Last Night's Market Recap

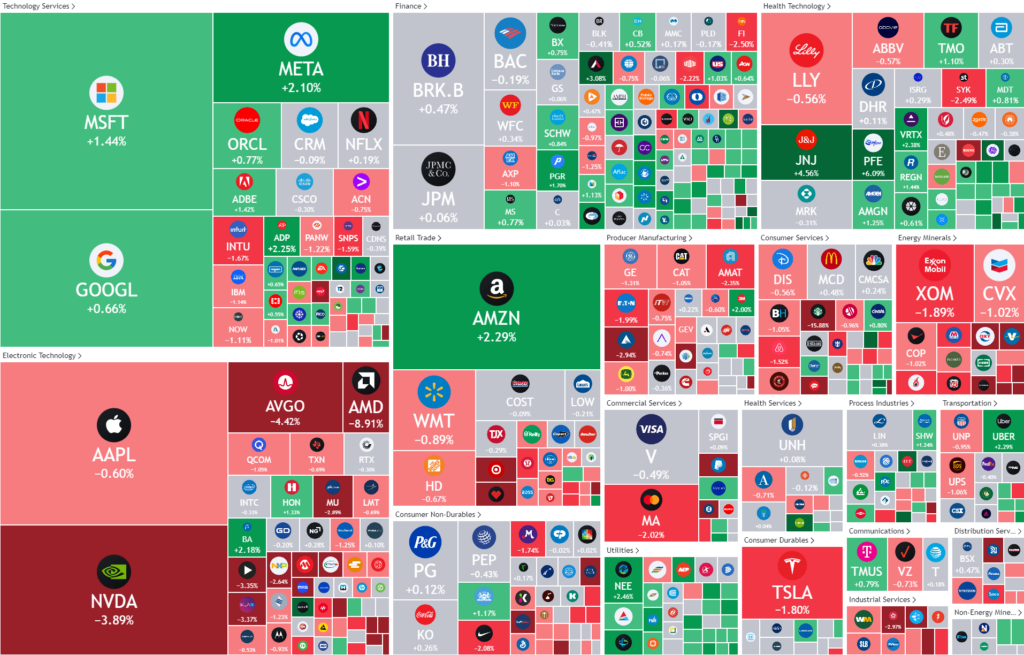

S&P 500 - Heatmap

Overnight – Fed downplays need for hikes & reinforces “Higher for Longer”

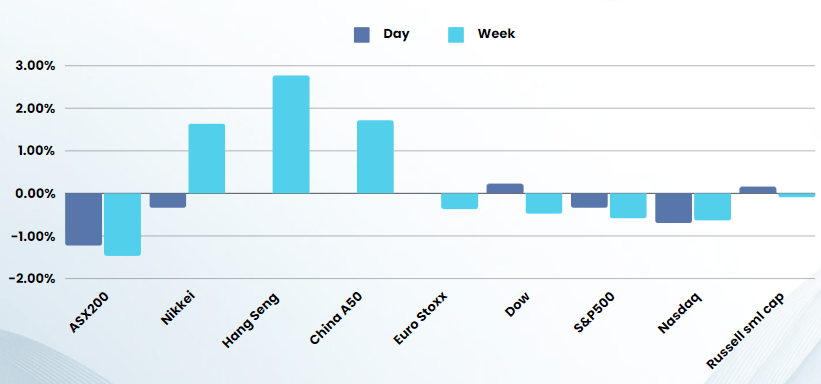

It was a rollercoaster ride in equities overnight, swinging between gains and losses as the Federal Reserve kept rates unchanged on Wednesday, but the central bank maintained its easing basis, downplaying the prospect of rate hikes.

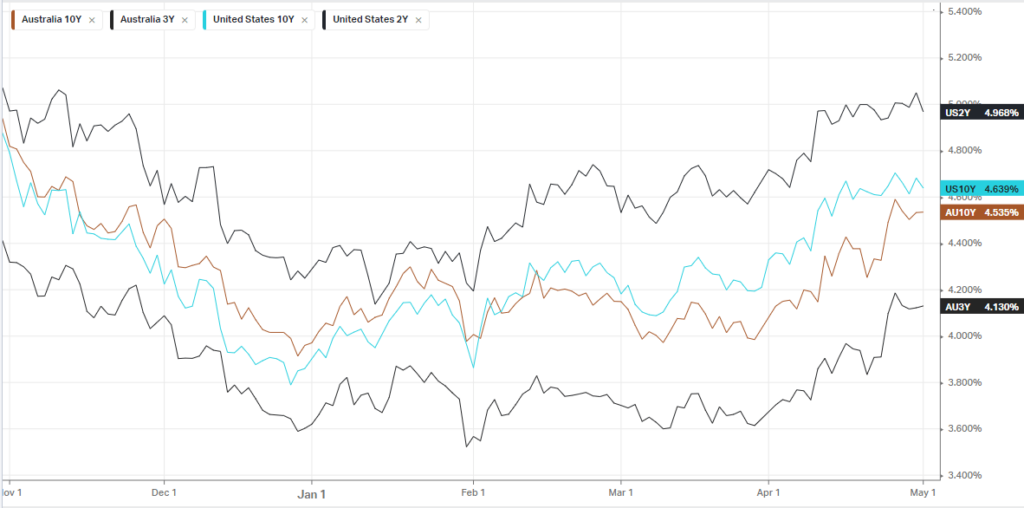

The Federal Reserve left interest rates unchanged within a 5.25% to 5.5% range, and signaled that rates could likely remain higher for longer than previously expected, but kept the rate hikes off the table. “it is unlikely that next policy rate move would be a hike,” Fed chairman Jerome Powell said Wednesday, though acknowledged that progress on inflation had stalled in recent months. The decision arrived on the heels of data showing the labour market is coming into the balance as job openings fell to a three-low in March. On the private labour market front, however, job gains in April topped economists expectations. The nonfarm payrolls report is due on Friday, which is expected to show that the U.S. economy added a healthy 243,000 jobs in April.

Amazon stock rose 2% as tech giant’s solid first-quarter earnings beat estimates underscoring the boost to its cloud business from AI demand overshadowed a revenue forecast that fell short of estimates. Chip stocks were a drag on the broader tech sector following 14% slide in Super Micro Computer and a 8% slide in Advanced Micro Devices (AMD)

Energy stocks were under pressure from a more than 3% slip in oil prices after a surprise build in U.S. stockpiles and strong crude production sparked doubts over tight supply conditions. The Energy Information Administration reported that weekly U.S. inventories for the week ended Apr. 26, jumped by 7.3M barrels, confounding expectations for a draw of 2.3M barrels.

Uranium stocks spiked higher as the US moved to ban Russian imports, its largest supplier

Earnings:

- AMD -8% – quarterly results that topped estimates after the chipmaker said it expects AI chip sales of roughly $4 billion for 2024, an increase of $500 million from its prior estimate for the year. However, this was not enough to meet Wall Street’s lofty expectations.

- Pfizer +6% – the drugmaker topped first-quarter expectations, and boosted its full-year outlook.

- Kraft Heinz -6% – the food giant missed expectations for first-quarter sales, as inflation-weary consumers pushed back on higher prices of its products.

- Yum! Brands -4% – after the restaurant group reported a surprise fall in quarterly global same-store sales, hurt by choppy demand for its KFC and Pizza Hut brands from inflation-weary consumers.

- Estee Lauder -13% – the beauty products company as its earnings and revenue topped consensus expectations, but guidance fell short of consensus estimates,

- CVS Health -18% – after the pharmacy chain reported a decline in first-quarter profits and slashed its full-year earnings outlook.

- Starbucks -16% – after its first quarter profit missed expectations, while its revenue weakened on worsening demand in North America and China.

Bonds

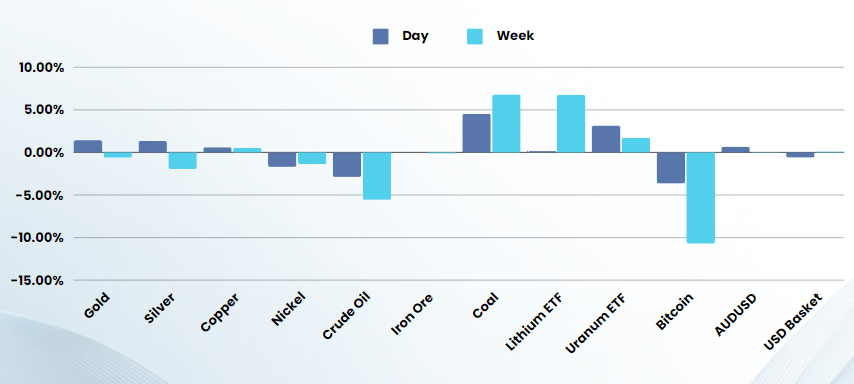

Commodities & FX

The Day Ahead

ASX SPI 7572 (-0.01%)

The ASX is likely to have a quiet day as most of the global markets were shut for May Day (excluding the US) and China remains shut today for a bank holiday.

Gold stocks and interest rate sensitive stocks are likely to be supported with the Fed not being as hawkish as the market feared.

Uranium stocks could see a continued rally on the US ban on Russian Uranium, while oil stocks will suffer under the weight of falling oil prices

Company Specific:

- National Australia Bank has declared a flat 84¢ per share interim dividend on a statutory profit that edged up 1.4 per cent to $3.49 billion for the six months to March 31. The bank also said it would lift its ongoing on market share buy-back by $1.5 billion

- Iress will hold its AGM after the financial software group upgraded its profit guidance this week.