What's Affecting Markets Today

Asian markets rise to start week

Asia-Pacific markets advanced on Monday, buoyed by rising industrial profits in China. Official data from the National Bureau of Statistics indicated a 4.3% year-on-year increase in China’s industrial profits for January to April. Consequently, Mainland China’s CSI 300 index gained 0.21%, while Hong Kong’s Hang Seng index rose 0.4%.

Investors are anticipating further economic data from China and India this week. China will release its official purchasing managers’ index on Friday, and India will report its fiscal Q4 GDP figures.

Japan’s Nikkei 225 increased by 0.22%, and the Topix index rose 0.3%, recovering from losses incurred last Friday. South Korea’s Kospi climbed 0.5%, though the Kosdaq remained flat.

These positive movements in the Asia-Pacific markets reflect optimism over industrial growth in China, contributing to a broader regional rally. The upcoming economic data releases are expected to provide additional insights into the region’s economic health.

ASX Stocks

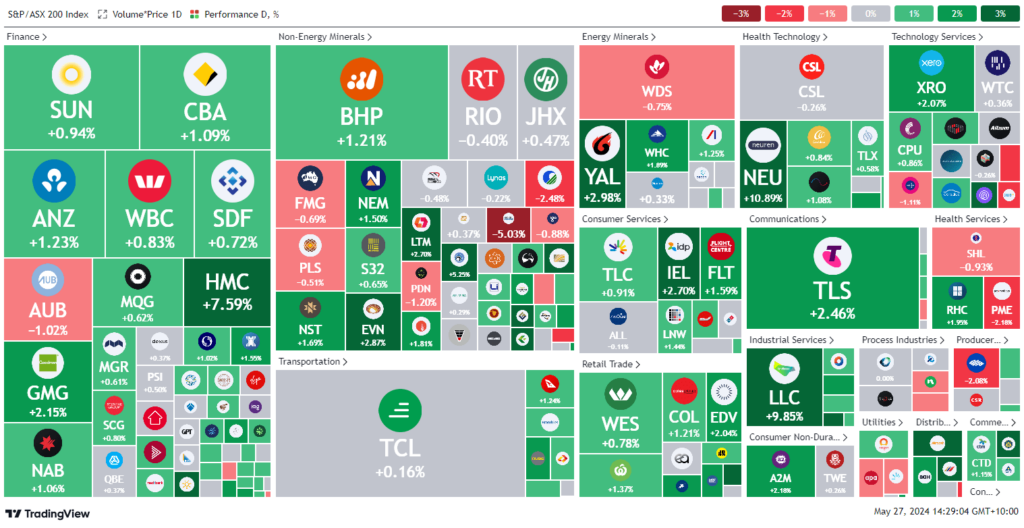

ASX 200 - 7,791.9 (+0.8%)

Key Highlights:

The Australian sharemarket rebounded on Monday, with the S&P/ASX 200 rising 60.2 points (0.8%) to 7787.8 by mid-afternoon, following a sharp sell-off last week. Interest rate concerns eased over the weekend, boosting rate-sensitive sectors, notably property, which gained 1.6%. All 11 ASX industry groups saw gains except energy, with Woodside Energy dropping 0.8% to $27.71 as oil prices hit a three-month low.

Key movers included Cettire, which surged 10.9% to $2.64, denying allegations of counterfeit products. Neuren Pharmaceuticals climbed 11% to $22.98 after positive trial results for its Pitt-Hopkins syndrome treatment. Lendlease rose 9.9% to $6.47, unveiling a new global strategy. HMC Capital, Lendlease’s major shareholder, jumped 7.5% to $7.44 post a $100 million capital raise. Megaport increased 2.3% to $14.03 after its chairman sold shares worth $15.9 million. Ingenia Communities advanced 3.9% to $4.91, forecasting strong earnings growth. Vista Group soared 17% to $1.96, following Potentia Group’s 18.5% stake acquisition. Adriatic Metals halted trading ahead of a $75 million equity raise.

Leaders

CTT Cettire Ltd 11.56%

NEU Neuren Pharma 10.96%

LLC Lendlease Group 9.76%

SNL Supply Network Ltd 8.19%

HMC HMC Capital Ltd 7.80%

Laggards

VUL Vulcan Energy Resources Ltd -7.13%

AD8 Audinate Group Ltd -6.09%

NIC Nickel Industries Ltd -5.03%

SLX SILEX Systems Ltd -4.52%

ERA Energy Resources of Australia Ltd -4.08%