What's Affecting Markets Today

Asian markets mixed

Asia-Pacific markets experienced mixed trading on Wednesday. Japan’s Nikkei 225 declined by 0.58%, while South Korea’s Kospi edged up 0.07%. The Reuters Tankan non-manufacturing index showed a slight improvement in business sentiment, rising to +26. Japan is set to release its April trade data and March machinery orders.

In the U.S., all three major indices closed in positive territory. The Nasdaq Composite increased by 0.22% to 16,832.62, the S&P 500 gained 0.25% to close at 5,321.41, and the Dow Jones Industrial Average rose 0.17% to 39,872.99. Investors are focused on Nvidia’s upcoming earnings report, which has driven recent market enthusiasm.

New Zealand’s S&P/NZX 50 climbed 0.5% after the Reserve Bank of New Zealand maintained the official cash rate at 5.5% for the seventh consecutive time. Hong Kong’s Hang Seng index rose 0.42% in early trading, and the CSI 300 increased by 0.1%.

ASX Stocks

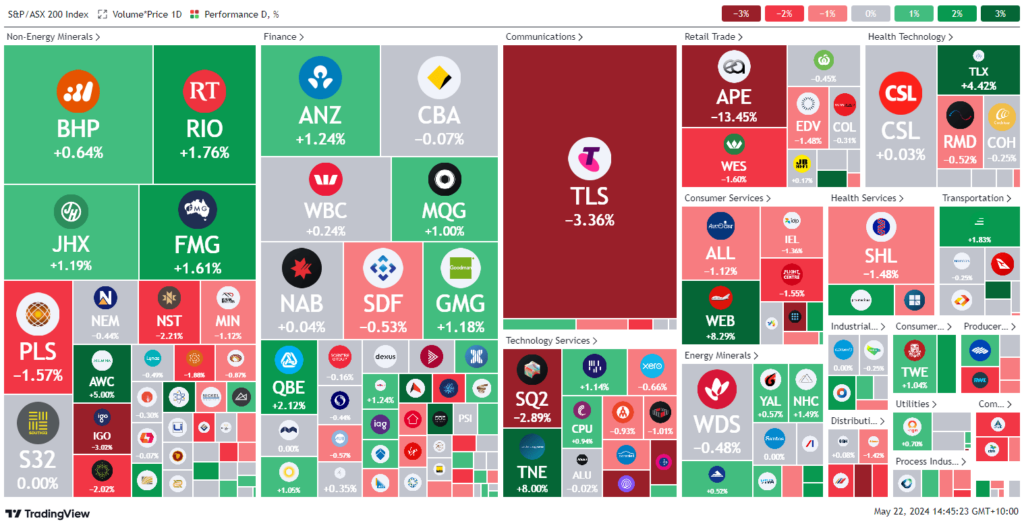

ASX 200 - 7,856.7 (+0.1%)

Key Highlights:

Australian shares rose 0.1% at midday, driven by gains in the tech and mining sectors, despite a 4% drop in Telstra following job cut announcements. Iron ore miners benefited from a price increase, with Fortescue up 1.7% and Rio Tinto up 1.3% as iron ore prices climbed 2.1% to $US120.95 per tonne overnight.

In London, BHP’s $64.4 billion bid for Anglo American faces a 5pm May 22 deadline for a formal offer under UK Takeover Panel rules.

The Reserve Bank of New Zealand held interest rates steady at 5.5%, leading to a rise in the New Zealand dollar against the Australian dollar.

Webjet plans to split its operations into two ASX-listed entities, boosting its stock by 11%. Technology One shares rose 4.8% following strong earnings and positive analyst upgrades. Telix Pharmaceuticals gained 7.3% after announcing plans to list on the Nasdaq. AP Eagers shares fell 14.3% due to a profit warning amid rising costs and dampened consumer demand.

Leaders

WEB Webjet Ltd 8.24%

TNE Technology One Ltd 8.06%

RSG Resolute Mining Ltd 7.92%

VUL Vulcan Energy Resources Ltd 6.67%

GQG GQG Partners Inc 6.33%

Laggards

APE Eagers Automotive Ltd -13.29%

ING Inghams Group Ltd -10.73%

360 LIFE360 Inc -4.89%

GEM G8 Education Ltd -3.66%

IFL Insignia Financial Ltd -3.63%