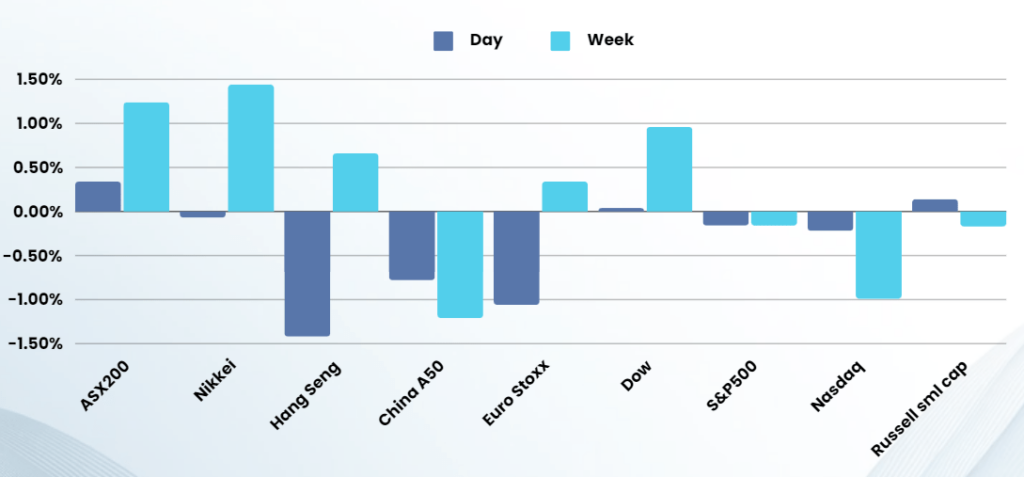

Last Night's Market Recap

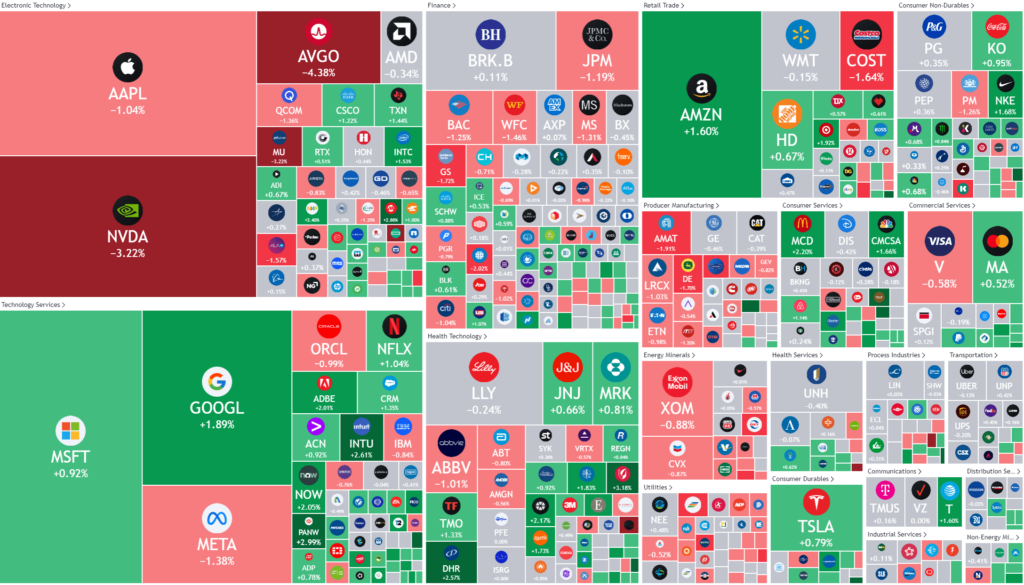

S&P 500 - Heatmap

Overnight – Nvidia stalls as Microsoft reclaims #1

Equities closed marginally higher despite Nvidia taking a second 3% hit in a row, cooling from its recent melt-up, handing back #1 spot to Microsoft

NVIDIA fell 3%, snapping an eight week win streak, as investors appeared to take profits on the chipmaker’s runaway rally that had seen it briefly usurp Microsoft as the most valuable company on Tuesday. Nvidia was valued at 3.14 trillion in recent trading, just shy of Apple $3.23T and Microsoft’s $3.33T valuations. Despite the blip in Nvidia, the general enthusiasm around the applications of artificial intelligence should mean that underlying demand for the stock remains strong.

The second manufacturing and services purchasing managers’ index readings for June came in higher than economists had expected, underscoring strength in the economy and sooner rather than later rate aren’t a matter of urgency. Existing home sales data for May also topped economists forecasts.

Flash services PMI increased to 55.1 this month, above expectations of 53.7, while manufacturing PMI edged up to 51.7, compared with expectations of a dip to 51.

A series of Fed officials have expressed caution about expecting rate cuts too soon, seeking more evidence that inflation has been tamed before the central bank would agree to easing monetary policy. Thomas Barkin, President of the Federal Reserve Bank of Richmond, emphasised the point on Thursday, stressing the need for further clarity on the inflation path before considering lowering interest rates. “My personal view is let’s get more conviction before moving,” Barkin told reporters following an event in Richmond on Thursday.

Stocks were expected to have a wild end to the session due to triple witching — when stock options, stock index futures, and index option contracts expire on the same day — usually stokes volatile as investors move out of old positions and take new ones, but the rise of the “single day options” has sucked much of the volume out of the longer term options market, which showed as the market closed with less of a bang, and more of a whimper

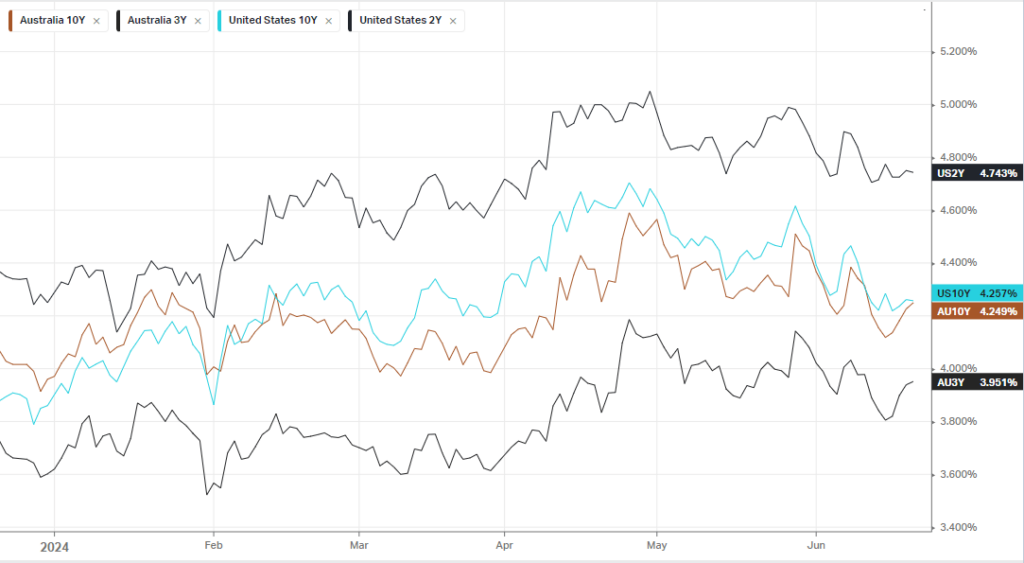

Bonds

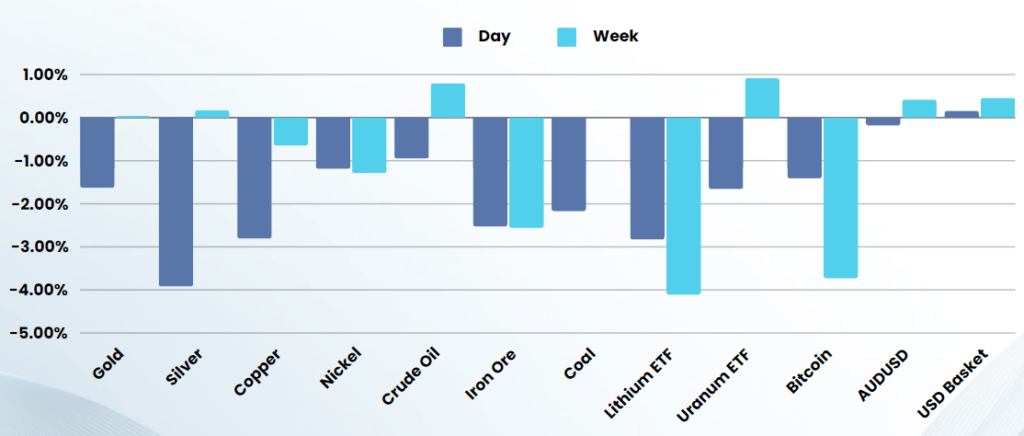

Commodities & FX

The Day Ahead

ASX SPI 7765 (-0.02%)

The ASX will be weighed down by the materials sectors as commodities prices headed lower on Friday night. This was a strange move given positive manufacturing data.

This week is likely to be very quiet with little corporate or economic news until Core PCE on Friday