Last Night's Market Recap

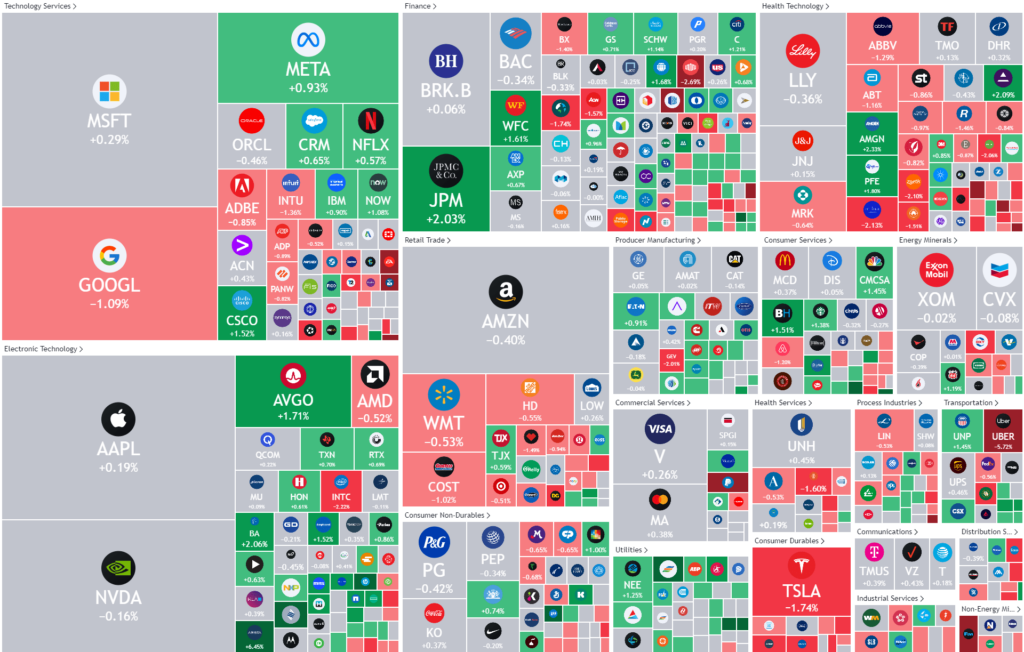

S&P 500 - Heatmap

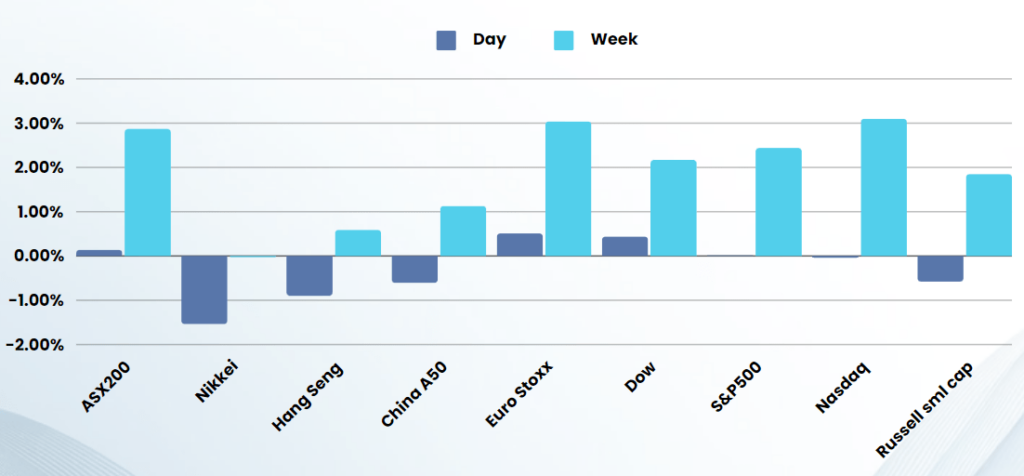

Overnight – Stocks end flat as quiet market conditions continue

Another quiet night in markets as stock ended flat due to a bounce in Treasury yields and earnings disappointments from ARM, Uber and Shopify

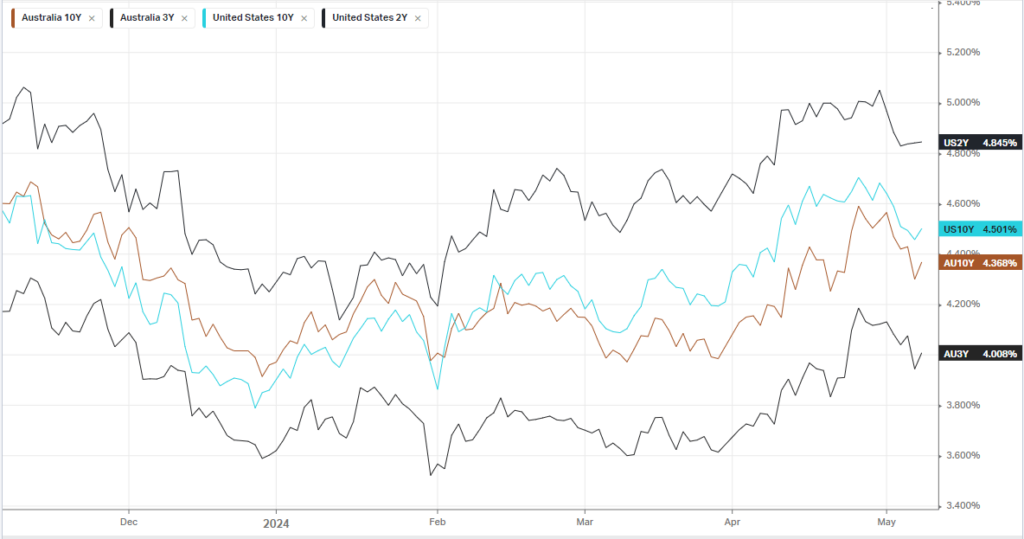

Treasury yields rose after the 10-year Treasury auction on Wednesday resulted in a lower-than-expected yield amid uncertainty about the timing of rate cuts ahead. The notes were awarded at 4.483%, just below the pre-sale, or when-issue, rate of 4.473%, signaling meagre investor appetite for the belly of the yield curve, which typically reflects rates maturing between ten and two years. The results come just as Fed officials continue to signal that rates will remain steady in the near-term, with further fed speakers set to deliver remarks this week.

Earnings:

- Uber -5% – the ride-hailing firm posted a surprise quarterly loss as gross bookings of $37.7 billion in the quarter fell short of estimates or $37.93B.

- Reddit +4% – the social media platform reported stronger-than-expected first-quarter earnings, as well as an upbeat second quarter outlook, in the company’s first earnings season as a publicly traded entity.

- Airbnb -8% – saw its shares dip about 8% in after-hours trading Wednesday after the company unveiled its financial results for the fiscal Q1 2024.

- ARM Holdings -7% – the chip designer delivered annual revenue guidance that fell short of estimates following better-than-expected fiscal fourth-quarter results as licensing revenue was boosted by the ongoing wave of enterprise spending on artificial intelligence.

- Shopify -18% – the company reported first-quarter results and provided revenue guidance for Q2, which implied a growth deceleration. In Q2’2024, Shopify expects revenue to grow at high-teens percentage rate on a year-over-year basis. This is a significant decline compared to the low-twenties percentage growth recorded in Q1.

Bonds

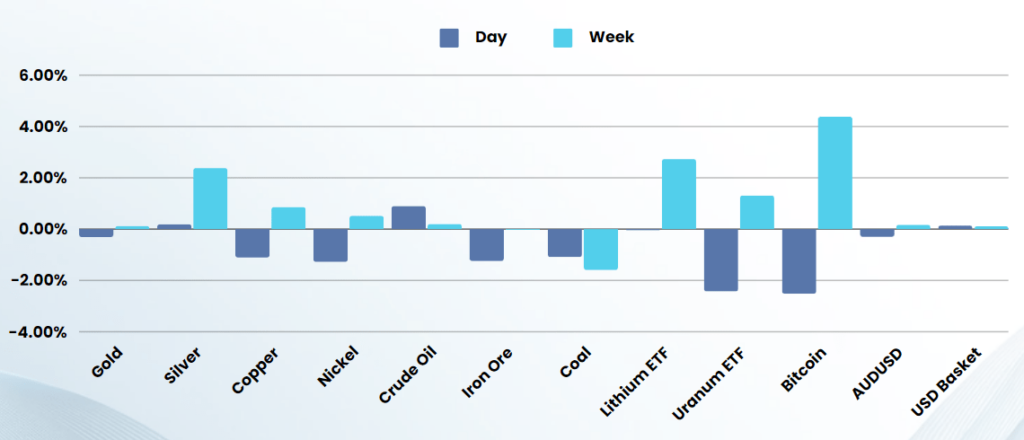

Commodities & FX

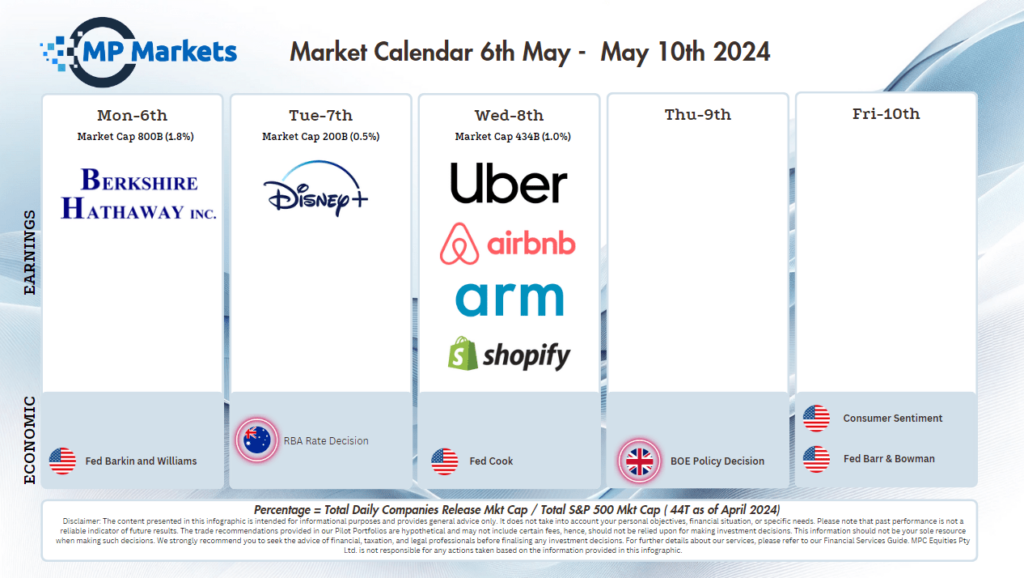

The Day Ahead

ASX SPI 7806 (-0.02%)

We are likely to drift off from the open today as the interest rate buzz fades and earnings updates from market darlings, JB Hi-Fi and CBA show cracks in the economy. Softer commodity prices also wont help the materials sector with Iron ore, Gold and Copper all lower.

Company Specific:

- CBA’s March quarter profit has slipped 3 per cent versus the first half of financial 2024 to $2.4 billion. The result is down 5 per cent on the prior comparable March quarter. It said home loan lending volumes grew 3.1 per cent in the March quarter on an annualised basis, versus the December quarter. Doubtful debts extended a gradual rise over the past 12 months as it recorded loan impairment expenses of $191 million in for the quarter on a total provision coverage ratio of 1.66 per cent. It said operating expenses grew 2 per cent with operating profit slipping 1 per cent. Operating expenses in the first half of financial 2024 were $3.06 billion.

- JB Hi-Fi – There’s a little more evidence of a slowdown in the consumer sector after retail darling JB Hi-Fi posted Australian same store sales down 0.3 per cent in the March quarter, versus the prior comparable quarter.Over the nine months to March 31 Australian JB Hi-Fi sales are flat, with The Good Guy sales down 7.3 per cent.

- REA Group increased $US34 million, or 15 per cent, to $US256 million, primarily driven by higher Australian residential revenues due to price increases, increased depth penetration, favourable geographic mix and an increase in national listing

- Industrials group Orica has lifted its underlying earnings before tax 10 per cent to $353.7 million for the six months to March 31.