What's Affecting Markets Today

Asian markets mixed

Asia-Pacific markets displayed mixed reactions as investors evaluated India’s election results. Prime Minister Narendra Modi’s Bharatiya Janata Party (BJP) failed to secure an outright majority in the lower house of parliament. Nevertheless, Modi is poised for a third term after the BJP-led National Democratic Alliance (NDA) secured 294 seats, surpassing the 272 required for coalition government formation.

In Japan, the Nikkei 225 declined by 1.26%, and the broader Topix index fell by 1.57%. Conversely, South Korea’s Kospi rose by 1.01%, and the Kosdaq increased by 0.34%. Hong Kong’s Hang Seng index gained 0.88%, while China’s CSI 300 index opened flat.

In the U.S., the Dow Jones Industrial Average rose by 0.36% as Wall Street steadied after a volatile start to the month. The S&P 500 added 0.15%, and the Nasdaq Composite advanced 0.17% to 16,857.05. Notably, Treasury yields declined, with the 10-year note rate dropping by approximately 7 basis points.

ASX Stocks

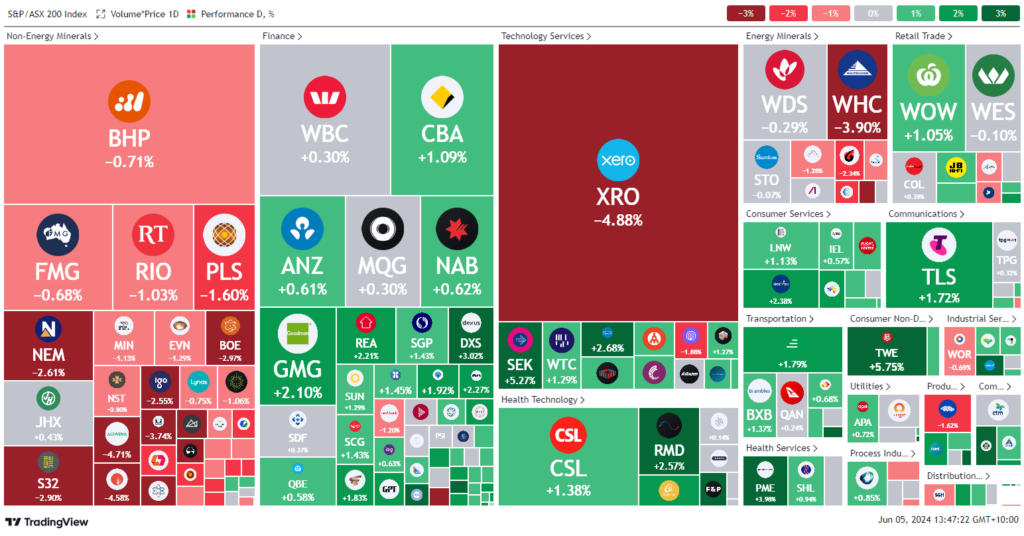

ASX 200 - 7,773.2 (+0.5%)

Key Highlights:

Australian shares are trending higher, with the S&P/ASX 200 up 26.3 points, or 0.3%, to 7763.4 by 1:26 PM AEST. Gains in eight of the eleven sectors offset overnight weakness in commodity prices. A late rally on Wall Street, spurred by the latest JOLTS jobs data indicating a slowing US economy, bolstered stocks, leaving room for potential rate cuts.

Despite disappointing first-quarter GDP growth of 0.1%, below the forecasted 0.2%, the ASX remained resilient. A 2% rally in rate-sensitive real estate stocks, led by Goodman Group and Mirvac, along with strength in the big four banks and supermarket giants, offset losses in energy and mining stocks. BHP, Fortescue, and Rio Tinto each fell around 1% due to weaker iron ore prices.

Treasury Wine Estates rose 6.1% to $12.08, reaffirming forecasts. Medibank dropped 1.2% amid legal proceedings over a 2022 cyberattack. Seek gained 4.9% after divesting Latin American assets, while Xero fell 5.9% after pricing $1.4 billion in convertible notes.

Leaders

MCY Mercury NZ Ltd 7.68%

TWE Treasury Wine Estates Ltd 6.32%

MEZ Meridian Energy Ltd 5.39%

SEK Seek Ltd 4.89%

DRO Droneshield Ltd 4.69%

Laggards

XRO Xero Ltd -5.49%

LOT Lotus Resources Ltd -5.11%

AWC Alumina Ltd -4.68%

SFR Sandfire Resources Ltd -4.63%

DYL Deep Yellow Ltd -4.57%