Last Night's Market Recap

S&P 500 - Heatmap

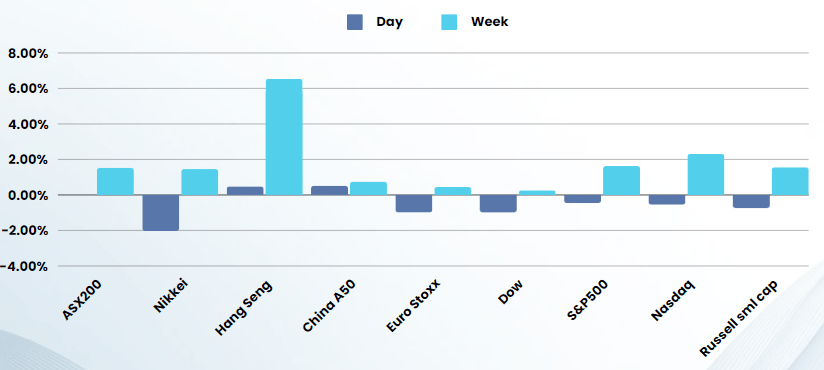

Overnight – Google earnings save the day for equities and Mag7

Google saved the day in afterhours trade, rallying 13% as equities closed lower, but well off session lows Thursday as Meta cut come losses, though rising Treasury yields on economic data showing slowing growth, but sticky inflation, forced traders to push out bets on a first rate cut to December.

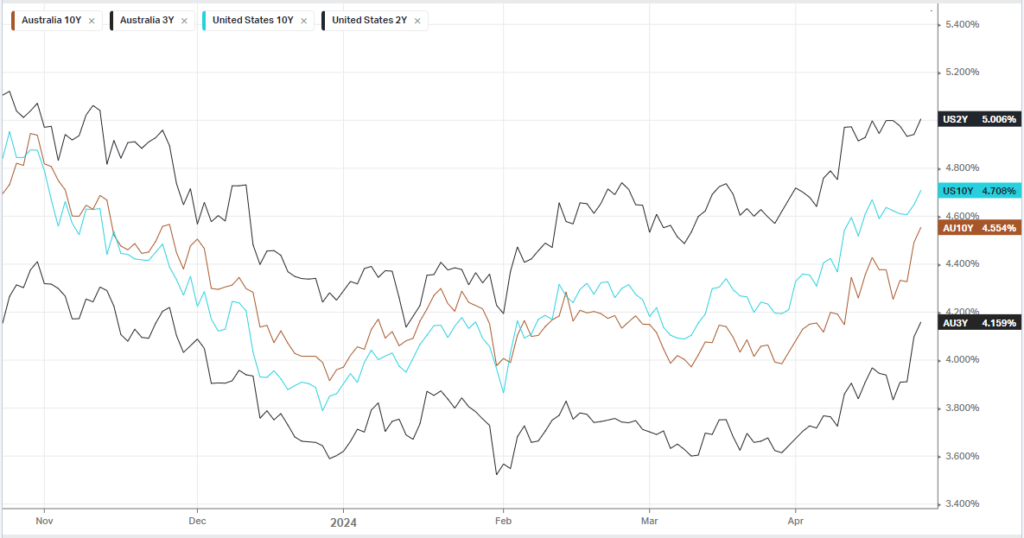

Treasury yields climbed after data showed the U.S. economy grew by just 1.6% in the first quarter, on an annualised basis, much slower than expected, while a core underlying measure of inflation surprised to upside in Q1, rising 3.7%, pushing out rate-cut bets. Swaps traders are no longer fully pricing in a first Fed rate cut before December. The weaker growth but strong inflation raised fears of stagflation, but some economists noted that growth wasn’t as weak as the report suggested.

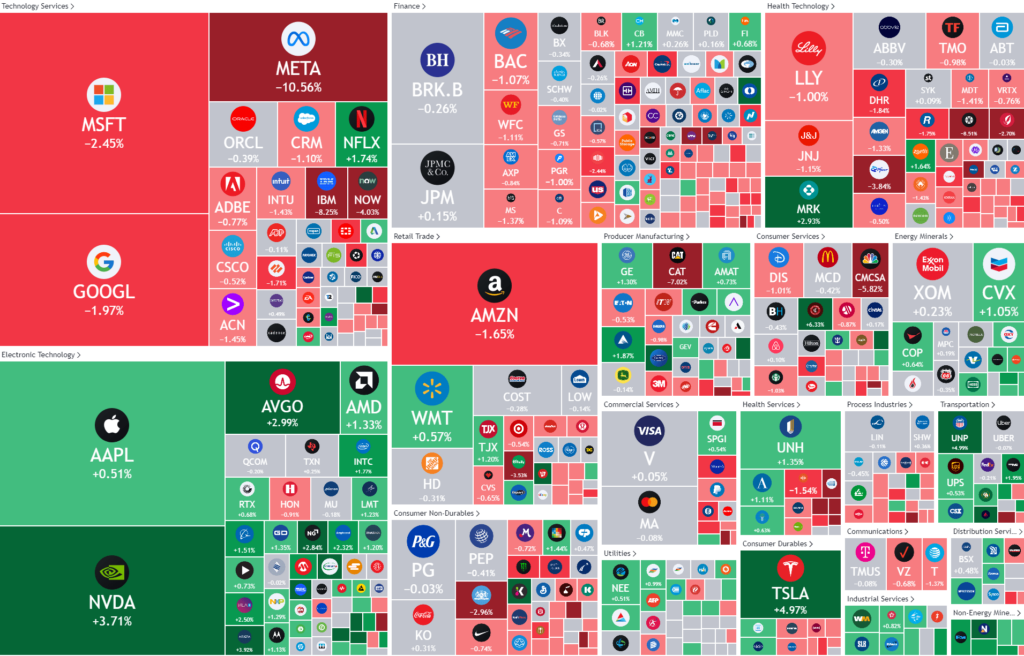

During the day session, before the Microsoft and Google results, big tech weighed down the market as Meta stock slid 10.6% to a near three-month low, after the Facebook parent forecast weaker-than-expected revenue for the second quarter due to higher spending on artificial intelligence. The stock had fallen as much as 16% intraday. Also IBM fell 8% on weak first-quarter earnings, while the firm also announced a $6.4 billion deal to buy Hashicorp

Earnings:

- Meta Platforms -10% – Shares of Meta Platforms fell sharply in aftermarket trade on Wednesday after a disappointing outlook for second-quarter earnings vastly offset strong first-quarter earnings, with selling spilling over into other major technology stocks. Meta’s shares slid 15.3% to $417.83- a near three-month low- after it forecast second-quarter revenue in the range of $36.5 billion to $39 billion, or $37.75 billion at the midpoint- lower than estimates of $38.3 billion. Losses in Meta’s stock spilled over into other major internet firms, given that they set a dour tone for upcoming earnings in the sector.

- Microsoft -2.65% (+4% aftermarket)– reported Thursday fiscal third-quarter results that beat Wall Street estimates, as strong demand for artificial intelligence underpinned better-than-expected performance in its cloud business Azure. Microsoft Corporation rose more than 4% in afterhours trading following the report.

- Alphabet -1.97% (+12% aftermarket) – shares popped more than 12% in after-hours trading Thursday after the Google owner reported better-than-expected top and bottom lines for the fiscal Q1 2024. Specifically, the tech behemoth posted earnings per share (EPS) of $1.89, topping the consensus estimates of $1.51. Revenue was reported at $80.54 billion, also above the projected $78.71 billion. Operating income for the quarter increased by 46% year-over-year to $25.5 billion, while net income soared to $58 billion, or $1.89 per diluted share

- Caterpillar -7% – often regarded as a bellwether of the economy, industrial machinery maker Caterpillar. fell 7% after they reported a mixed first quarter of 2024, with earnings surpassing analysts’ expectations but revenue falling short.

- Ford -1% – fell nearly 1% despite reporting stronger first-quarter earnings and positive guidance on free cash flow, weakness in its EV business was offset by stronger performance in its commercial business.

Bonds

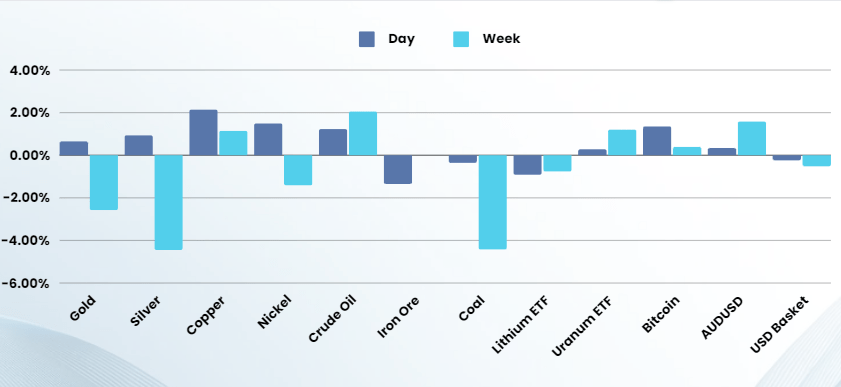

Commodities & FX

The Day Ahead

ASX SPI 7626 (-0.34%)

The Australian market was shut yesterday with the US market effectively now unchanged after being down over 2% at stages over the last 2 days. The bounce in tech after the bell is likely to make little difference to the ASX200. Gold, Silver, Copper and Iron ore all rallied over the 2 days, meaning a bid tone for the materials sector, however market reaction to BHP’s $60B bid for Anglo American in a full script offer is likely to divide opinions

Australia’s most accurate interest rate predictor, Warren Hogan of Judo bank, has said he now expects 3 (that’s right 3) rate hikes in the coming months, a comment that is likely to see the high growth, consumer discretionary and REIT sectors suffer.

Company Specific:

- BHP is doubling down on its big bet on copper demand growing exponentially in the global shift away from fossil fuels, with a bold takeover bid for British resources heavyweight Anglo American that values it at almost $60 billion. In what shapes as the biggest deal of his career, BHP chief executive Mike Henry is advancing his global copper interests after repeatedly warning there is not enough supply to electrify the global economy and meet climate targets. BHP’s bid is £31.1 billion ($59.6 billion), and Anglo American investors will receive 0.7097 of BHP stock for each share