Last Night's Market Recap

S&P 500 - Heatmap

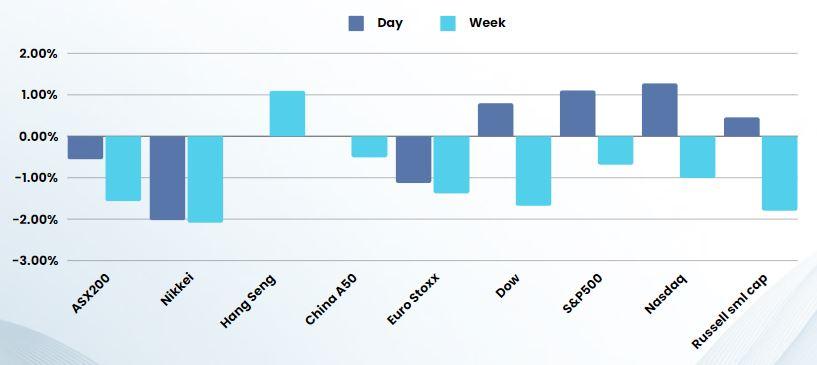

Overnight – Equities Rally despite strong payrolls pushing back cuts

Equities rallied Friday night despite very strong US employment numbers put any form of rate cuts this year into question.

Data released earlier Friday showed that nonfarm payrolls increased by 303,000 jobs in March, more than the expected 212,000 gain. The unemployment rate came in at 3.8%, a fall from 3.9% the prior month, while average earnings rose 0.3% on a monthly basis, in line with expectations. The sharp uptick in new jobs created last month didn’t spark a jump in wages to threaten a faster pace of inflation as the number of people entering the labour market, or the participation rate, jumped. While the odds of a June Fed rate cut fell to 51% from 59% a day earlier, pushing Treasury yields higher, Morgan Stanley continued its call for a June cut. “The data point to a noninflationary expansion of the labour market and do not alter the Fed’s course to a June cut,” Morgan Stanley said.

Inflation data for March is due next week, and is likely to provide more cues on the path of interest rates.

Apple stock rose 0.5% after the iPhone maker announced it is laying off more than 600 workers in California, its first major job losses since the pandemic. Tesla fell 3.6% after the electric vehicle maker cut the price on some of its Model Y SUVs by about $5,000. Musk, meanwhile, denied a Reuters that it was scrapping its plans to produce a low-cost Model 2. Johnson & Johnson stock was flat after the drug giant announced it will buy medical device maker Shockwave Medical up 2%, in a $13.1 billion deal. HubSpot stock rose 2% after Reuters reported that Google-owner Alphabet) has been talking to its advisers about the possibility of making an offer for the online marketing software company with a market value of $35 billion.

Energy stocks including Valero Energy Occidental Petroleum Baker Hughes were up more than 1%, underpinned by a jump in oil prices to their highest level in five months as worsening geopolitical tensions in the Middle East raised concerns over tightening supply.

Iran, the third-largest OPEC producer, has vowed revenge against Israel for an attack on Iran’s embassy in Syria on Monday, and Israel has vowed to defend itself.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7853 (+0.48%)

We are in for a positive day, however there will be increasing talk about rate cuts being pushed back in the US which is likely to cap gains. Gold, silver and copper are likely to buoy the materials sector, while the broader market will receive a boost from the offshore lead