Last Night's Market Recap

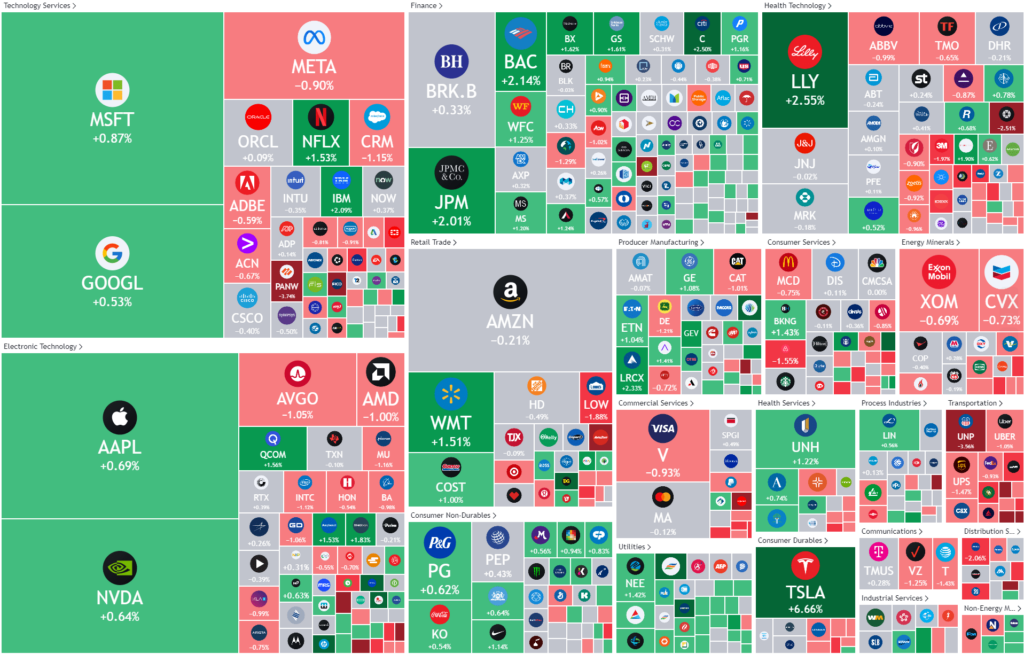

S&P 500 - Heatmap

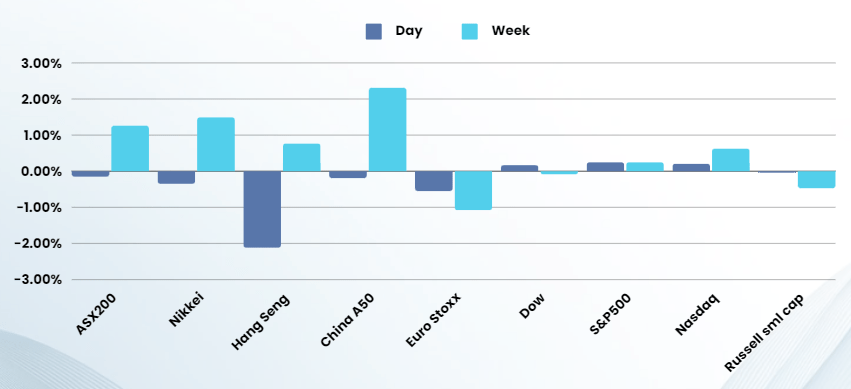

Overnight – Market treads water ahead of Nvidia results

Stocks eked out a small gain as the S&P 500 and Nasdaq closed at record highs Tuesday as the intraday dip in tech was bought ahead of eagerly awaited earnings from AI-darling Nvidia due Wednesday.

Tech climbed after struggling for direction earlier in the day as investors continue to weigh quarterly earnings ahead of Nvidia’s results due Wednesday. Palo Alto Networks fell nearly 4% cutting the bulk of earlier losses eve as analysts flagged that the cybersecurity firm’s latest billings forecast disappointed elevated expectations. Nvidia traded just above the flatline as the AI bellwether gears up to report results that many expect will top expectations. “We expect NVDA will again beat expectations and raise the bar with guidance,” Wedbush said in a recent note, highlighting several factors including robust demand for the chipmaker’s various product offering. Microsoft rose nearly 1% ahead of its presentation Tuesday, where many on Wall Street are eagerly awaiting an update on its latest AI developments.

In Crypto, Ethereum continued its rally on Tuesday, rising more than 8% on amid ongoing hopes that the Securities and Exchange Commission could deliver a decision on spot ether exchange-traded funds applications this week.

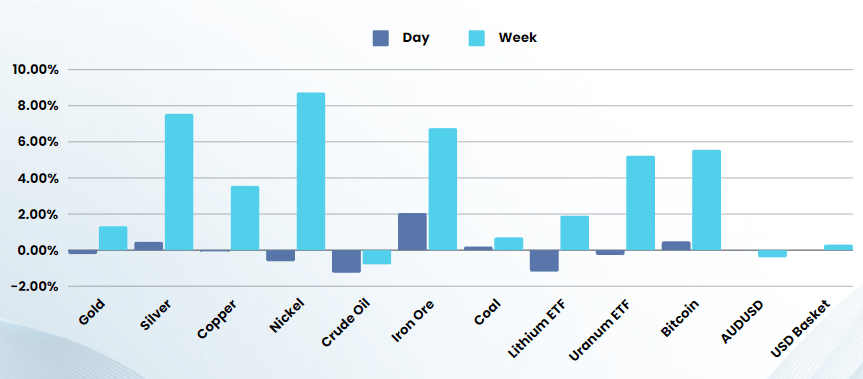

Gold and Silver fell away from recent highs as jawboning from Fed members increased fears of higher interest rates, while copper maintained its gains, finishing flat, as Africa’s biggest copper producer, the Democratic Republic of Congo (DRC) battled a failed coup attempt

All eyes turn to Nvidia earnings after the US close tomorrow (6am Sydney time) to see if the AI rally has staying power.

Earnings

- Macy’s +5% – after the department store chain lifted its adjusted earnings per share forecast for the full year, as its turnaround plan unveiled in February started to bear fruit.

- Lowe’s -3% – after the home improvement retailer reported a drop in quarterly sales on Tuesday, as inflation-hit Americans cut back on big-ticket discretionary home improvement projects.

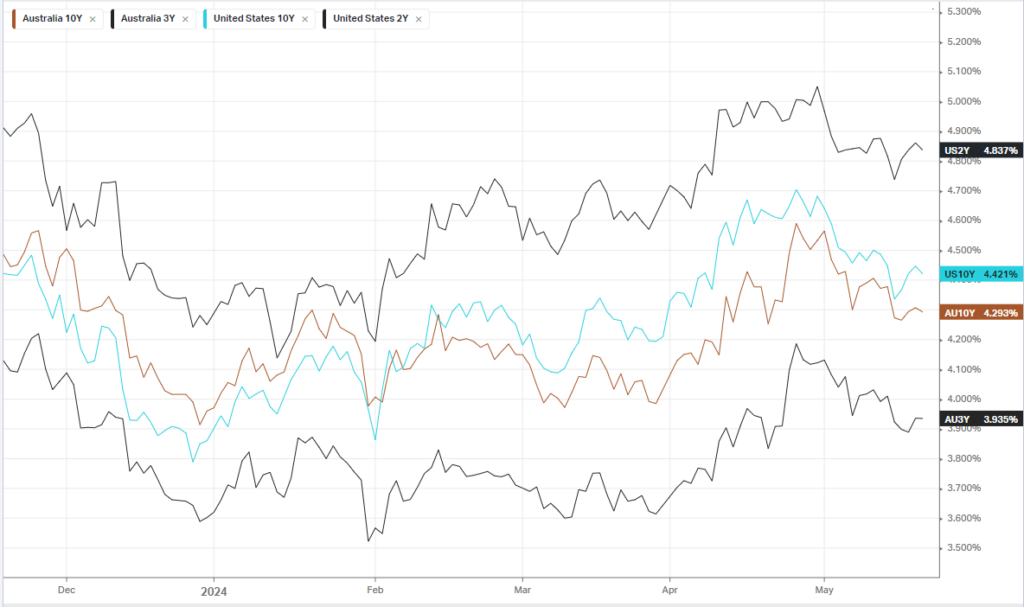

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7913 (+0.26%)

We are in for a relatively quiet day as the market waits on the final Mag7 to report earnings. Materials will be mixed as Iron ore gained, but gold, silver and nickel took a breather from their recent rallies. Agriculture stocks may see a bid tone after upgrades for Elders and a recent run in soft commodity prices support the sector.

The RBNZ meets today, however there will be limited reaction to any moves or comments.

Company Specific:

- Webjet releases earnings. Eagers Automotive, Telix Pharmaceuticals and Virgin Money UK all host AGMs.