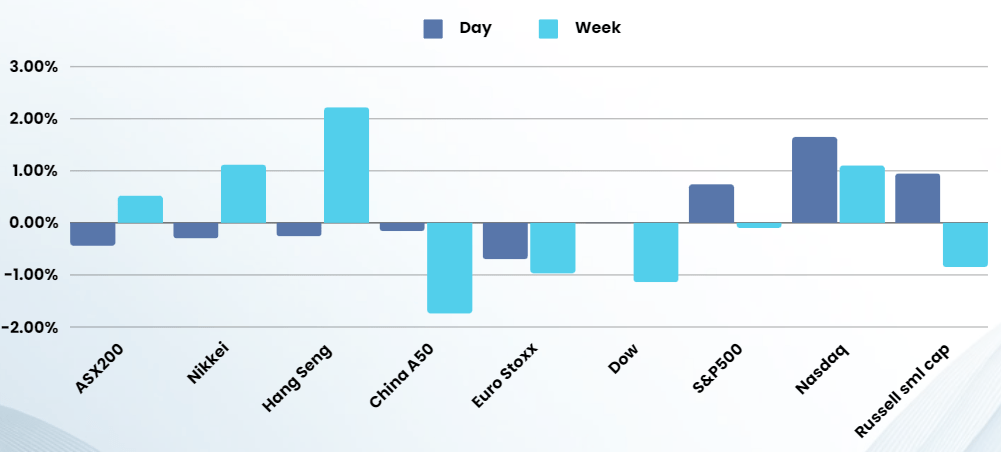

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Big tech leads market higher as inflation jitters ease

Equities recovered from yesterdays inflation nerves, led by tech, as data showing cooling producer prices eased inflation jitters somewhat just a day ahead of earnings from major Wall Street banks.

U.S. producer prices increased by slightly less than expected in March, with PPI rising 0.2% last month, after rising by 0.6% in February. Economists had expected the PPI to gain 0.3%. In the 12 months through January, the PPI increased 2.1%, below the 2.2% expected, after climbing 1.6% in February. The data come just a day after consumer inflation data for March rose more than expected, denting investor optimism for a Federal Reserve rate cut as soon as June. On the labour market front, the number of Americans filing new claims for unemployment benefits fell more than expected last week, suggesting that the labour market remained healthy.

Big tech, meanwhile, led the broader market higher, powered by a more than 4% in Apple on a Bloomberg report that the tech giant is looking to boost Macbook sales by focusing the next upgrade of its M-family of chips on artificial intelligence.

Amazon, meanwhile, closed at a record high after the Amazon CEO Andy Jassy talked up the opportunity for AWS as cloud computing is set for a major boost from generative artificial intelligence.

Tonight’s earnings from Wall Street banks including JPMorgan Chase, Citigroup and Wells Fargo with BlackRock, the world’s largest asset manager, will be in focus. There may not be significant moves in the banks due to multiple catalysts over the next three months including an easing of investor concerns regarding Basel 3 Endgame (B3E) and more news on capital returns through the CCAR (Comprehensive Capital and Analysis Review)

We still see major market risk in earnings over the next month as the spending on AI, coupled with the lack of revenue created may hurt some companies sitting at inflated prices due to “blue sky” earnings expectations. We recommend trimming or selling holdings that sit at elevated prices or historically high forward PE’s

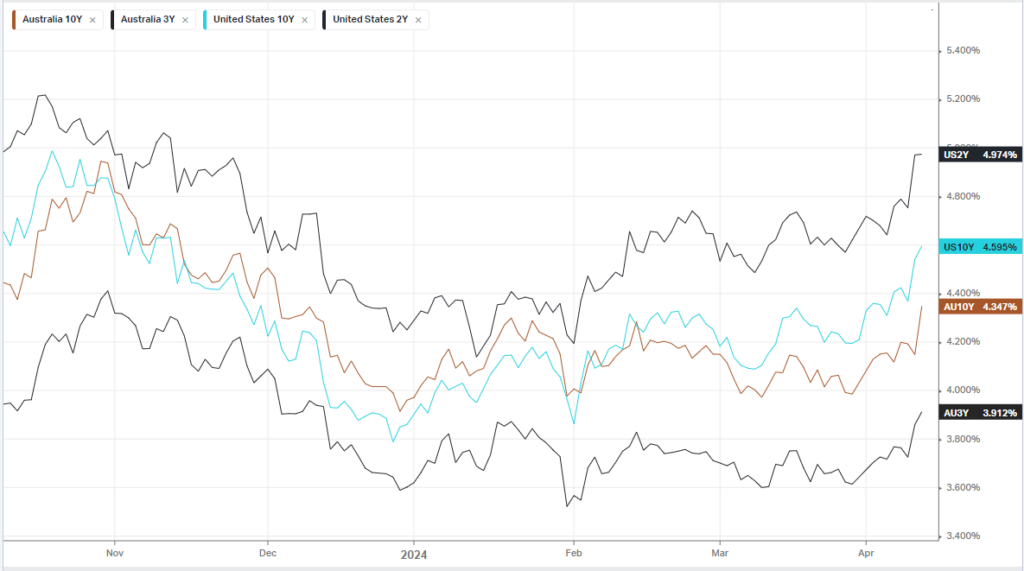

Bonds

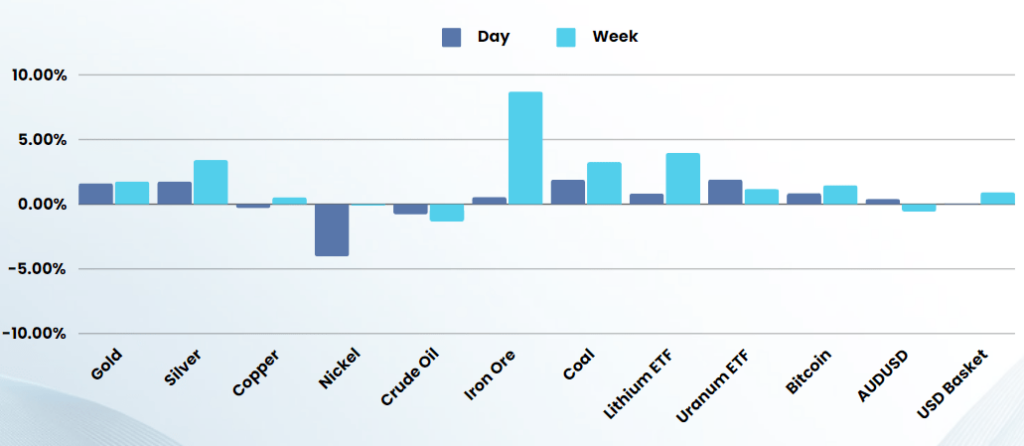

Commodities & FX

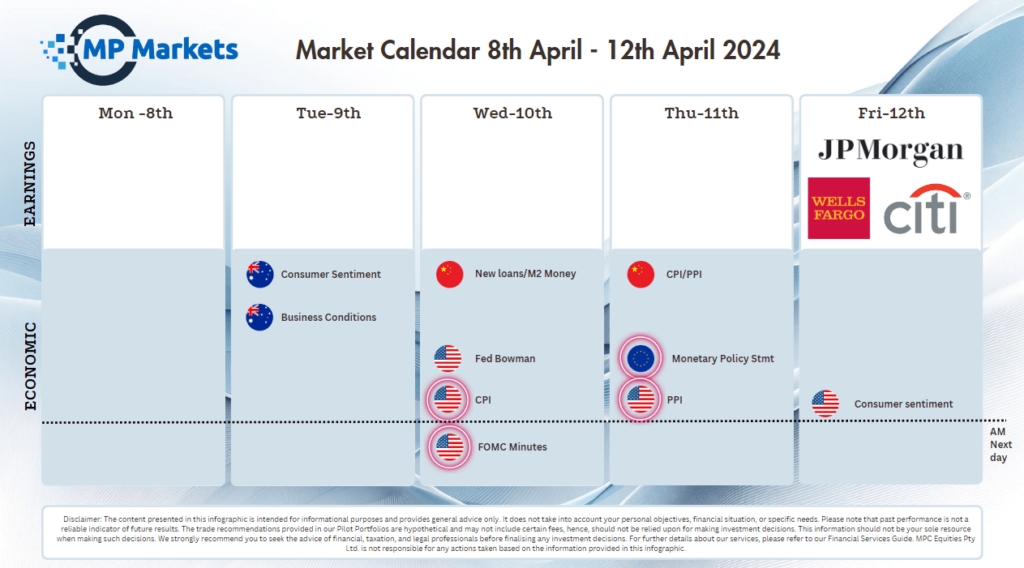

The Day Ahead

ASX SPI 7820 (-0.36%)

The ASX is likely to open slightly lower and grind higher over the day as jitters around US inflation and the Chinese economy ease, albeit for different reasons. The slightly better than expected US data has reduced the shock of higher CPI, whereas China’s deflationary data leaves room for more stimulus which should be good for the Aussie market.

We remain very cautious, looking to take profits at these levels after a significant 6 month rally in global equities into seasonality weakness of May and the timeline of predicted rate cuts being pushed back further and further

Company Specific:

- AMPis hosting its AGM today.

- Koganshares will begin trading ex-dividend.

- NextDC, the country’s largest listed developer and operator of data centres, is raising $1.32 billion to expand its operations in Sydney and Melbourne. Shares are scheduled to hit trading sometime before the open of trading on Monday.