What's Affecting Markets Today

Leadership Turmoil at Star Entertainment

Star Entertainment’s Executive Chairman, David Foster, has chosen to temporarily step aside from his role as Chairman of Bendigo and Adelaide Bank. This decision follows an inquiry into Star Sydney, which highlighted significant leadership disunity and oversight failures within the casino’s management. The inquiry, led by Adam Bell, SC, has also been delayed by the late submission of crucial documents pertaining to the casino’s former CFO, Christina Katsibouba, further complicating the proceedings.

Decline in Chinese Demand for Iron Ore

The Reserve Bank of Australia (RBA) has issued a cautionary note about the future of iron ore demand from China, suggesting that the peak may have already been reached. This downturn is projected to significantly affect Australian government revenue and the mining sector for decades. The RBA forecasts a dramatic drop in steel demand, primarily due to a decrease in urban residential construction, as China faces demographic challenges and reduced rates of housing demolition.

ANZ Bank’s Economic Forecast

Despite a slight increase in Australia’s unemployment rate to 3.8% in March, ANZ Bank maintains its prediction of a 25 basis points cut in interest rates by November. The bank’s economic analysis suggests that the Reserve Bank of Australia’s expectations for slower employment growth and a rising unemployment rate by mid-year remain plausible. ANZ’s steadfast outlook reflects a broader anticipation of necessary adjustments in monetary policy to address evolving economic conditions.

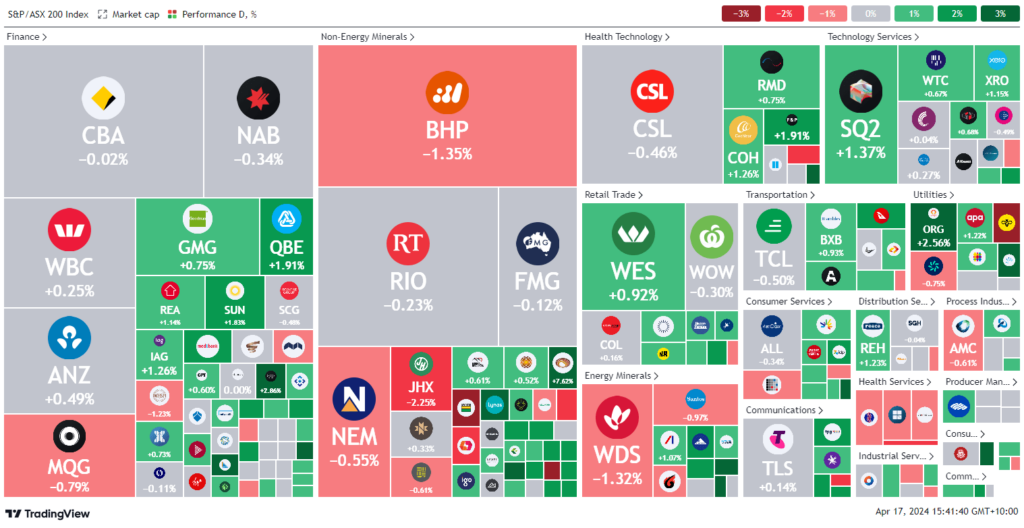

ASX Stocks

ASX 200 - 7,638.1 (+0.40%)

Key Highlights:

In March, Australia’s unemployment rate slightly increased by 0.1% to 3.8%, closely aligning with market expectations and slightly below the Reserve Bank of Australia’s projections of reaching 4.2% by June and 4.3% by year’s end. Meanwhile, the S&P/ASX 200 index rose by 0.4% at midday, buoyed by gains in major iron ore companies like BHP, Fortescue, and Rio Tinto due to stronger iron ore prices, with the materials sector leading gains at an increase of 1.25%. This market positivity was influenced by a global rise in risk appetite after Federal Reserve Chair Jerome Powell hinted at maintaining higher interest rates to manage persistent inflation concerns. Additionally, oil prices retreated from earlier highs, with Brent crude trading at $US87.80, reflecting a cautious approach by central banks sensitive to inflationary pressures. On Wall Street, concerns about delayed interest rate cuts led to a fourth consecutive day of losses. In stock-specific movements, South32 and BlueScope Steel saw notable increases due to rising base metal prices and new U.S. tariffs on Chinese steel, respectively, while MMA Offshore and Challenger also reported strong gains following positive financial updates.

Leaders

HTA – Hutchison Telec Ltd (15.15%)

TLX – TELIX Pharmaceuticals Ltd (9.13%)

AMI – Aurelia Metals Ltd (7.35%)

MAQ – Macquarie Tech Group Ltd (6.89%)

WGX – Westgold Resources Ltd (5.51%)

Laggards

HZN – Horizon Oil Ltd (-8.11%)

AGI – Ainsworth Game Technology Ltd (-7.31%)

WAM – WAM Capital Ltd (-5.88%)

MCY – Mercury NZ Ltd (-5.88%)

SMP – Smartpay Holdings Ltd (-4.62%)