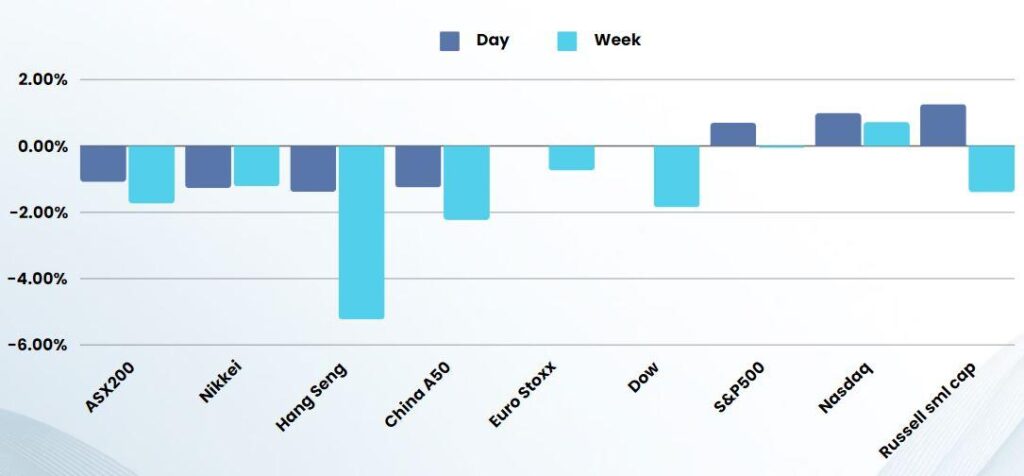

Last Night's Market Recap

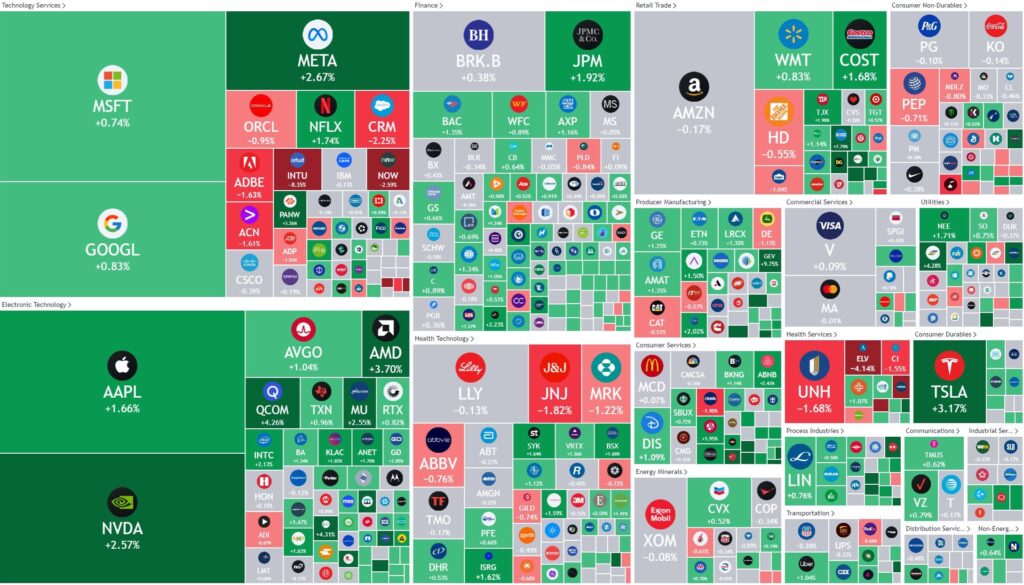

S&P 500 - Heatmap

Overnight – Nvidia carries the weight of the market on it shoulders

Stocks push higher on Friday as the Nasdaq rallied to a record close, ending the week with a win as a Nvidia-led surge fueled bullish bets on stocks offsetting jitters about higher longer interest rates ahead of the long holiday weekend.

Tech led the market higher as investors bought the dip in big tech stocks a day earlier and continued to add bullish bets on chipmaker NVIDIA following the latter’s bumper first-quarter earnings report.

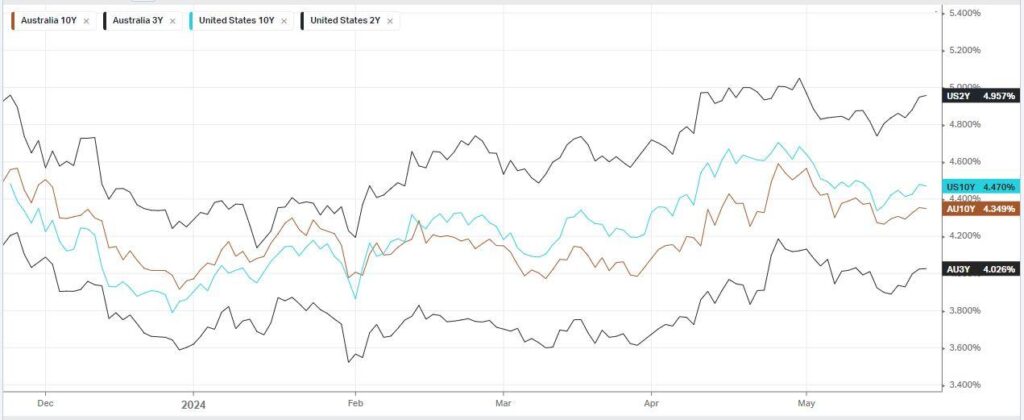

Rate jitters still remained however, as Analysts at Goldman Sachs have pushed back their forecast for the first Fed rate cut to September from July following a slew of Fed speak that flagged concerns about that the path of inflation toward the 2% target will likely take longer than expected. Concerns about inflation were eased somewhat following a fall in the University of Michigan survey’s 12-month inflation expectation to 3.3% from 3.5% previously. The widely-watched CME Fedwatch tool indicated a roughly 45% chance that the Fed brings rates down from a more than two-decade high level of 5.25% to 5.5% in September.

Elsewhere on the economic front, durable goods orders grew 0.7% in April, a slip from 0.8% growth the prior month.

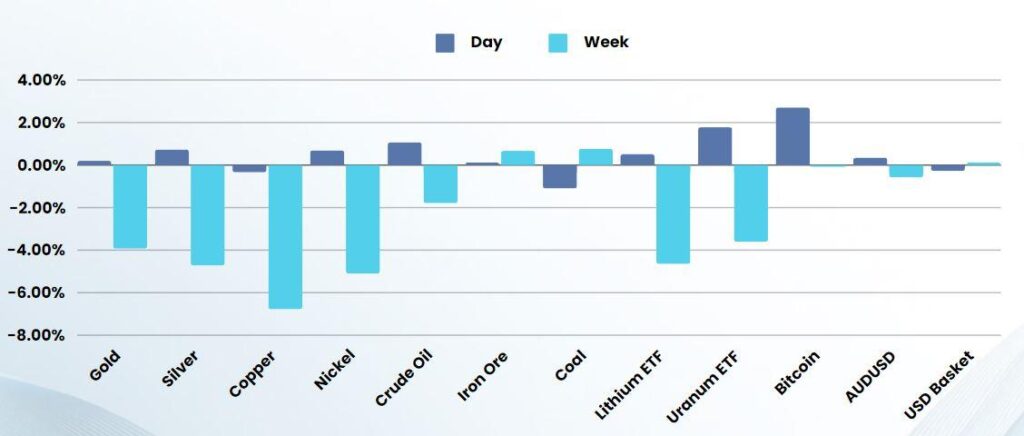

Metals and commodities settled after a heavy sell off this week due to higher rate expectations pushed the USD higher

In crypto land, another incremental step in legitimising the “investment worthiness” of digital currency was welcomed with the news that the SEC will approve an Ethereum ETF. Coinbase rose more than 8% as the U.S. Securities and Exchange Commission approved applications from several ether exchanged-traded funds, or ETFs, to list funds that buy and hold ether on U.S. exchanges. The SEC approved applications for eight ETFs including VanEck, Fidelity, Franklin, Grayscale, Bitwise, ARK Invest 21Shares, Invesco Galaxy and BlackRock – to list on the Nasdaq, NYSE Arca, and Cboe BZX exchanges.

Earnings

- Workday -15% – after the human resources software provider cut its annual subscription revenue forecast due to lower headcounts and higher deal scrutiny. On the positive side, strategic deals and global expansion have been major success drivers, alongside the company’s focus on innovation and customer value. Despite facing increased scrutiny in large and net new deals, Workday remains committed to investing for growth while managing margin expansion.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7798 (+0.60%)

With the US and UK on holidays for Memorial Day, we are unlikely to see any major movements today. The BOJ Gov speech may trigger a reaction in a thin market.

There is increasing talk around China blockading or moving on Taiwan in June, which would normally be rumour and chest beating. One thing that sparks concern is that the Chinese have been rapidly stockpiling Copper, Silver, Gold and grains in the first half of year, which could be a commodity play, but could possibly signal they are preparing for any potential economic sanctions

Company Specific:

- Select Harvest and Task Group are expected to deliver updates today