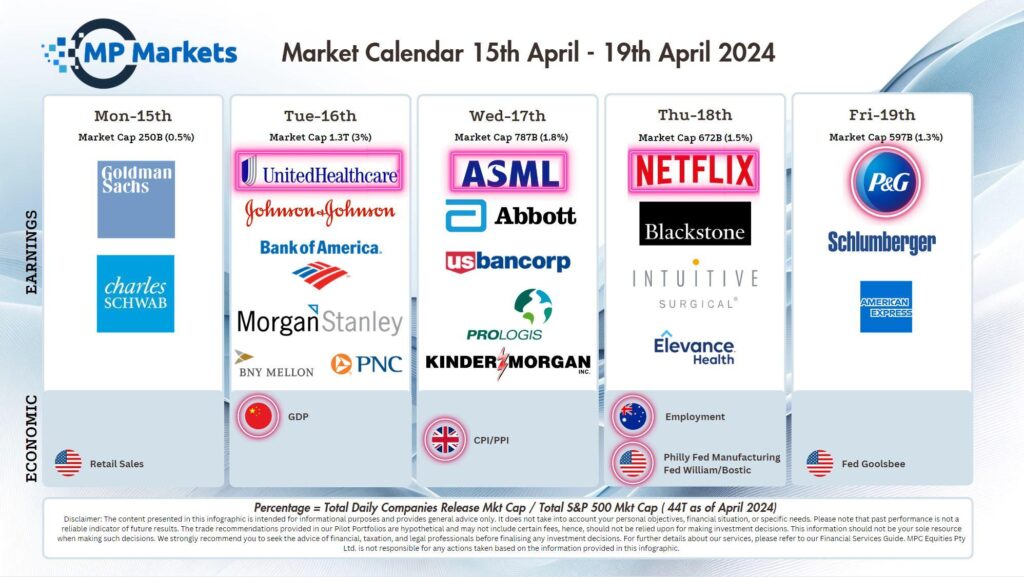

Last Night's Market Recap

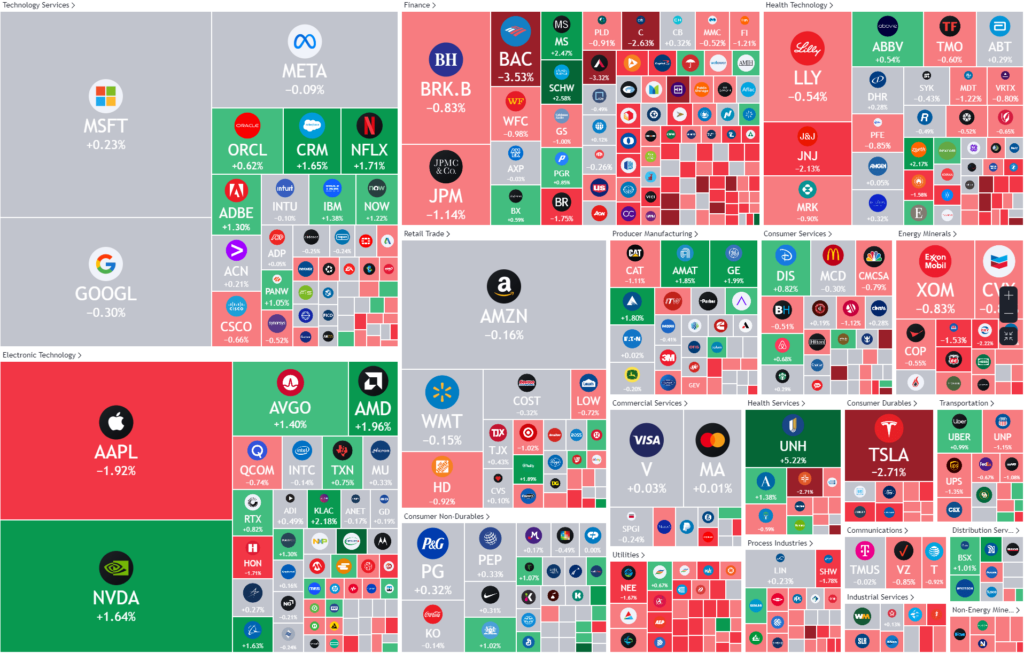

S&P 500 - Heatmap

Overnight – “Higher for Longer” reaffirmed by Fed Chair Powell

Stocks finished slightly lower in a highly volatile session as Federal Reserve Jerome Powell signaled the need for rates to remain higher for longer following recent inflation data that surprised to the upside.

“The recent data have clearly not given us greater confidence,” to consider starting the rate cut cycle, instead the data “indicate that it’s likely to take longer than expected to achieve that confidence.”

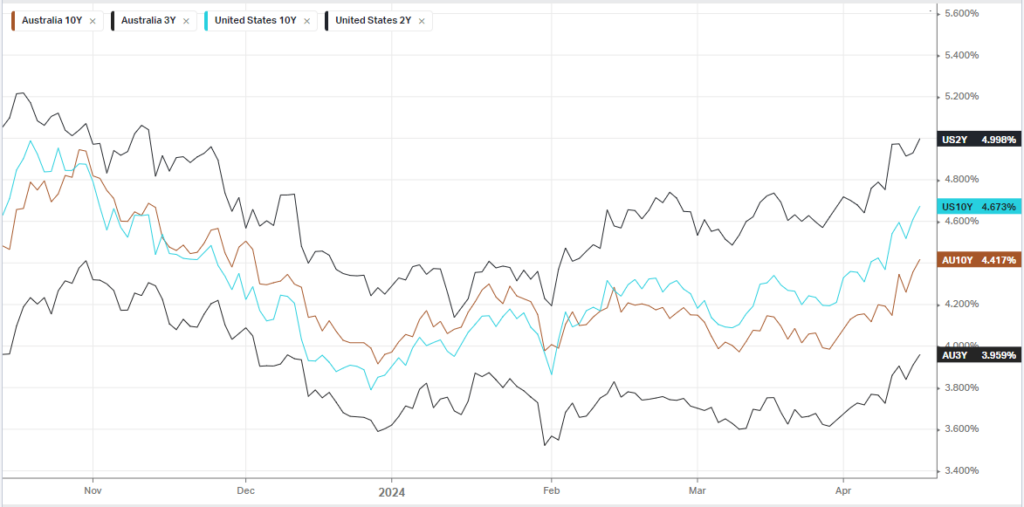

The Fed has previously flagged the need for greater confidence, led by incoming economic data, that inflation is on sustainable path lower to begin cutting rates. The remarks further dented investor hopes on sooner rate cuts, pushing Treasury yields higher, with the yield on the 2-year Treasury topping 5% for the first time since November.

The Fed chief, however, added that policy is “well positioned to handle the risks that we face,” easing some fears, albeit still nascent, that the central bank may be forced to consider the prospect of higher interest rates. There is a growing risk that the Fed could raise rates to as high as 6.5% next year as U.S. economic growth and sticky remains sticky, strategist at UBS highlighted in a note recently, though said that this hawkish outcome wasn’t its base case scenario.

Earnings:

- UnitedHealth +5.48% a major Dow component, jumped 5% after the health insurer maintained its 2024 forecast even as it disclosed a potential hit of up to $1.6 billion this year related to a data breach at its Change Healthcare unit, in its first full public disclosure of the financial impact of the cyberattack. The company also reported first-quarter revenue that topped Wall Street estimates.

- Morgan Stanley +2.45% reported robust first-quarter results for 2024, marking a significant surge in its wealth management business. The firm announced $15 billion in revenue, alongside an earnings per share (EPS) of $2.02 and a return on tangible equity of 20%. The company’s wealth management division recorded record revenues and net new assets totaling $95 billion.

- Bank of America -3.50% reported quarterly results that beat analysts estimates, but the stock fell nearly 4% amid concerns about its valuation given its recent run up. Given the share price “outperformance over the past approximately six months, we no longer see sufficient upside to recommend the shares,” HSBC said in a research note Tuesday, flagging various risks including deposit cost pressure and deposit outflows.

- Johnson & Johnson -2.15% stock slipped after the healthcare giant reported disappointing first-quarter revenue numbers as sales from its blockbuster psoriasis drug Stelara fell short of expectations.

Bonds

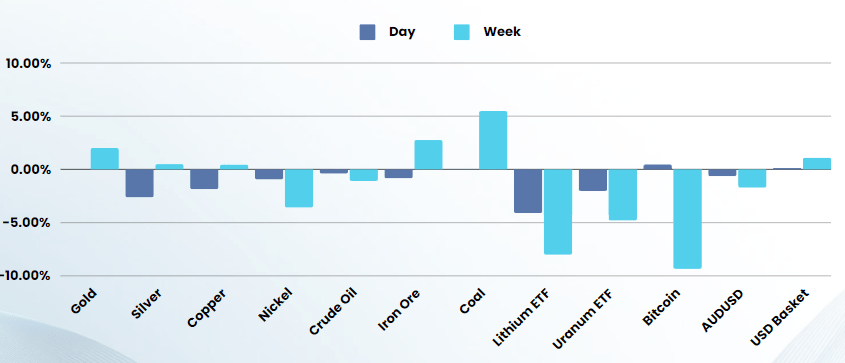

Commodities & FX

The Day Ahead

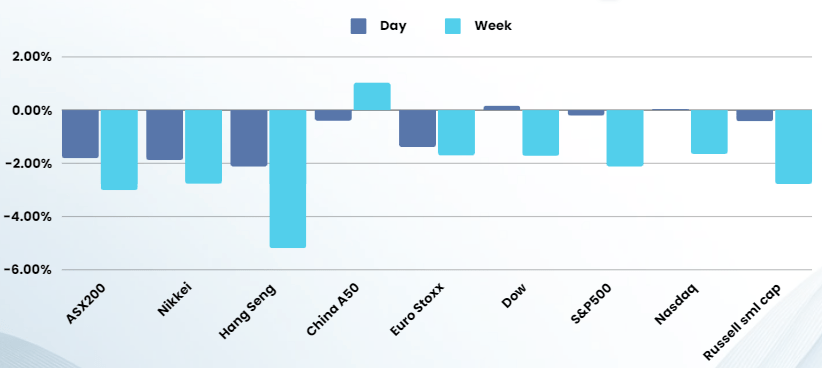

ASX SPI 7612 (-0.30%)

The ASX is likely to see another negative day as comments from US Fed Chair gave the market no reason to buy the dip. The markets emerging realization that close to record low unemployment rates, expanding manufacturing sector and hot consumer spending are reasons to be raising rates, not cutting them.

AU10Y and 3Y bond yields have hit 4 month highs, while the US2Y is hovering just below the key 5% level

Interest rate sensitive sectors like REITs and high debt stocks are likely to feel the brunt of the selling today

Company Specific:

- Investors will be watching Lynas Rare Earths closely as shares open this morning after Australia’s richest person Gina Rinehart bought up a sizable stake in the company, disclosed late after trading yesterday. Mrs Rinehart’s Hancock Prospecting lifted its stake in Lynas, the world’s biggest non-China producer of rare earths, to 5.82 per cent on Tuesday. The share raid has fuelled speculation Australia’s richest person may emerge as a kingmaker in any rare earths mega-merger between Lynas and New York-listed MP Materials.

- Bank of Queensland will release its earnings

- Rio Tinto and Evolution Mining are expected to detail production updates.