What's Affecting Markets Today

Asia falls after Dow drops 500 points overnight

In the Asia-Pacific region, markets experienced declines on Friday, significantly influenced by Japan’s Nikkei 225, which dropped by 2.3% following a brief surge past the 40,000 mark on Thursday. The broader Topix index also saw a decrease of 1.7%. The downward trend was a reflection of Wall Street’s movements, prompted by comments from U.S. Federal Reserve officials that suggested potential delays in rate cuts, especially if inflation persists. Minneapolis Fed President Neel Kashkari’s remarks on Thursday added to these concerns, hinting at the possibility of maintaining current rates in the face of ongoing inflation.

Additionally, oil prices were on an upward trajectory, with WTI crude surpassing $86 a barrel, reaching a six-month high, and Brent crude climbing to $90.65. Despite the market downturns, Japan reported a less significant drop in household spending for February, a mere 0.5% year-over-year decline, surpassing Reuters’ expectation of a 3% decrease. Moreover, Japan’s recent wage negotiations resulted in notable pay increases, likely to boost consumer spending.

In other developments, S&P disclosed its business activity figures for Hong Kong. The Reserve Bank of India is anticipated to maintain its benchmark lending rate at 6.5%, according to a Reuters poll. South Korea’s Kospi and the small-cap Kosdaq experienced losses, while Hong Kong’s Hang Seng index gained 0.4% after a public holiday. Mainland Chinese markets remained closed.

ASX Stocks

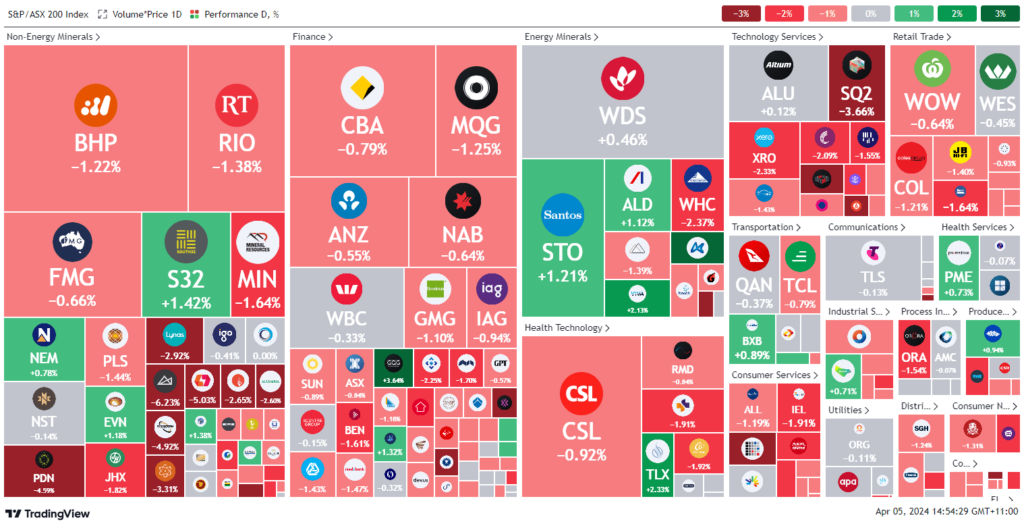

ASX 200 - 7,753.3 (-0.8%)

Key Highlights:

At midday, the S&P/ASX 200 witnessed a decline of 0.5%, primarily driven by losses in base metal and iron ore sectors. Iron ore prices fell below $US100 a ton, impacting major miners BHP and Rio Tinto, both down by 0.8%. Conversely, energy stocks showed resilience, buoyed by Brent crude futures reaching a five-month high of over $US91 a barrel amid escalating tensions between Israel and Iran, with Santos marking a 0.3% increase.

ANZ Bank anticipates further short-term gains for oil prices due to positive economic indicators, supply constraints, and rising geopolitical tensions. This outlook is in contrast to Minneapolis Fed President Neel Kashkari’s recent comments on the potential absence of U.S. rate cuts this year due to stagnant inflation.

In the commodities market, gold retreated from its record high, while copper hit a 14-month peak. The financial sector saw GQG Partners’ funds under management rise to $US143.4 billion, boosting its share price by 0.7%. Conversely, Magellan experienced net outflows of $700 million in March, leading to a 2.2% drop in its share price. West African Resources maintained its gold production forecast for 2024.

Leaders

CEN Contact Energy Ltd 7.13%

GQG GQG Partners Inc 3.64%

RRL Regis Resources Ltd 3.28%

ELD Elders Ltd 3.02%

ASK Abacus Storage King 2.93%

Laggards

CIA Champion Iron Ltd -6.30%

WGX Westgold Resources Ltd -6.12%

DYL Deep Yellow Ltd -5.54%

CMM Capricorn Metals Ltd -4.92%

LTM Arcadium Lithium Plc -4.88%