What's Affecting Markets Today

Asia markets mixed

Ahead of pivotal central bank meetings and anticipated inflation reports from the U.S. and China, Asia-Pacific markets displayed a mixed performance. Central banks in Korea, New Zealand, Thailand, and the Philippines are poised for policy discussions, with a consensus by S&P Global predicting unchanged interest rates. Notably, the Bank of Korea, an early stopper of rate hikes in 2023, is under scrutiny for potential rate cut signals. Attention will also shift to forthcoming U.S. and China inflation data, alongside China’s March trade figures. Market movements saw Japan’s Nikkei 225 advance 1.54%, crossing the 39,000 threshold, while the Topix index increased by 1.33%. South Korea’s Kospi edged up by 0.12%, in contrast to the Kosdaq’s 1.28% decline. The Australian S&P/ASX 200 slightly rose by 0.19%. Meanwhile, Hong Kong’s Hang Seng and the Chinese CSI 300 index dipped by 0.71% and 0.77%, respectively, following a holiday break.

ASX Stocks

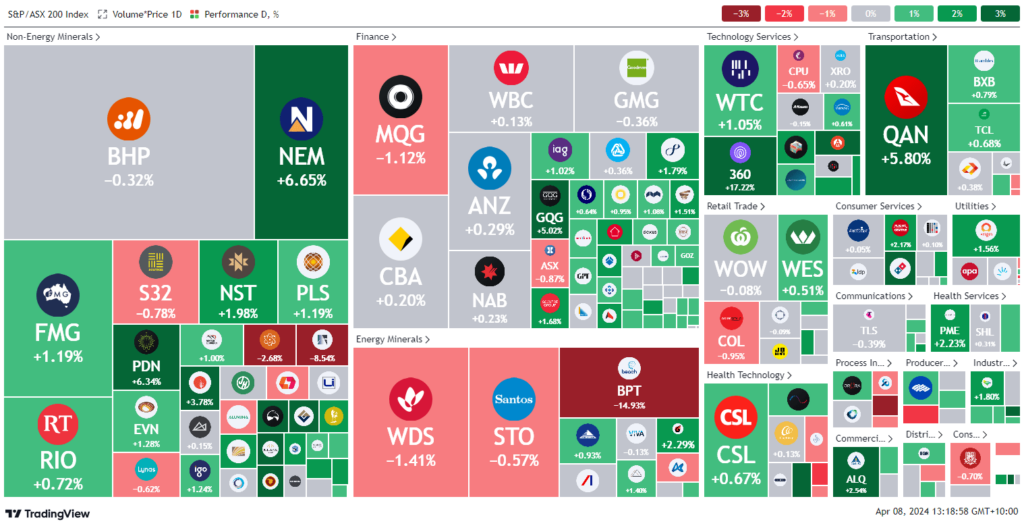

ASX 200 - 7,789.1 (+0.2%)

Key Highlights:

In the week’s opening session, the Australian stock market saw gains, driven by a significant uplift in technology shares, which helped counteract declines from energy companies Woodside and Santos. The S&P/ASX 200 index rose by 0.1% to 7,784.5 points, mirroring a positive shift in the All Ordinaries index. The upward momentum follows a robust jobs report from the U.S., where 303,000 jobs were added in March, exceeding expectations and nudging the unemployment rate down to 3.8%. Consequently, U.S. markets experienced gains across major indices. However, energy stocks on the ASX underperformed, dropping by 0.8% amid cooling oil prices. Noteworthy movements include Life360’s 17% surge after reporting a record number of active users, while Elders plunged 24% due to trading challenges. Additionally, Qantas announced a $448 million share buyback and enhancements to its loyalty program, with shares up 3.4%. Other notable mentions include Qoria’s rejection of a takeover bid, Ansell’s acquisition halt, and significant drops for Beach Energy and APM Human Services due to operational and financial setbacks.

Leaders

360 LIFE360 Inc 17.05%

A4N Alpha Hpa Ltd 9.27%

NEM Newmont Corporation 6.72%

ADT Adriatic Metals Plc 6.35%

PDN Paladin Energy Ltd 5.99%

Laggards

APM APM Human Services Int Ltd -28.68%

ELD Elders Ltd -24.21%

BPT Beach Energy Ltd -14.91%

AZS AZURE Minerals Ltd -8.40%

NUF Nufarm Ltd -3.65%