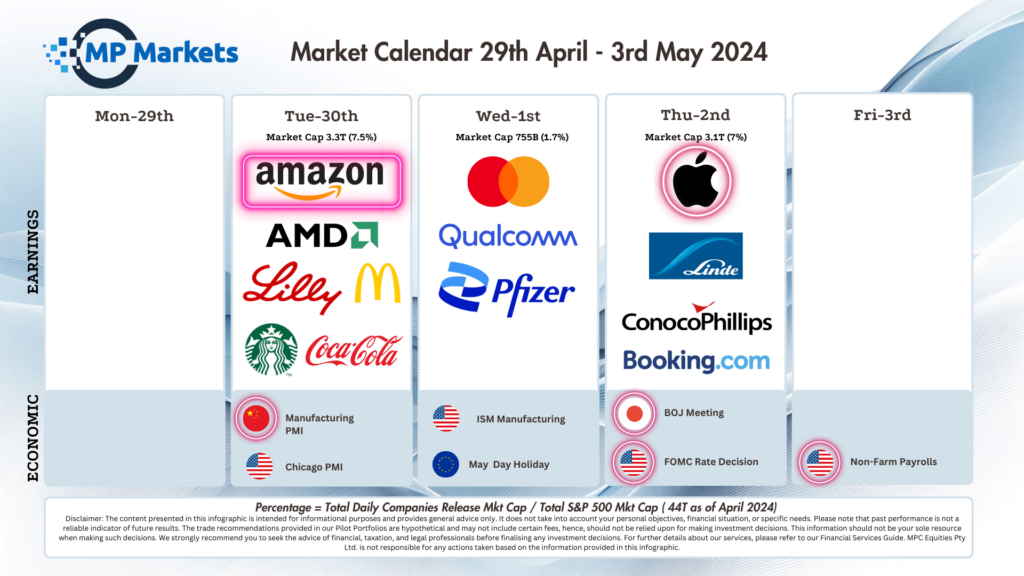

Last Night's Market Recap

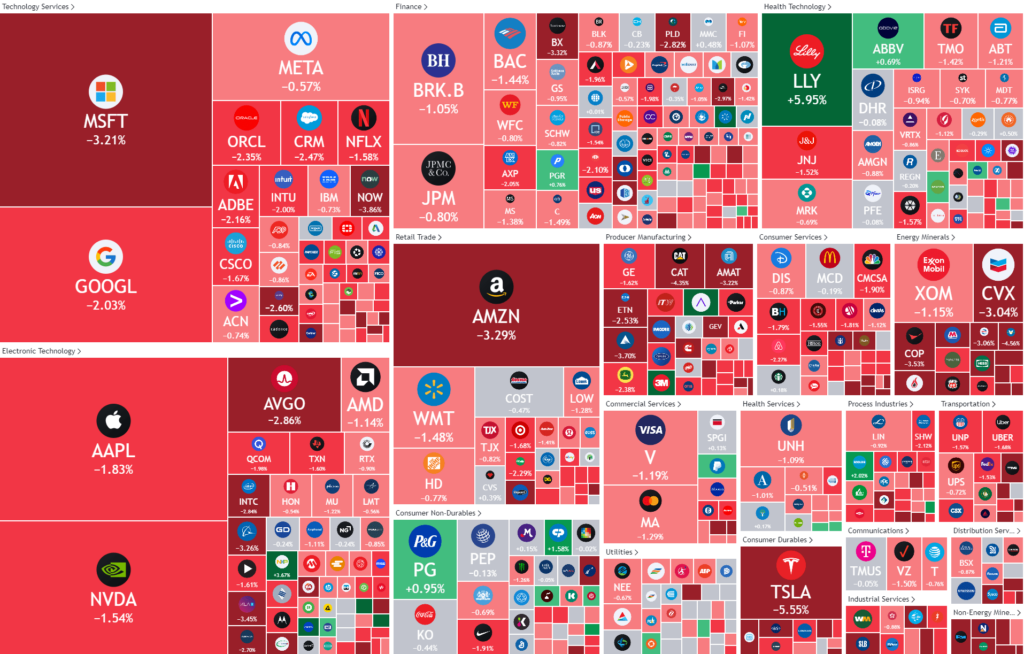

S&P 500 - Heatmap

Overnight – Wage inflation puts pressure on Fed to be hawkish on rates

A hotter than expected wage inflation number has put extra pressure on the Fed as the US Central Bankers start their 2-day policy meeting on interest rates

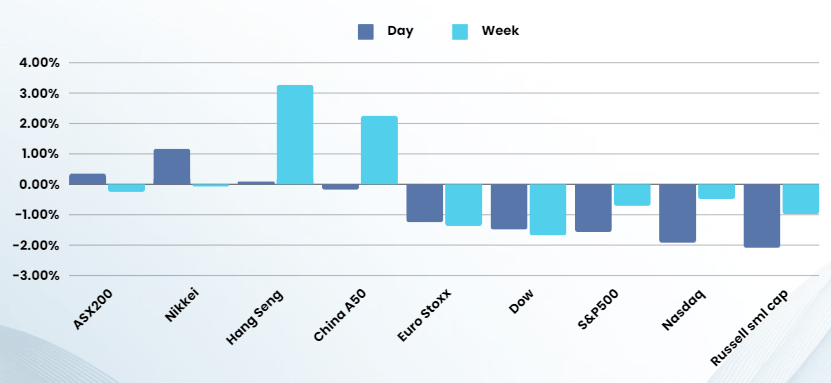

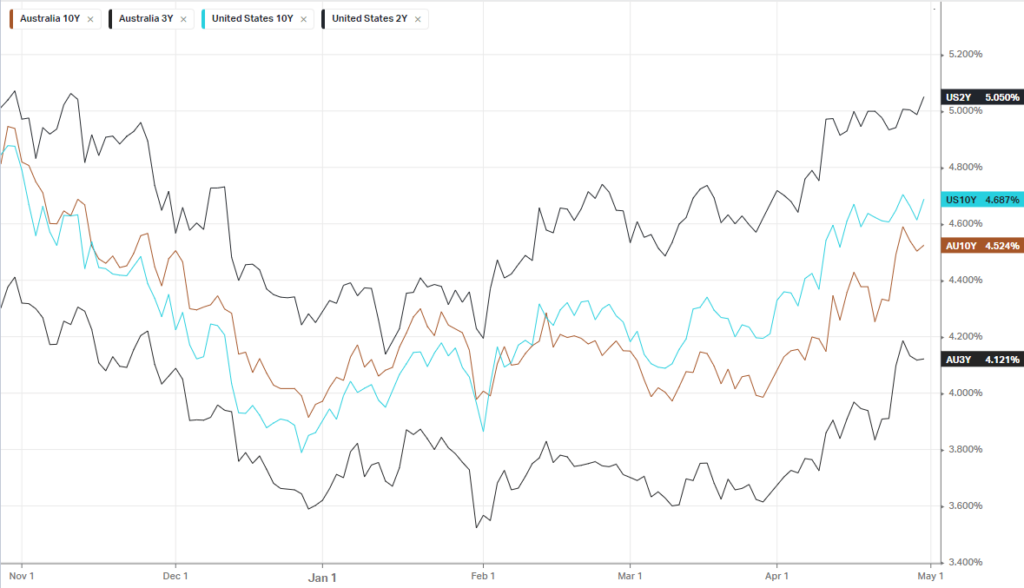

All the major US indices finished down 4%-5% for the month, the first losing month since November as stocks buckled under the pressure of the higher bond yields, as the US2Y broke above 5% and the US10Y hovered at 6-month highs around 4.70%

U.S. labour costs increased more than expected in the first quarter, driven by a rising wages and benefits, stoking fresh concerns about inflation just as investor bets on Fed rate cuts continue to cool. The Employment Cost Index increased 1.2% last quarter after rising by an unrevised 0.9% in the fourth quarter, while labour costs increased 4.2% on a year-on-year basis. The report followed data last week that showed price pressures heating up in the first quarter. The Federal Reserve kicked off its two-day policy-setting meeting Tuesday, and is widely expected to keep its benchmark interest rate unchanged in the current 5.25%-5.50% range, where it has been since July. Fed Chair Jerome Powell remarks that will follow the monetary policy statement is likely to take on added importance as investors are eager for clues on whether the Fed chief is likely to adopt the market’s less dovish view on the rate outlook.

Investors have largely priced out the likelihood of rate cuts this summer, with September now seen as the favourite month for the Fed to start a rate-cutting cycle. Bearing in mind that analysts are unwinding frivolous rate cut expectations from early in the year and the reality is that any rate cut would be next year

The US Central Bank will deliver its rate decision at 4am tomorrow morning, with a press conference at 430am AEST

Earnings:

- Amazon -3.29% (+2.95% after market) – The company rose as high as +6% after delivering results, before settling at half that gain, largely unchanged on the day. The stock fell away from its highs as the company forecast second-quarter revenue below Wall Street expectations on Tuesday, as it expects tepid spending from cost-conscious businesses on its cloud-computing services. with Amazon Web Services (AWS), the largest provider of cloud-computing services, posted a 17% rise in revenue to $25.0 billion in the first quarter, compared with expectations of $24.53 billion. That compares with a rise in cloud-computing revenue of 31% for Microsoft and 28% for Alphabet for the January-to-March period.

- Eli Lilly +6% – stock rose 6% after after the pharmaceutical giant reported better-than-expected earnings for its first quarter, and hiked its full-year guidance on strong sales of its blockbuster diabetes drug Mounjaro and newly launched weight loss treatment Zepbound.

- 3M Company +5% – stock rose nearly 5% after the industrial conglomerate topped analysts’ expectations for its first quarter, adding that it expects its dividend payout ratio to be approximately 40% of adjusted free cash flow.

- Coca-Cola -0.5% – was lower despite the beverage giant reporting quarterly earnings and revenue that beat expectations, and raising its full-year outlook for organic revenue.

- McDonald’s -0.5% – slipped after its reporting weaker than expected Q1 earnings as same-store sales missed analyst estimates as calls to boycott on the chain amid the ongoing Middle East war weighed on growth.

Bonds

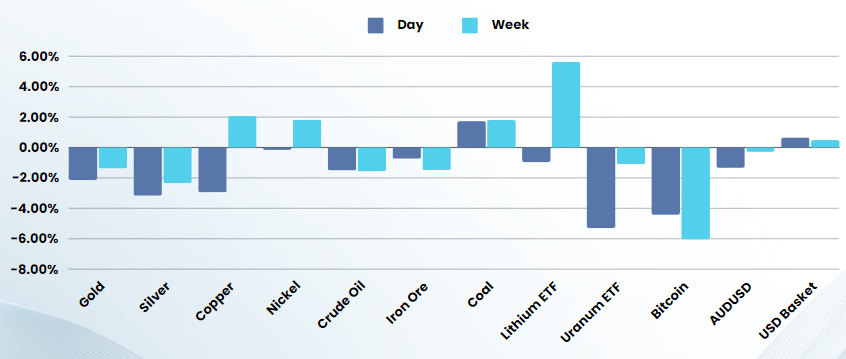

Commodities & FX

The Day Ahead

ASX SPI 7593 (-1.12%)

The local market is in for some heavy selling from the open as global inflation figures continue to tie the hands of central banks who are having to unwind any talk of rate cuts. The materials sector will take a hit with Gold, silver, copper and Iron ore all fell overnight on strength in the USD due to higher bond yields.

Healthcare, staples and financials may do the heavy lifting in supporting the index.

On the flipside, Tech will be hit on the weak US lead and higher yields, Consumer discretionary is likely to suffer with weak retails sales numbers yesterday and higher global interest rate expectations and energy will also suffer with oil sitting on a key support level around 80-81 and Uranium also took a hit as Cameco, the worlds largest producer, disappointed on earnings