Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Tech rally continues to hide broader market weakness

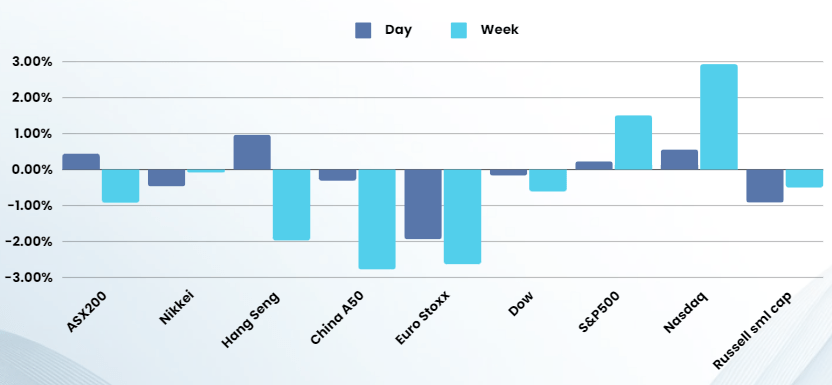

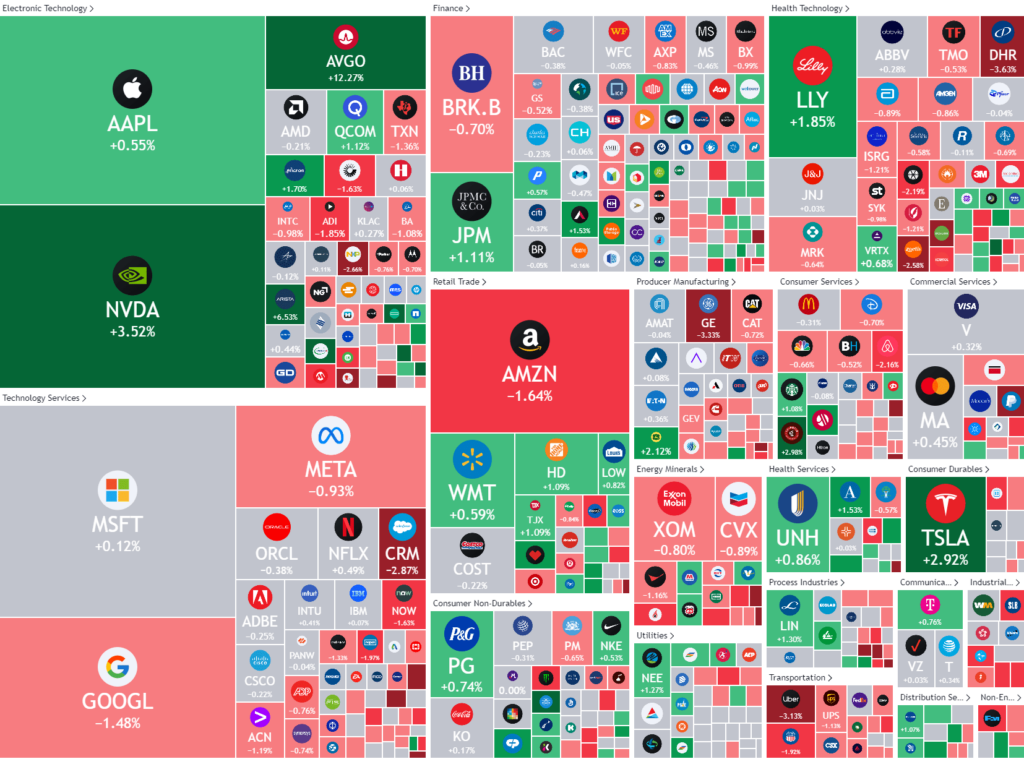

US stocks clinched another record close, as surge in Broadcom lifted chip stocks and bets on rate cuts this year were boosted by further signs of slowing inflation despite the broader market falling 1% and Europe falling 2%

While the market keeps making record highs on an index level, the move higher is been driven exclusively by tech, with the broader market looking quite unhealthy with the Russell 2000 small caps index down 1% overnight and European markets dropping nearly 2%

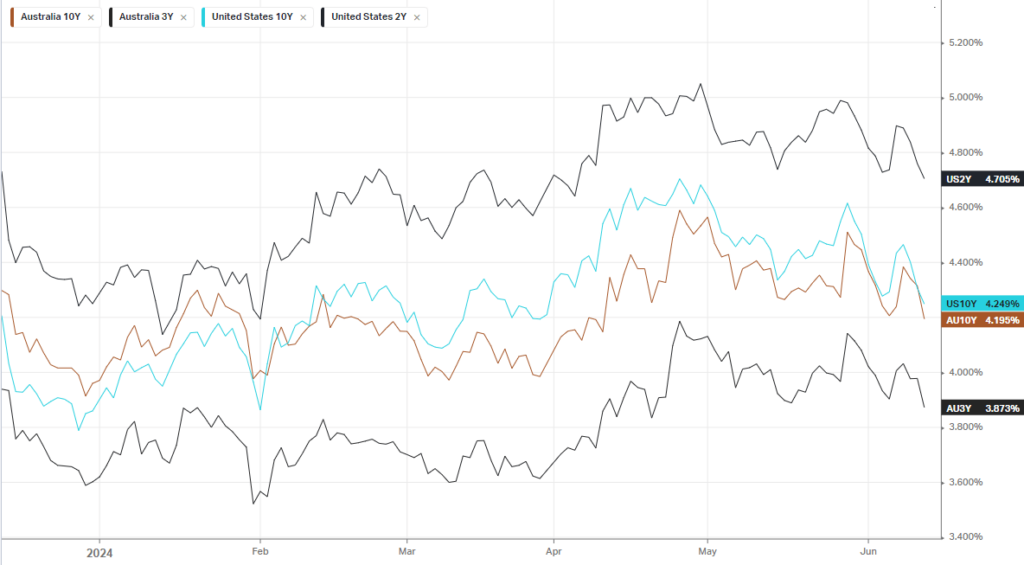

U.S. producer prices unexpectedly fell in May, as the producer price index dropped 0.2% last month after advancing by an unrevised 0.5% in April. In the 12 months through May, the PPI increased 2.2% after rising 2.3% in April. This followed weekly jobless claims data showing the number of Americans filing new claims for unemployment benefits jumped to a 10-month high last week, boosting financial market hopes that the Federal Reserve would start cutting interest rates in September.

The odds of two rate cuts following the data now stand at about 70% even as the Fed signalled on Wednesday for just a single cut this year, down from a prior estimate in March for three cuts.

Concerningly, the recent shift to the far-right in the recent EU elections and the subsequent snap election called by President Macron has elevated risks for the region. This dragged down the Eurostoxx by 2% and saw French bond yields rise to the largest premium to EU bonds in 7 years.

Earnings

- Broadcom +12% – surged over 12% after the chipmaker clocked bumper earnings and lifted its annual guidance amid rising AI demand. The firm also announced a 10-for-1 stock split. The chipmaker said its non-AI networking markets, which have been a “fairly big headwind to numbers have bottomed,” UBS said as it lifted its price target on the stock to $1,735, up from $1,610 previously.

Bonds

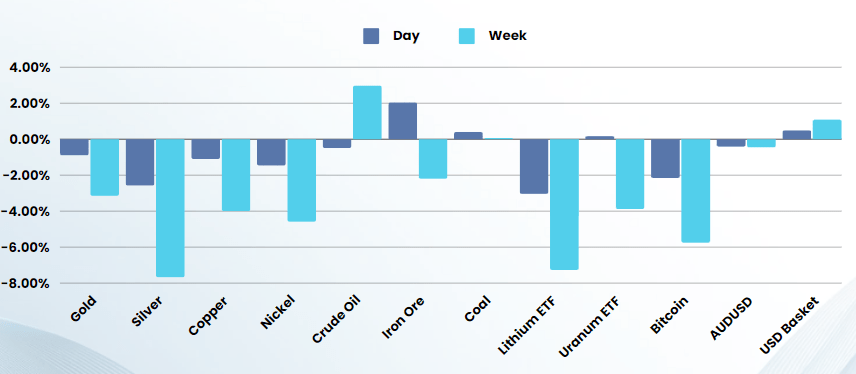

Commodities & FX

The Day Ahead

ASX SPI 7749 (-0.01%)

Despite record highs in the US, the ASX is likely to have a negative day as commodities drifted lower and concerns around the European elections resulting a shift to the right could mean political instability weighed on EU markets.

The Mega-Cap tech stocks masking the underlying weakness in global equities leaves the market vulnerable to a shock down move if AI spending doesn’t meet expectation at the next round of company updates in July