Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Equities take a breather as Fed says CPI “not enough” to cut rates

The DOW briefly topped 40,000 for the first ever as investors weighed up comments from Fed Williams, a rebound in Treasury yields and a rally in Walmart.

The latest consumer inflation data has been broadly well received by financial markets, but Federal Reserve Bank of New York President John Williams said this news, while positive, is not sufficient for the U.S. central bank to cut interest rates sometime soon. Willaims also stated that he couldn’t see “any need to tighten monetary policy today,” largely ending any speculation that the Fed might need to raise rates further to reduce inflation to desired levels. Fed Mester also spoke overnight saying he “believes that it will take longer to reach our 2% goal than I previously thought,” Mester said, adding that further monitoring of incoming data will be needed.

Bets on a September rate cut continued to provide support to stocks as Wednesday’s softer-than-expected consumer price index data was followed up by data pointing to a cooling the labor market. Initial jobless claims in the U.S. fell to 222,000 in week ended on May 11, down from an upwardly revised total of 232,000 in the previous week. Economists had called for a reading of 219,000. Treasury yields, however, rebounded from a slump a day earlier as Fed speakers remain cautious and stress the need to monitor further incoming data for signs that inflation is on a sustainable path lower.

Elsewhere, Chubb stock rose nearly 5%, to a record high, after Warren Buffett’s Berkshire Hathaway revealed it had taken a $6.72 billion stake in the insurer. Meta Platforms stock fell nearly 2% after the European Commission launched a investigation into the Facebook parent over alleged breaches of the bloc’s strict online content law to do with child safety risks.

Earnings

- Walmart +7% – the major dow component, jumped 7% after lifting its guidance following fiscal Q1 results that beat Wall Street estimates on both the top and bottom lines.

- Canada Goose +15% – after the apparel maker reported better-than-expected fiscal Q4 results, and talked up the prospect of annual margin improvement.

- Cisco Systems -2% – as its cut to annual earnings guidance overshadowed an upgrade to revenue guidance and quarterly results that beat on both the top and bottom lines.

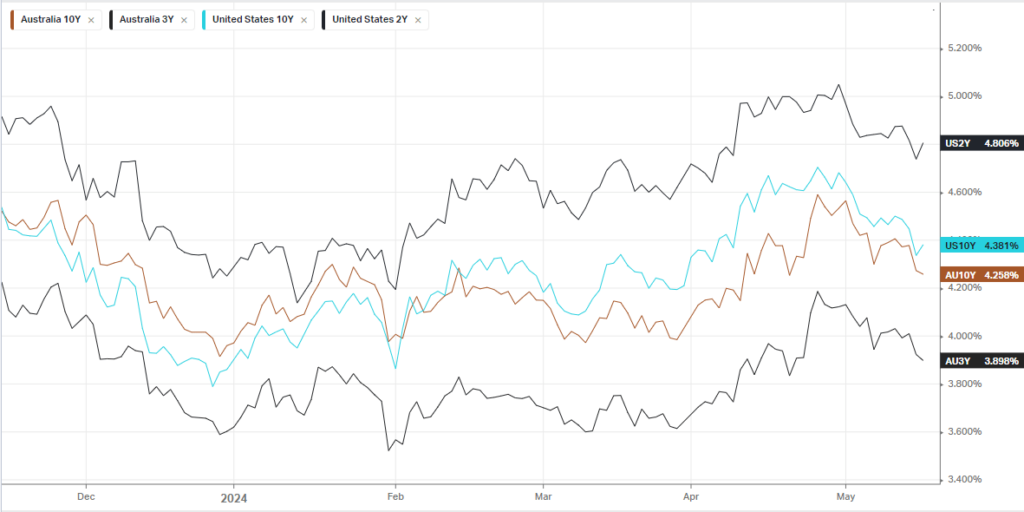

Bonds

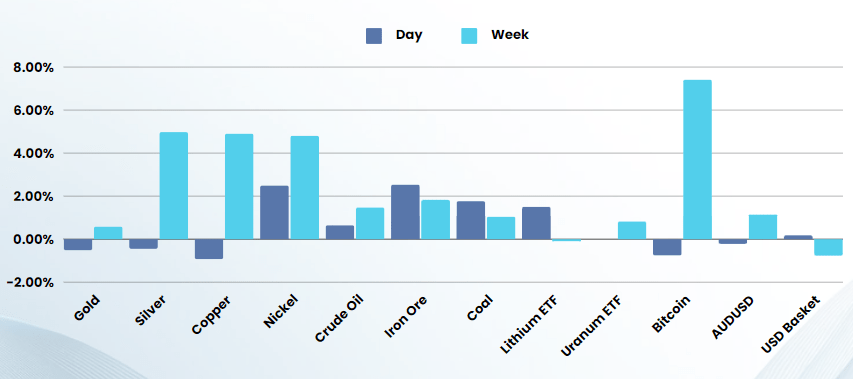

Commodities & FX

The Day Ahead

ASX SPI 7875 (-0.55%)

The ASX is likely to give back some of yesterdays impressive gains as investors potentially look to take profits. While there has been plenty of optimism this week around inflation and rate cuts, Central bankers have been very clear that they would like to see more data. This means at least 2 more CPI readings that show a dramatic reversal in inflation will need to be released for the market expectations of a September cut to be right. This is possible, but highly unlikely

We remain cautious and agile as the higher equities rally on this hope, the further it can fall