Last Night's Market Recap

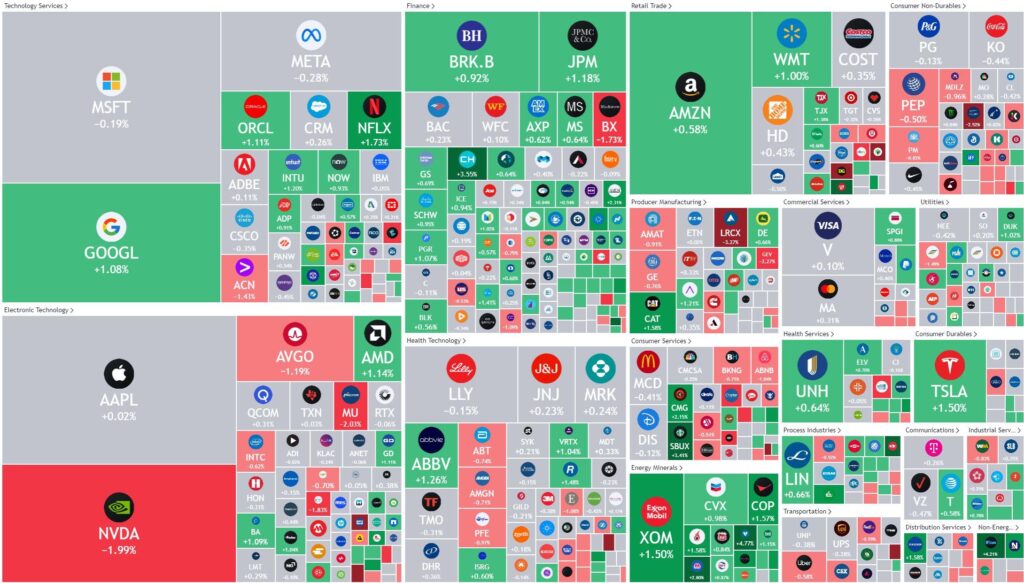

S&P 500 - Heatmap

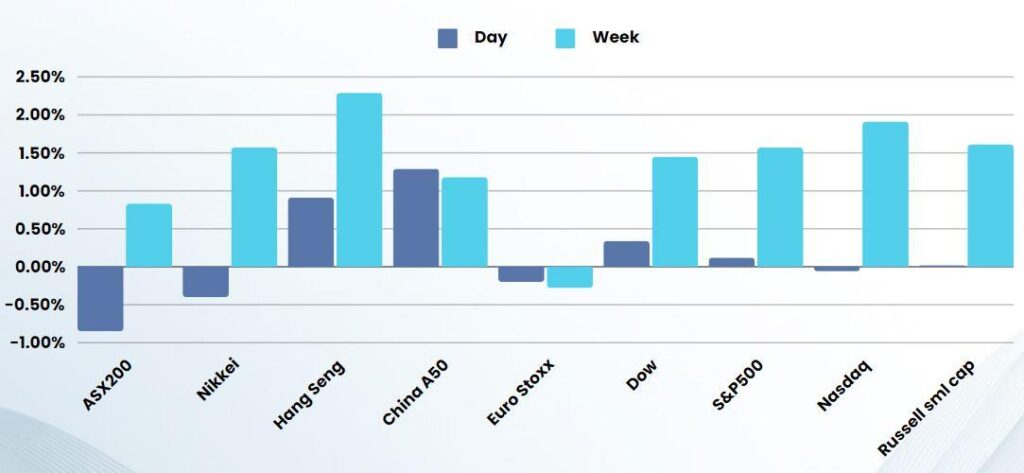

Overnight – Equities stall, Metals surge higher

The Dow closed above 40,000 for the first time ever on Friday, notching a five-week win streak as rate-cut hopes while precious metals soared with copper & Gold making a record highs and silver playing catch-up with gold at new decade highs

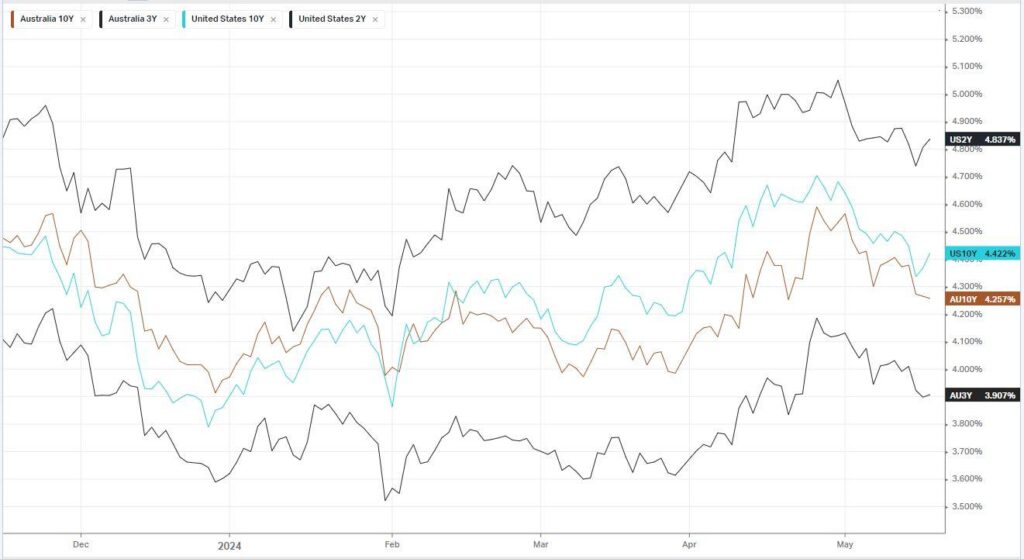

Helping the tone last week has been softer-than-expected consumer inflation readings, which drove these averages to record highs on Wednesday and Thursday. However, several Fed officials have since warned that the central bank still needed more confidence to cut interest rates, and that the timing of the move remained uncertain, limiting volatility Friday. Fed Gov. Bowman said on Friday that she would be willing to back a hike if disinflation stalls, or reverses, added that she was monitoring data to evaluate whether policy was sufficiently restrictive. “While the current stance of monetary policy appears to be at a restrictive level, I remain willing to raise the target range for the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or reversed,” Bowman said.

Bowman’s remarks followed a slew of Fed speak this week that called for higher for longer rates to assess incoming data. Their comments saw investors second-guess expectations for rate cuts this year, with traders slightly paring bets on a reduction of 25 basis points in September, according to the CME Fedwatch tool.

Advanced Micro Devices AMD gained more than 1% after Reuters reported that Microsoft plans to offer its cloud customers AMD chips as an alternative to Nvidia chips. NVIDIA fell 2% on the news.

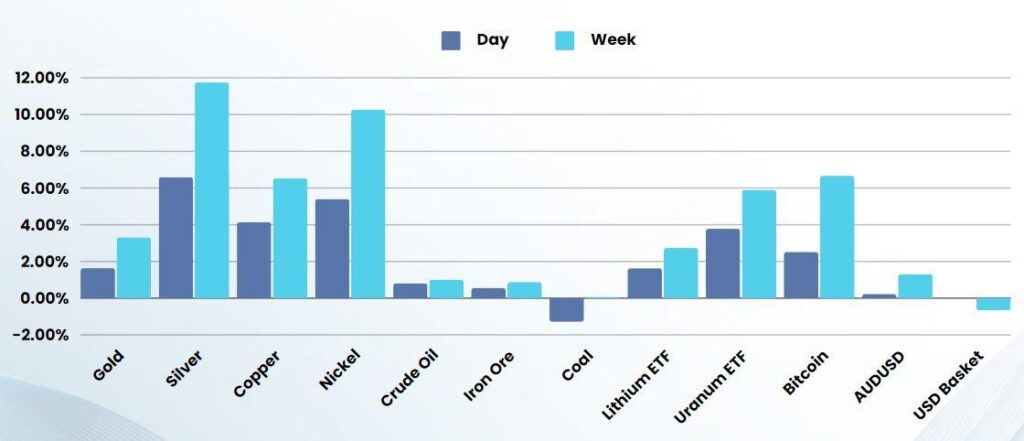

Precious metals had a spectacular night with Copper settling at an all-time high of $5.08lb due to the increasing concerns over supply of the essential metal with data centre demand also adding to the energy transition demand for the red metal. Gold made a fresh high above $2400, while Silver made decade highs around $32 due to the perceived peak in rates and the spiralling US debt issue

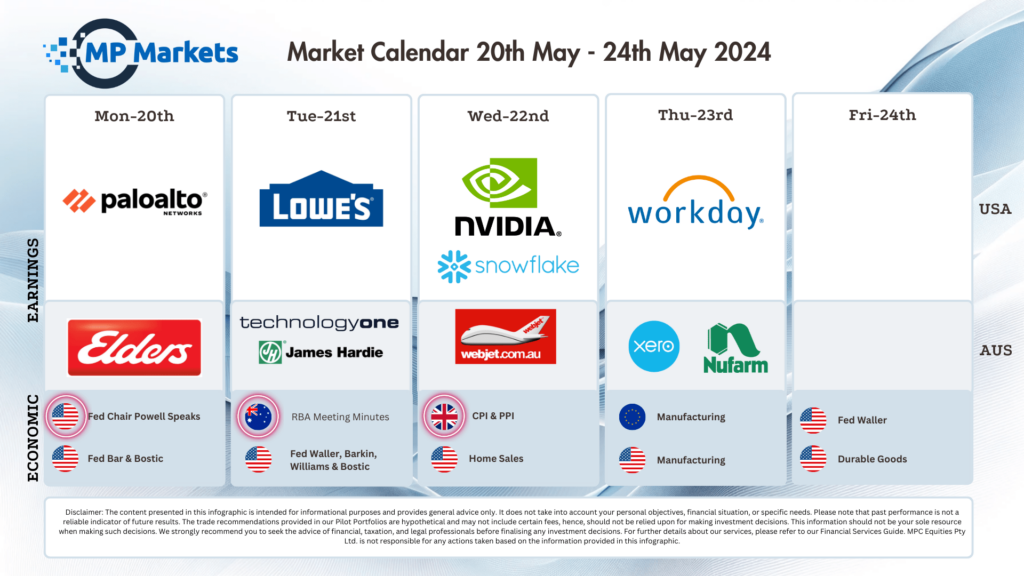

Earnings

- Take-Two Interactive +1% – even as the video game maker lowered its bookings guidance for 2025 after delaying the release of Grand Theft Auto game to the fall of 2025. The video game did, however, deliver quarterly that beat Wall Street estimates.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7876 (+0.44%)

The index will be dragged up by the materials sector today with Gold, Silver, Copper & Nickel all soaring last week. The banks may see some benefit also with rate expectations being pared back.

With a raft of Fed speakers this week and Nvidia earnings on Thursday morning AU time, we expect the first half of the week to be relatively quiet outside the metals rally which could see prices squeeze significantly higher with the recent momentum

Company Specific:

- Elders (ELD) report earnings