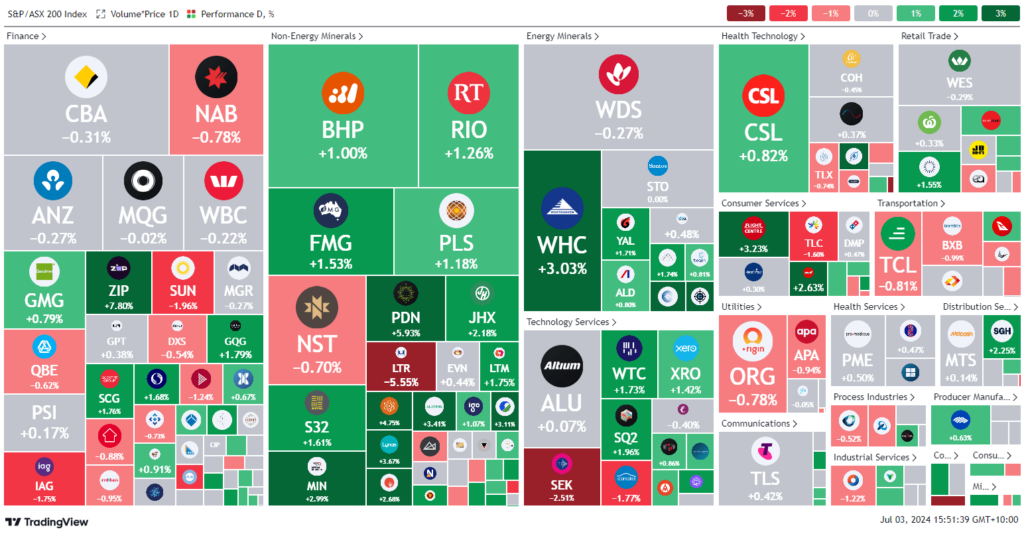

ASX 200 - 7,734.4 (+0.2%)

Key Highlights:

Mining and energy stocks boosted the Australian sharemarket on Wednesday afternoon, following overnight gains on Wall Street. The S&P/ASX 200 Index climbed 0.2%, or 13.8 points, to 7732 with six of the 11 sectors advancing.

Despite May retail trade data exceeding expectations with a 0.6% rise against a 0.3% forecast, market reaction was muted.

The materials sector excelled as iron ore futures in Singapore rose to $US110.70 per tonne for the August contract. BHP Group increased by 0.7%, Fortescue Metals by 1.4%, and Rio Tinto by 1.1%. Energy stocks also gained, mirroring crude oil price rises, with Santos up 0.9% and Beach Energy up 1.9%.

Coal miners Whitehaven and Yancoal surged 6.3% and 4.5%, respectively, after a fire at Anglo American’s largest Australian metallurgical coal project halted production, potentially for months.

Booktopia, the troubled online book retailer, entered voluntary administration with McGrathNicol appointed to oversee the process. Shares remain suspended since mid-June.

Leaders

ZIP ZIP Co Ltd 7.80%

NXL NUIX Ltd 5.72%

DYL Deep Yellow Ltd 5.51%

PDN Paladin Energy Ltd 5.49%

DRO Droneshield Ltd 5.23%

Laggards

LTR Liontown Resources Ltd -5.24%

SLC Superloop Ltd -4.76%

GNC Graincorp Ltd -4.11%

MND Monadelphous Group Ltd -3.64%

PGC Paragon Care Ltd -3.37%