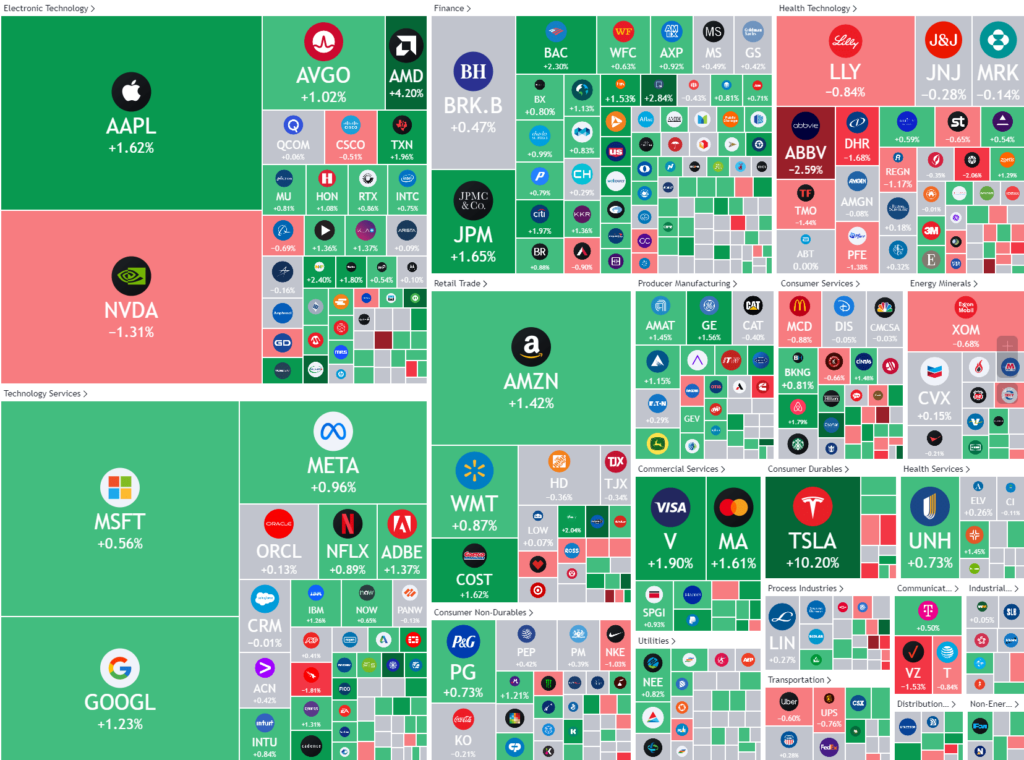

Last Night's Market Recap

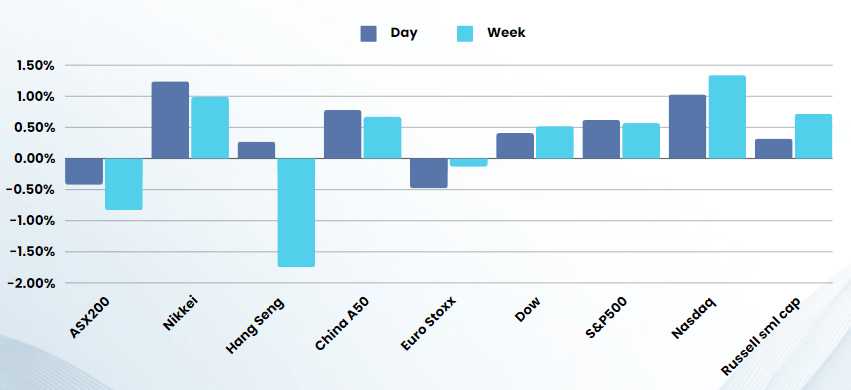

S&P 500 - Heatmap

Overnight – S&P500 hits record as Powell says there is progress on inflation

The S&P500 hit a record high overnight, underpinned by a surge in Tesla and optimism over rate cuts after Federal Reserve Chair Jerome Powell cheered recent progress on inflation.

Fed Chair Jerome Powell said the Fed has made “quite a bit of progress and in bringing inflation back down” toward the central bank’s target, though added more confidence that inflation was a sustained path lower would need before the rate-cutting process gets underway.

Traders now see a 64% change of rate cut in September, up from about 61% last week, according to the Fed Rate Monitor Tool. The remarks come just a day ahead of the minutes of the Fed’s June meeting and more insight into the labour market, with nonfarm payrolls on Friday. Ahead of the monthly jobs report, the May job openings and labour turnover report, a gauge of demand for labour showed vacancies at 8.14M, up from 7.92M in April and above economists forecast of 7.96M. The labour sector has been running hot despite sticky inflation and high interest rates and is also a key consideration for the Fed in cutting interest rates.

In a week of the 4th of July holidays, we don’t expect the current uptrend to be disrupted unless payrolls shows another strong showing.

Company specific

- Tesla +10% – the EV maker rose 10% after the EV maker said it had delivered 443,956 EVs in the second quarter, beating estimates of 438,019. The better-than-expected deliveries in Q2 marked “a huge comeback” by the electric vehicle maker, with the worst now likely in the rearview mirror for the company, Wedbush Securities said Tuesday. The update on deliveries comes just weeks ahead of Tesla’s Q2 results due Jul. 23, and its RoboTaxi Day on Aug. 8, Wedbush added, with the latter event expected to see the EV maker tout the next part of its autonomous story.

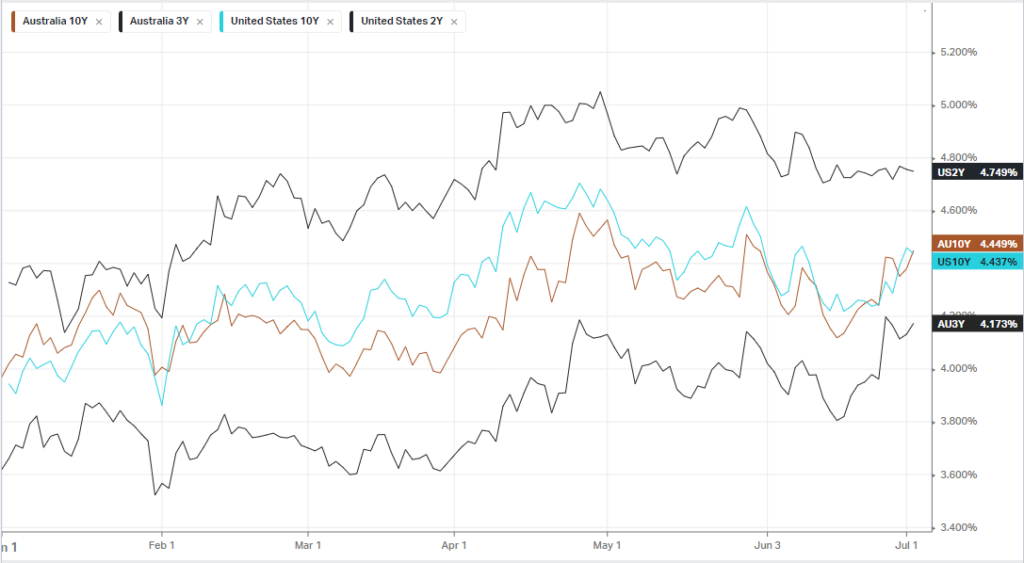

Bonds

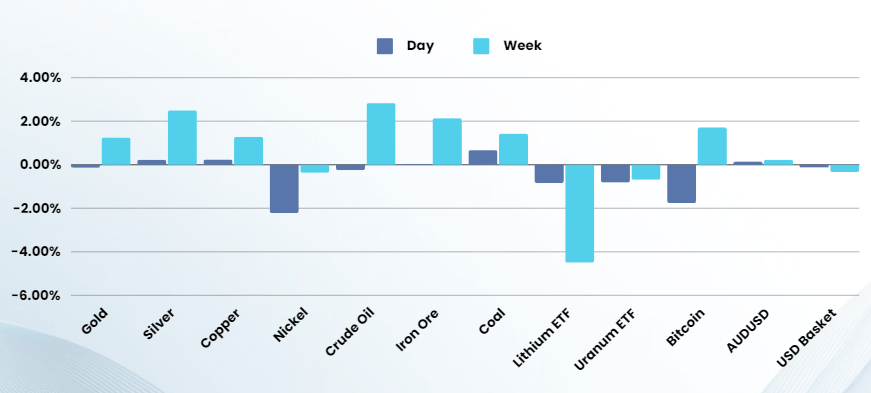

Commodities & FX

The Day Ahead

ASX SPI 7722 (+0.24%)

We are in for another quiet day with the peak of US summer driving low volumes. A string of PMI numbers are due in Europe and the US

While domestically, Retails sales and building approval numbers are due at 1130 which could see further pressure on the consumer discretionary sector

Company Specific:

- Liontown – CEO, Tony Ottaviano says the company’s flagship Kathleen Valley mine would be in production on-time and on-budget before the end of the month. Also the announcement of a long term offtake & funding deal with Korean giant, LG